GlobalData has been tracking data on deployments of Internet of Things (IoT) technology by enterprise organizations for several years, via its IoT Deployment Tracker. While collecting available information on deployment projects undertaken in 2020 will continue in early 2021 as more information becomes available, the data collected so far provides useful insights on where activity is occurring regionally, by sector, and for each common use case. Below are highlights—including how enterprise IoT market activity in 2020 looks compared to 2019.

Increased share for Asia-Pacific

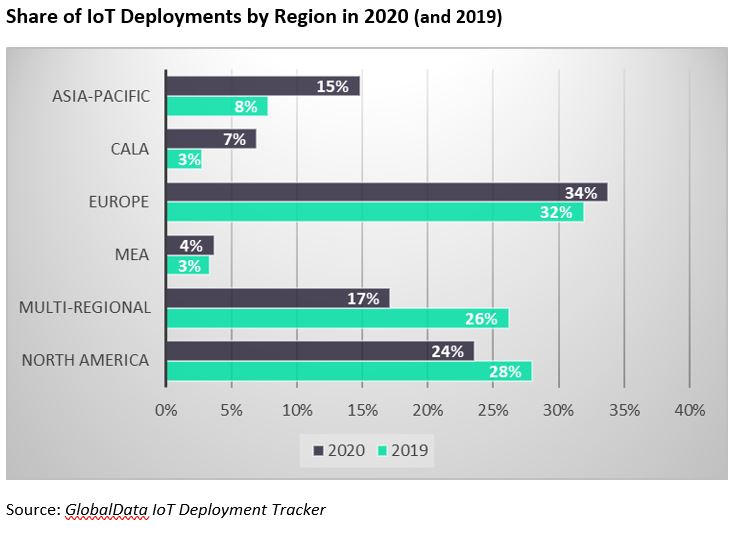

The total number of deployments tracked—that is, the number of IoT projects implemented, not the number of things connected—increased by 30% in 2020. Europe still accounts for the most IoT deployment activity for which data is available, increasing its share of deployments tracked in 2020 to 34%. Asia-Pacific increased its share of deployments to 15%, up from 8% in 2019, and the CALA region (Central and Latin America) also increased its share. North America’s share of global deployments fell to 24%. That’s not because fewer deployments were tracked there in 2020, but because its annual increase was more modest than in other regions.

One other notable takeaway from the regional breakdown is that IoT deployments with a multi-regional or global remit (for example, those taking advantage of roaming SIMs or satellite connections) declined in both number and share in 2019, reflecting a world in lockdown with borders (and multi-national projects) temporarily shuttered (see Figure 1).

