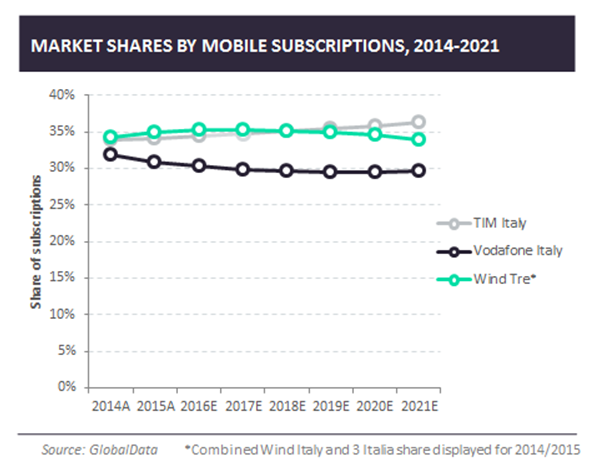

Competition is set to intensify in the Italian telecom market following the launch of Wind Tre and Iliad’s upcoming market entry.

These are interesting times for the Italian telecommunications market. With estimated revenue of $30.3bn in 2016, Italy was the fourth largest market in Western Europe.

Following a period of fairly stagnant growth, revenue is expected to pick up over the next five years, thanks to operator investments in next-generation fixed and mobile networks and regulatory initiatives, such as the national ultra-broadband plan.

However, political instability could play a role in putting economic recovery and telecom market growth at risk, following former Italian leader Matteo Renzi’s defeat in the constitutional referendum last December and consequent resignation as prime minister.

The merger between 3 Italia (part of CK Hutchison) and Wind Italy (owned by VimpelCom) was approved by the European Commission (EC) in September 2016, and the deal was finalised in November 2016.

The new entity, Wind Tre, officially launched in January 2017.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAs part of the remedy package proposed to the EC, French telco group Iliad signed an agreement to launch as a fourth mobile network operator in Italy.

Iliad’s entry will disrupt the market but it won’t have the same impact as Iliad’s entry had on the French mobile market.

Recent price declines in the Italian market, which is predominantly prepaid, will dampen Iliad’s opportunity to gain market share through the launch of discounted offers, for example.

Iliad, allegedly targeting 10-15 percent mobile share, is unlikely to enjoy the same fixed-mobile cross-selling opportunity and brand recognition as in France and in Italy market shares are already fairly evenly distributed.

Telecom Italia (TIM Italy), who lost its crown as number one mobile operator to Wind Tre in 2016, will look to respond to recent developments and has pledged to invest €11bn ($11.6bn) as part of its 2017-2019 financial plan, including €5bn towards expanding ultra-fast broadband networks.

Wind Tre has stated planned investments in mobile and broadband network enhancements of €7bn.

Related Company Profiles

Iliad SA

VEON Ltd

CK Hutchison Holdings Ltd