The International Telecommunication Union in 2015 outlined three initial use cases for 5G, the next generation of mobile network technology after 4G.

These were enhanced mobile broadband, massive machine type communications and ultra-reliable low latency communications.

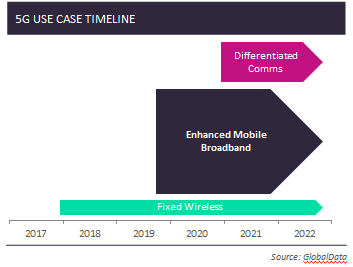

However, the first commercial use case for 5G will likely to be fixed wireless, even though it was not highlighted in these initial specifications.

Fixed wireless brings fast internet speeds akin to those fibre optic cable in small areas where fibre broadband is not economically viable, using high frequency spectrum.

In advanced markets where very high frequency bands, notably 28GHz, are available, a number of operators will begin rolling out pre-standard 5G equipment to provide high speed fixed-wireless access because:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData- It can be deployed in urban areas and deliver early revenues (fixed broadband access), supporting the business case.

- It is less complicated and easier to bring to market than more complex uses of 5G, particularly because devices do not have restrictions in terms of size, weight and battery life, and there is no mobility requirement – the users are in a fixed location.

- 28GHz spectrum has been tested in several regions and has gained vendor support. It is well suited to fixed wireless, is available in advanced data markets such as the US and Korea.

The risk is that it will not be easy to upgrade the infrastructure to support standardised mobile services.

AT&T and Verizon in the US, and KT in South Korea are following this deployment strategy but most operators will invest only in standard infrastructure and focus initially on enhanced mobile broadband services, which will likely be the biggest opportunity in the next five years, and which will help to support the growing demand for mobile data in densely populated areas.

Many early enhanced mobile broadband services, such as those expected from China Mobile and NTT DOCOMO, will use 3.5GHz spectrum to add capacity and speed, initially at least, in urban areas.

However, some others, such as T-Mobile USA, will use low frequency spectrum, enabling rapid nationwide deployment and lower costs.

Such a strategy is also beneficial for operators with more limited fibre backhaul access. Other differentiated communications use cases are not likely to take off until 2021.

Related Company Profiles

NTT DOCOMO Inc

KT Corp

China Mobile Ltd