The global semiconductor shortage will be resolved within two years but a fresh approach is needed for chips in automotive systems and supply chains, according to NVIDIA CEO Jensen Huang.

Soaring demand and shrinking supply in semiconductors because of Covid-19, severe weather and factory fires have forced automakers including Ford, General Motors and Hyundai to halt or interrupt production of cars and trucks.

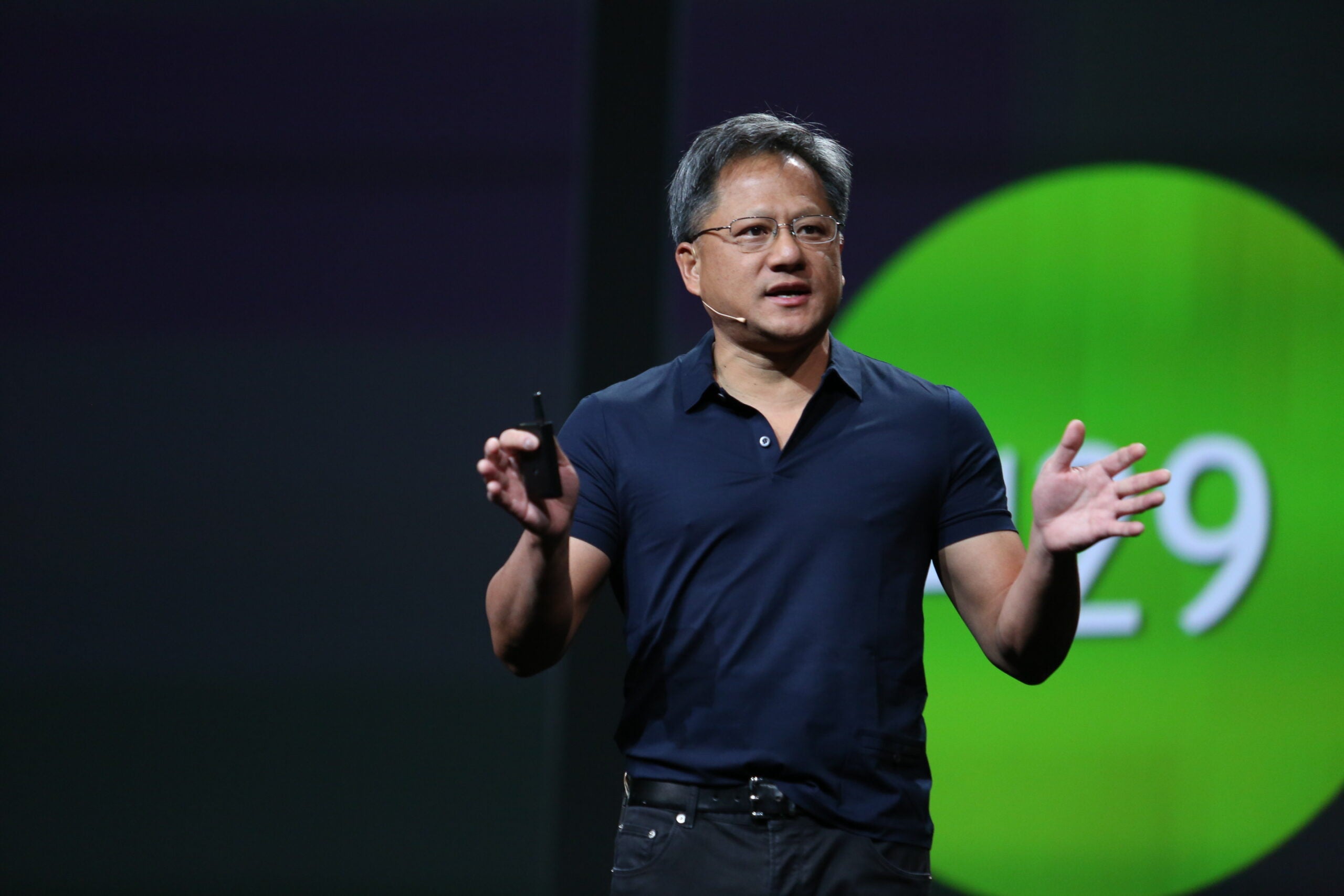

Speaking to reporters at Nvidia’s GTC conference, Huang said the automotive sector’s “super complicated” supply chain meant that recovering from Covid-19 closures was “far more complicated than anybody imagined”.

He said: “Covid exposed a weakness in the supply chain of the automotive industry, which has too many components that go into cars.”

The problem, Huang said, could be addressed by having “a few centralised components”. A typical modern car can have more than 100 semiconductors powering functions such as fuel economy or connected features.

GlobalData Automotive analysts, in a briefing issued in January said that automotive production is “as reliant on computer chips as the consumer electronics industry”.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Instead of thousands of components it really wants to be a few centralised components because you could keep your eyes on four things a lot better than you can keep your eye on 10,000 places,” Huang said.

Such a shift in vehicle design philosophy would benefit Nvidia, which makes advanced types of chips that could take on multiple functions in a vehicle.

Huang added that global chip demand, particularly in the data centre, was “driving the pendulum towards very large chips that are very advanced versus a lot of small chips that are less advanced”.

This has created an imbalance in chip consumption, Huang said.

“The industry now recognises this and the world’s largest companies recognise this, and they’ll build out the necessary capacity,” said Huang. “I doubt that it will be a real issue in two years because smart people now understand what the problems are and they’ll address it.”

Nvidia itself is a supplier to the automotive industry, with its GPUs and systems-on-chips (SoCs) used to power autonomous vehicle tech. This week the Santa Clara headquartered company announced Atlan, a system-on-chip for driverless vehicles that’s due for launch in 2025.

Huang “confident” of Arm deal approval

Huang also provided an update on Nvidia’s $40bn acquisition of British processor design company Arm.

The deal, first announced in September 2020, currently faces regulatory probes in multiple countries. There have been concerns that some of Nvidia’s rivals that currently use Arm’s designs could be negatively affected if the deal goes through.

“I’m very confident that the regulators will see the wisdom of the transaction,” Huang said, adding that discussions with regulators are “going as expected and constructively”.

He said the deal will “provide a surge of innovation and will create new options for the marketplace”.

However, Arm co-founder Hermann Hauser has previously said the deal should not go through as it will create the next US tech monopoly.

“There is not a single important semiconductor company in the world which does not have an Arm licence,” said Hauser in October last year. “Nvidia has an opportunity to become the quasi monopoly supplier of microprocessors to the world.”

Huang told reporters yesterday that he is confident that the deal will still go through in 2022.

He also has “every confidence” that the ongoing US-China trade disputes will “not be an issue” for Nvidia. In 2019 the US government prohibited Nvidia, Intel and AMD from selling to Chinese companies.

Huang said the company would do whatever was necessary “when the time comes”. This could include adapting Nvidia’s supply chain to cater to customers, Huang explained.

Nvidia this week announced Grace, a high-performance CPU based on Arm technology that is intended for use in massive AI neural networks and supercomputing.

The new chip puts it in direct competition with the likes of Intel and AMD in the data centre and AI cloud computing space. However, Huang believes it is unlikely it will cause problems for its partnerships with those companies.

He pointed to the relationship with AMD, in which Nvidia competes in the GPU space but buys AMD CPUs.