Graphics processer maker NVIDIA has been using its financial muscle to avoid major supply chain problems, making a $1.6bn payment in the third quarter to secure chip supply amid the global shortage.

Chip fabrication plants have been unable to keep pace with soaring demand for semiconductors because of Covid-19, severe weather and factory fires. This has caused major supply chain disruption in sectors ranging from automotive to gaming.

Nvidia, which provides GPU chips to both these sectors, said that its outstanding inventory purchases and long-term supply obligations had increased by $2.57bn from a year earlier. That cost now stands at $6.9bn.

“When it came up, I jumped on the opportunity,” Nvidia CEO and founder Jensen Huang told Reuters. “Nvidia has a lot of cash, and we generate a lot of cash. I was more than delighted to secure our future growth with cash.”

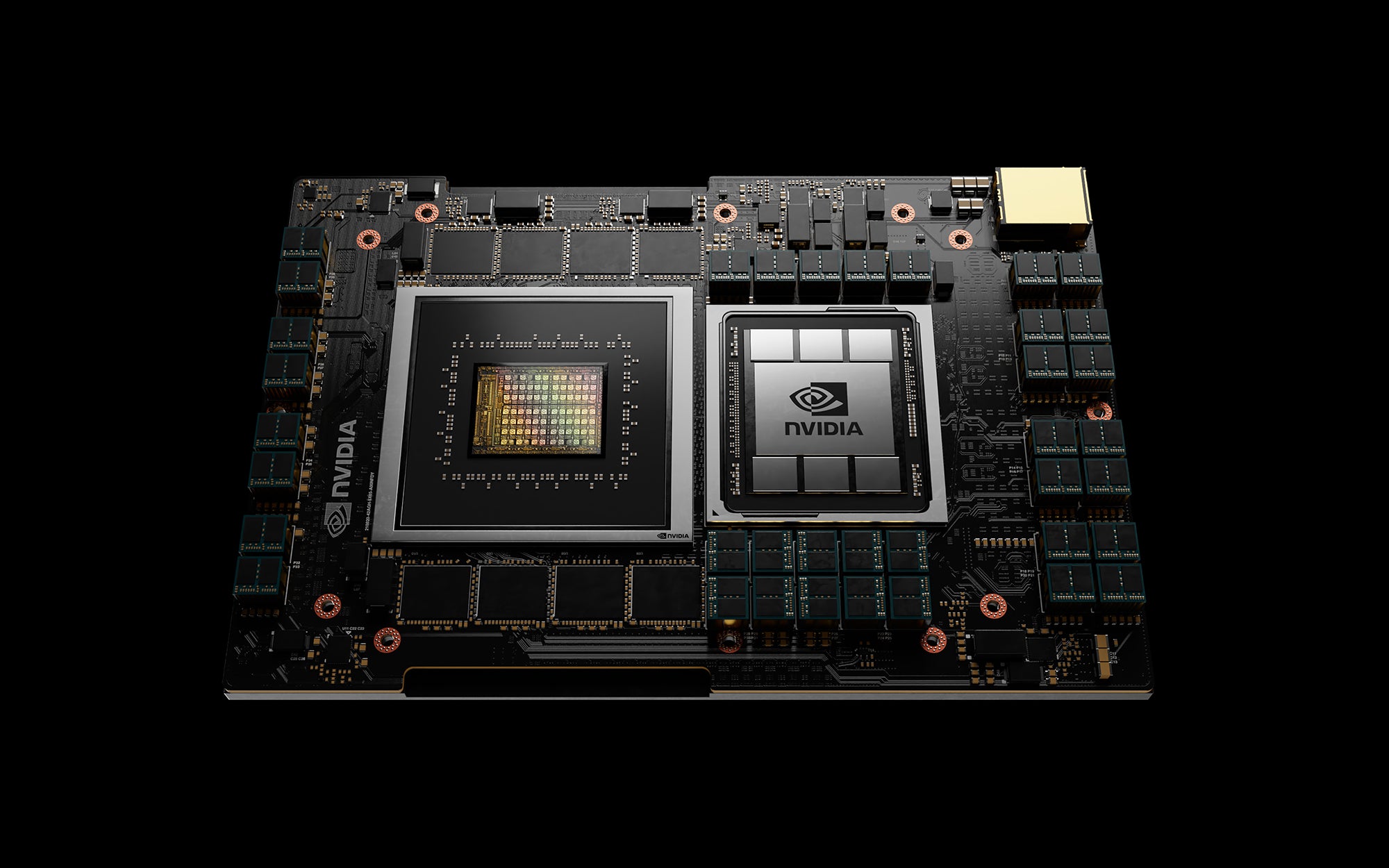

Nvidia is a fabless chip company, which means it designs its semiconductor hardware but outsources manufacturing to a chip foundry.

In April Huang called for a simplification of automotive supply chains. All major automakers including Ford, General Motors and Hyundai have been forced to halt or interrupt the production of cars and trucks during the last 18 months due to the chip shortage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataLike many chip company chief executives, Huang expects the semiconductor shortage to spill over into 2022.

According to a GlobalData report, the semiconductor industry is “at the start of a 10-year reset in the wake of the pandemic, geopolitical turmoil, and the resulting global shortage”.

Nvidia is also betting on the tech world’s latest buzzword – the metaverse. While Facebook, recently rebranded as Meta, is using the term metaverse to describe the next version of the internet that relies heavily on virtual and augmented reality, Nvidia is describing it as the “Omniverse”.

Last month it released Omniverse Enterprise, a set of software tools to help developers create virtual worlds.

“Omniverse will be used from collaborative design, customer service avatars and video conferencing, to digital twins of factories, processing plants, even entire cities,” Huang said.

“Omniverse brings together NVIDIA’s expertise in AI, simulation, graphics and computing infrastructure. This is the tip of the iceberg of what’s to come.”

The metaverse or Omniverse could prove a lucrative trend for Nvidia and other chipmakers, with the technology requiring significantly more computing power that will require more advanced chips.

Huang has previously said he believes the metaverse will be a “3D extension of the internet that is going to be much, much bigger than the 3D world that we enjoy today”.

It comes as the company reported record overall revenue of $7.10bn for its third quarter, up 50% year on year and surpassing analyst expectations. Its gaming unit brought in revenue of $3.22bn, up 42%, while its data centre business brought in $2.94bn, up 55%.

Earnings per share for the quarter were up 83% at $0.97.

The tech company forecast fourth-quarter revenue of around $7.40bn.