Competition in Egypt’s telecoms market is evolving as telcos position themselves to leverage Fixed-Mobile Converged (FMC) packages for subscriber acquisition, retention, and ARPUs uplift.

FMC packages often include mobile lines, fixed broadband and additional value-added services. These enable telcos to cross-sell mobile services to their residential customer base and fixed broadband and pay-TV services to their mobile subscriber base.

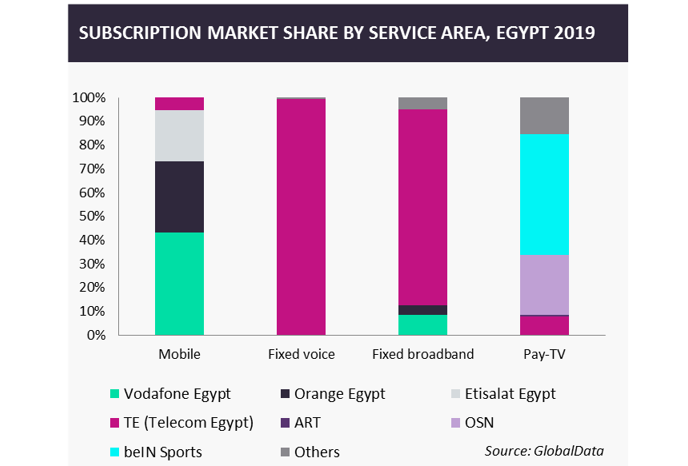

The current telecoms competitive landscape is described in the below chart, courtesy of leading research and data company GlobalData:

After launching its mobile arm (WE) in 2017, incumbent Telecom Egypt (WE) has been leveraging its strong foothold in the fixed services segment, to ramp up its subscriber share in the mobile market. FMC packages represent a sizable cross-selling opportunity for the telco. Its Indigo mobile postpaid plans include a range of FMC packages bundling home broadband with fixed voice, mobile Internet and mobile voice services. These packages are segmented in a way that appeals to a relatively large customer segment spectrum from the mid- to the high-end of the market.

FMC packages used as incentives

Etisalat Egypt, third mobile player with a 21.3% subscriber share, is leveraging FMC packages to increase its foothold in the fixed services segment. The telco has a clear focus on the premium and family segments. Its postpaid premium Emerald packages, come bundled with multiple mobile lines for the family, with the high-end packages including fixed broadband and an OSN pay-TV subscription combined with access to a personal account manager, international concierge and a smartphone voucher. Such a targeted convergence strategy on the premium segments could help Etisalat yield higher residential ARPUs.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAlthough not offering FMC bundles at this stage, Orange Egypt, second mobile player by subscriber share, is leveraging high-speed broadband packages as a mainstay to try and reduce the gap with Telecom Egypt in the fixed services market. The telco is complementing these packages with 4G router plans in the geographical areas it does not yet cover with commercial DSL or fiber services.

With a 43.0% mobile subscriber share, mobile market leader Vodafone Egypt has secured a licence from the local telecom regulator in February 2020 to offer triple-play services. With FMC packages emerging in the country, increasing its presence in the fixed services segment will be important for the telco to help protect its leadership position in the mobile market.

In summary, the increasing competitiveness of the Egyptian market has driven telcos to evolve their offerings, as they strategize to compete in new ways alongside increasing market pressure driven by Covid-19.

GlobalData revised its forecasts on Egypt’s telecommunications services to account for the Covid-19 crisis impact. Although still posting strong year-on-year growth, GlobalData expects Egypt’s 2020 telecoms service revenue to be circa 6 percentage points lower than the pre-Covid19 base scenario.

Related Company Profiles

Telecom Egypt Co

FMC Corp