GPU maker NVIDIA has reported record revenues in its third-quarter results, with its data centre business continuing to enjoy strong growth.

For the quarter ended 25 October Nvidia reported total revenue of $4.73bn, up 57% year on year and edging the $4.41bn predicted by analysts.

Net income increased 49% year on year to $1.34bn, with diluted earnings per share of $2.12.

The US multinational has historically brought in most of its revenues from its gaming business, in which it sells high-performance graphics processing units. But in the previous quarter Nvidia’s data centre segment overtook gaming for the first time, with digital transformation projects sparked by the coronavirus pandemic appearing to drive up sales.

This quarter marked a return to business as usual for Nvidia, with gaming retaking the top spot as it brought in revenues of $2.27bn, up 37% year on year.

However, data centre revenues continued to grow, soaring 162% from the year-ago period to $1.90bn.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNvidia Q3 results: “Firing on all cylinders”

Nvidia CEO and founder Jensen Huang said his company was “firing on all cylinders”.

He said the company’s new NVIDIA GeForce RTX GPU was enjoying “overwhelming” demand.

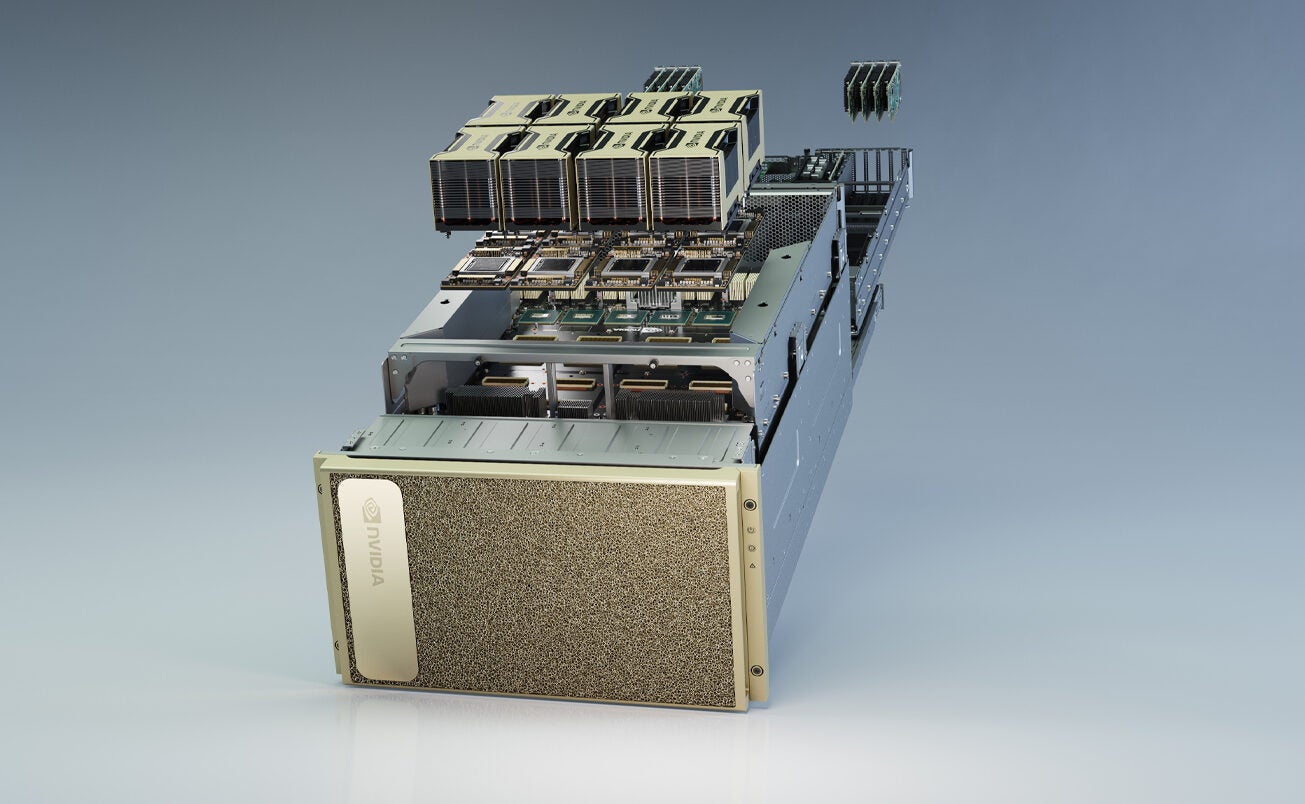

“We are continuing to raise the bar with NVIDIA AI. Our A100 compute platform is ramping fast, with the top cloud companies deploying it globally. We swept the industry AI inference benchmark, and our customers are moving some of the world’s most popular AI services into production, powered by NVIDIA technology.”

During Q3 Nvidia announced it will acquire British semiconductor firm Arm from SoftBank in a $40bn deal. The investment is expected to benefit revenues in the long run and solidify its position as a semiconductor powerhouse.

“We are positioning Nvidia for the age of AI, when computing will extend from the cloud to trillions of devices,” said Huang.

Nvidia’s automotive division, which includes partnerships with the likes of Mercedes-Benz for autonomous cars, saw revenue drop 23% year on year to $125m.

For the fourth quarter of fiscal 2021, Nvidia expects revenue to come in at $4.80bn, with an error margin of plus or minus 2%.

Nvidia’s share price is up 122% since the start of 2020.

Read more: Holodecks, robots will be part of future offices: NVIDIA CEO Jensen Huang