Payment processing provider Stripe has been named Silicon Valley’s most valuable privately-owned tech company ever after a $600m funding round gave it a $95bn valuation. However, its new value fell short of some expectations.

The higher view of the company’s value was based on “secondary market” transactions, where shares of a private company’s stock are bought and sold after they are first issued. In February it was reported that some such transactions had valued Stripe at $115bn. When rumours of an upcoming cash injection started to circulate at the end of 2020, some analysts thought that the new round could value Stripe at more than $100bn. It is unclear why the discrepancies between these expectations and the final deal occurred.

Regardless of the way the negotiations played out, the fintech has thus narrowly failed to secure hecacorn bragging rights, though it has almost tripled its valuation over the past year. The latest round also saw Stripe overtake the $75bn valuation Elon Musk’s SpaceX achieved in February. The fintech is also more valuable than Facebook and Uber were before going public.

Smashing previous pre-IPO valuation records has seemingly done nothing to loosen the lips of Stripe’s leadership when it comes to potential flotation plans in 2021.

This silence hasn’t prevented the $95bn valuation from pushing the IPO rumour mill into overdrive. Stripe’s recent string of board hires – including former Bank of England governor Mark Carney, Aon’s CFO Christa Davies, and General Motors’ former CFO Dhivya Suryadevara – has also fuelled flotation speculations as such recruitment drives have often heralded IPOs.

On the other hand, some investors worry that recent skyrocketing tech valuations are unsustainable in the face of rising inflation expectations sending ripples through the US bond market, increased regulations and vaccine rollouts accelerating the reopening of the locked-down economies which have fuelled the massive growth of the tech sector over the past year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCovid-19 social distancing rules helped Stripe to scale up its operations over the past year as ecommerce grew in popularity during the pandemic. Over 200,000 new European companies have signed up to the platform since the health crisis began.