Covid may have postponed some projects

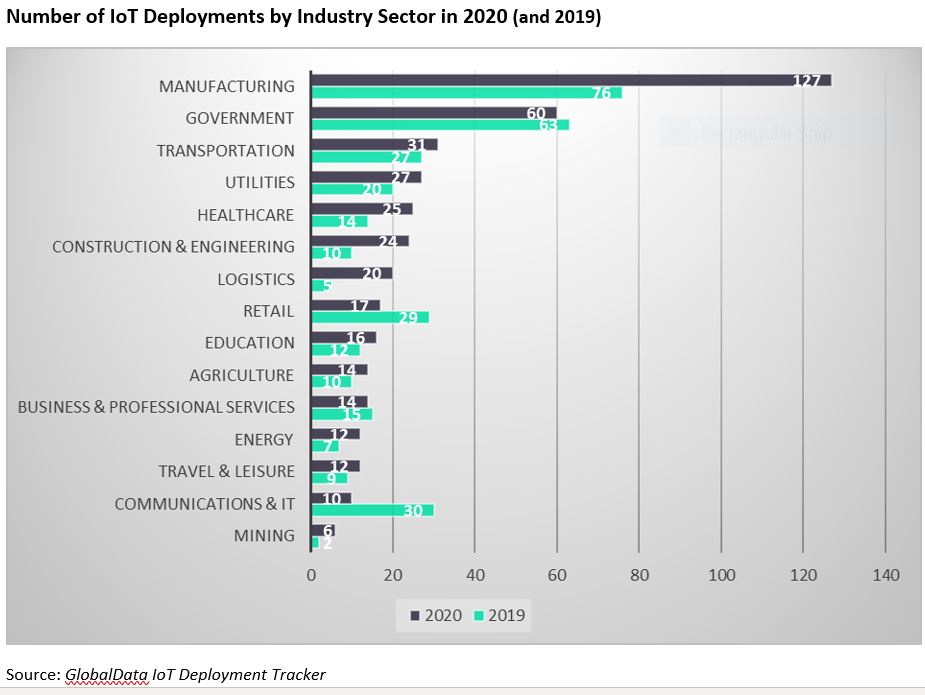

Comparing IoT deployments by vertical sector in 2020 is illuminating, showing how much of the overall growth in number of deployments is due to an increase in manufacturing sector deployments tracked from 76 to 127 (more than a quarter of all deployments this year). That growth is especially interesting given the impact of Covid-19 restrictions on factory sites during the first wave of the pandemic, which may have postponed some IoT projects. Some of the other vertical trends seem to make sense for 2020 in the context of the pandemic, with the number of healthcare sector deployments tracked increasing from 14 to 25 and retail deployments decreasing from 29 to 17.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWhile travel and leisure as a sector has been impacted by Covid-19 even more than retail, its share of deployments actually increased slightly. An example of a deployment in that sector is Michigan’s Crystal Mountain ski resort, which opened its winter season with an RFID system that automates lift ticket access and the use of chair lift operations with handsfree operations and reduced queues. Both the logistics and construction/engineering sectors showed notable increases in deployments, and there is no question that these sectors have been impacted by the pandemic. Sharing a fundamental requirement for asset tracking, in the age of Covid enterprises in logistics and construction may more urgently require solutions for people monitoring and condition monitoring.

Asset tracking narrowly outpaced advanced automation in IoT use cases

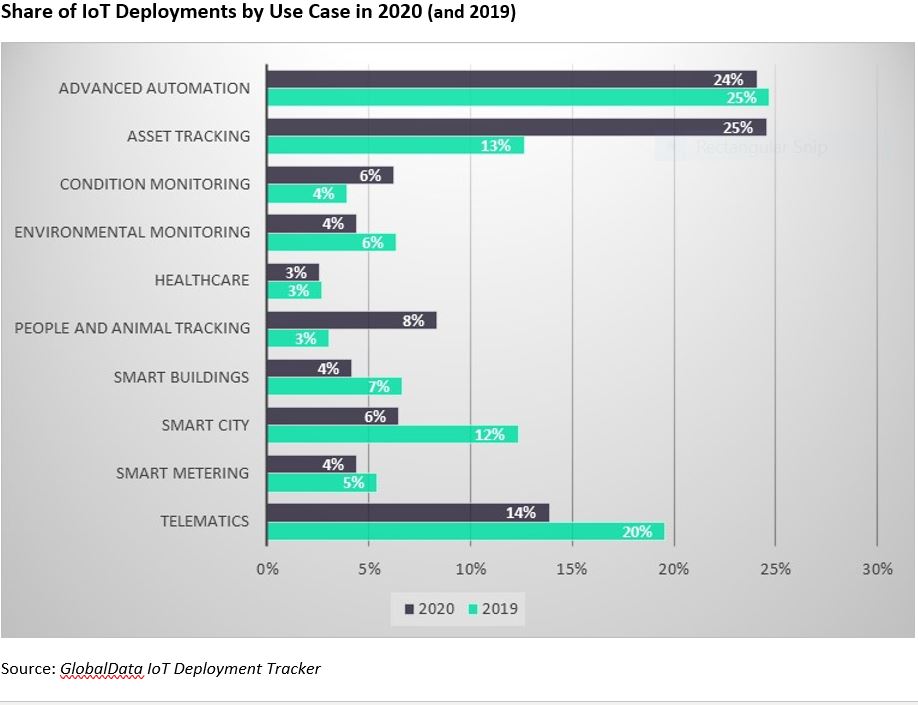

Indeed, asset tracking and people monitoring are the IoT use cases which showed the biggest jump in share of deployments in 2020 compared to 2019, perhaps reflecting the acute need for enterprises to be able to more precisely locate their people, equipment, and products in the supply chain during a public health crisis.

