Tech startup Next Insurance has leveraged the momentum of the insurtech boom to secure $250m in a new funding round, which doubled its valuation to $4bn within the scope of seven months.

The SME-focused insurtech startup netted $250m in a raise in September last year at a $2bn valuation. Next Insurance has now raised $880m in venture capital in total since the launch in 2016. FinTLV Ventures and Battery Ventures led the raise.

The news comes hot on the back of its recent acquisitions of digital insurance agency AP Intego and artificial intelligence company Juniper.

“We believe we’re leading the charge in the transformation of digital insurance,” founder and CEO Guy Goldstein said in a statement. “This latest funding round, which also doubles our valuation, is proof the investor community is confident in our vision. We are dedicated to simplifying the business insurance experience so that small business owners can shop for and buy affordable insurance policies that fit their exact needs completely online.”

2020 proved a breakout year for the insurtech sector. Depending on who you ask, startups in the sector secured between $6.2bn and $7.1bn last year.

It also proved a pivotal year thanks to companies like Lemonade and Root Insurance enjoying successful public debuts over the 12-month period. Hippo Insurance, which raised a $150m Series E round in July and a $350m convertible note in November 2020, is also reportedly eyeing an initial public listing in the not too distant future.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe trend has seemingly continued. Only the other week, UK-based insurtech Zego joined the unicorn club on the back of a $150m round.

Next Insurance is leveraging artificial intelligence (AI) to accurately price its coverage. It is not alone in doing so.

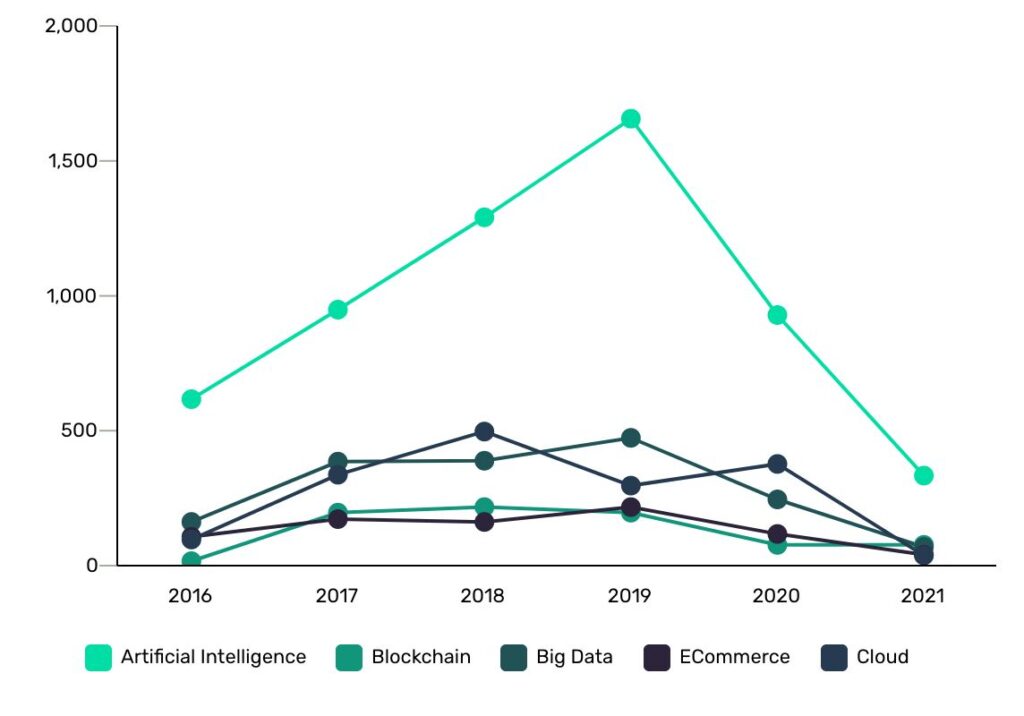

Looking at completed capital investments since 2016 on the GlobalData Technology Intelligence Centre, investors are seemingly interested in backing AI solutions. AI investments peaked in 2019 with 1,660 recorded by GlobalData’s analysts.