Asset tracking even narrowly outpaced advanced automation as the most common use case (25% of all deployments) this year. Smart city, smart buildings, and smart metering deployments decreased in number and share, perhaps reflecting local lockdown measures (although IoT has been utilized by local authorities and building owners for some Covid-19-related applications like temperature screening and crowd size monitoring in public spaces). Surprisingly, healthcare as a use case did not increase its share of deployments, even though, as noted previously, the healthcare sector itself connected more things in 2020 than in 2019.

Meanwhile, Telematics deployments also decreased in share of global deployments in 2020. It could be that with fleets grounded during parts of the year, vehicle monitoring took a back seat to other enterprise imperatives.

Increase in cost reduction as a deployment goal

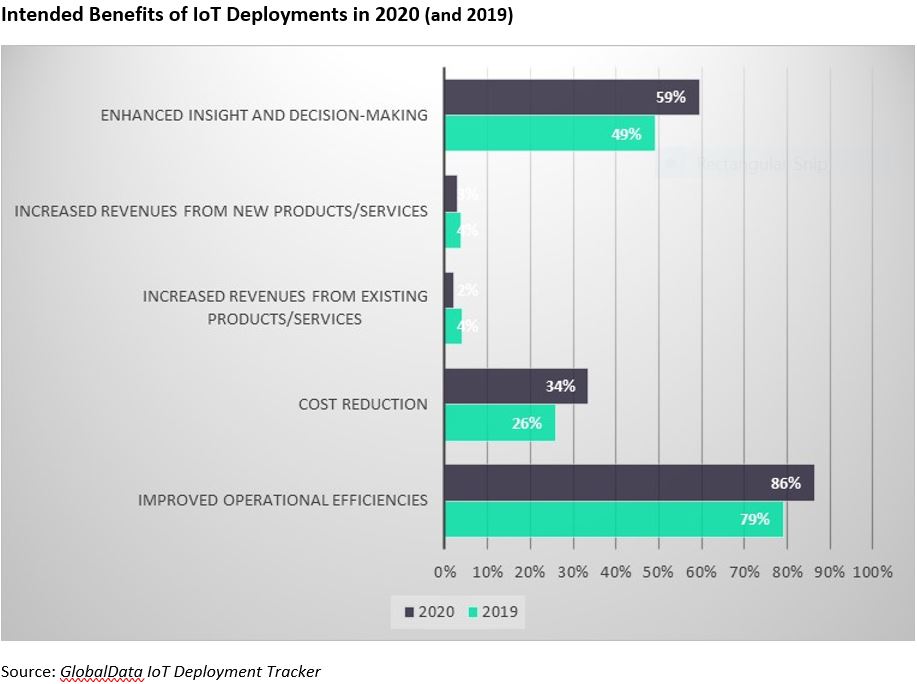

One of several other data points tracked in GlobalData’s IoT Deployment Database are the intended benefits, or project goals, of each deployment. In 2020, the main takeaway is the increase in cost reduction as a deployment goal in 34% of deployments, up from 26% in 2019. However, enhanced insight and decision-making and improved operational efficiencies also increased their prevalence as project goals in new deployments this year. For this chart, each deployment can be represented in more than one category, since they may have more than one goal, or intended benefit.

Notable increases across all three of the above goals indicates a higher incidence of deployments with multiple, or “all of the above” intended benefits. Only increased revenues (from new and existing products) decreased in share in 2020, and only slightly. It should not be surprising that improving operational efficiencies is now such a dominant goal in deploying IoT- represented in 86% of all known deployments this year—given the unprecedented challenges enterprises have faced in 2020 across all sectors.