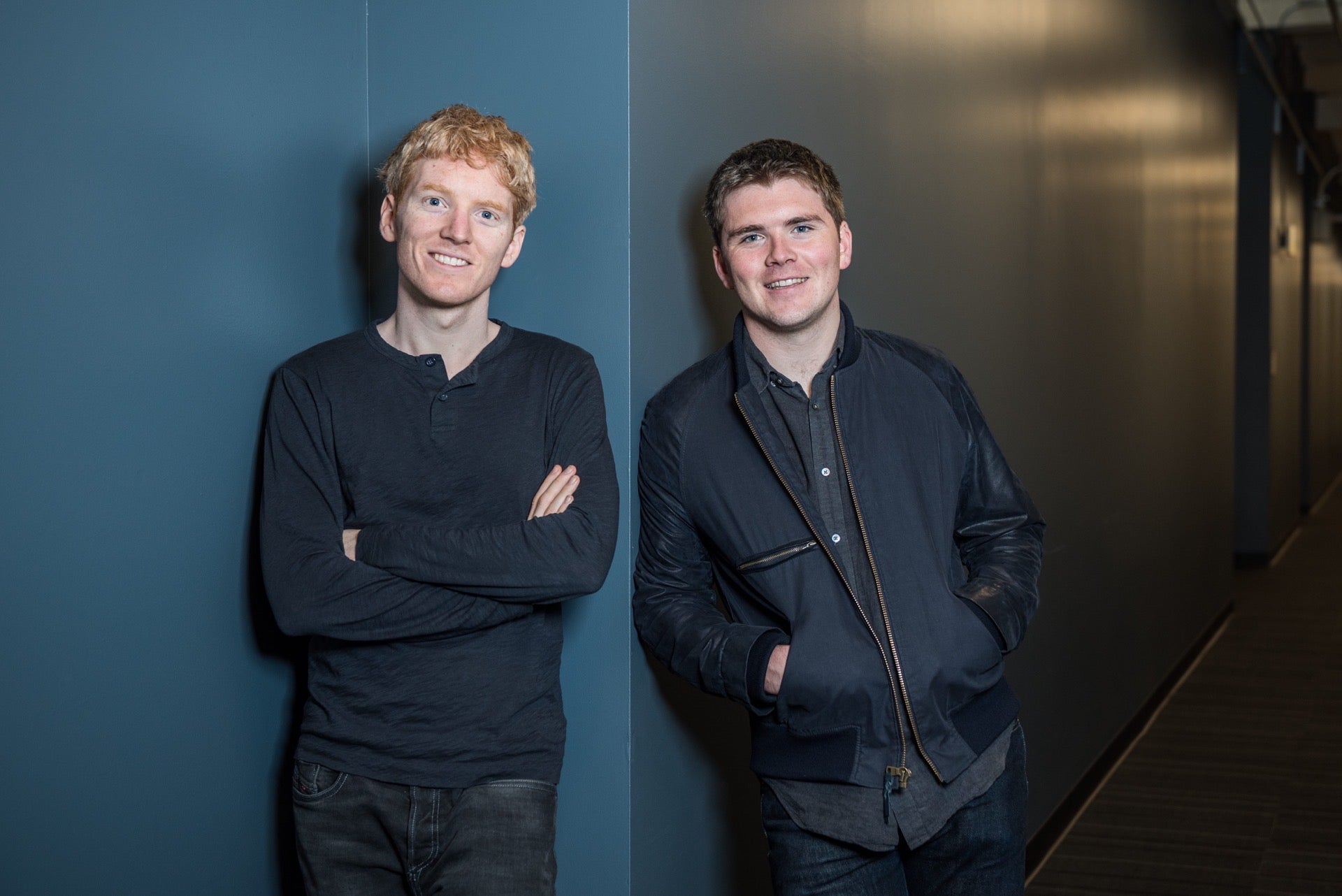

Stripe president and co-founder John Collison has claimed that its systems handled almost 5,000 requests a second in 2020, including payments, refunds, customer data checks and other queries to its application programming interface.

Deal with it

Stripe’s latest funding round saw its valuation grow from the $35bn set by its $600m Series G round in April 2020. Investors backing the raise include Allianz X, Axa, Baillie Gifford, Fidelity Management & Research Company, Sequoia Capital and Ireland’s National Treasury Management Agency (NTMA). PayPal and Y Combinator were two early backers of Stripe.

The inclusion of two insurance heavyweights among its investors – Allianz and Axa – has triggered some speculation that Stripe might move into the budding insurance technology space. The company has made no comment on any such move.

Officially, the online payments provider will use the cash injection to scale its European operations, especially at its Dublin headquarters, in order to meet growing demand for its services across the continent.

“We’re investing a ton more in Europe this year, particularly in Ireland,” said John Collison. “Whether in fintech, mobility, retail or SaaS, the growth opportunity for the European digital economy is immense.”

Thirty-one of the 42 countries where Stripe operates are in Europe. Its clients include Axel Springer, Jaguar Land Rover, Maersk, Deliveroo, Klarna and N26.

Europe is also home to two of Stripe’s biggest rivals: Checkout.com and Adyen. Checkout.com was briefly Europe’s most valuable privately-owned fintech at the beginning of the year before tridecacorn Klarna snatched back the crown at the start of March. Adyen went public in 2018 and is competing against Stripe in several key markets in Europe, Asia and the Americas.

Stripe is also facing increased competition from smaller startups moving in on its territory. London-based neobank Revolut announced a new feature at the end of 2020 that would enable it to accept online card payments as it moved into the merchant acquiring marketplace, putting it on a collision course with Stripe, Adyen and others who offer similar services.

More than just a deal

Since John Collison and his brother Patrick Collison, who serves as Stripe’s CEO, moved from Ireland to found their enterprise in Silicon Valley in 2010, the business has grown into a global fintech powerhouse, bolstering the growth of the sector.

“Stripe has always made its mission to increase the GDP of the internet; its own transaction volume is now more than the whole internet was when it was founded – showing the incredible impact that fintechs can have on our lives when they really focus on solving a particular problem,” Jonathan Hughes, co-founder and CEO of digital banking startup Pollinate Horizons told Verdict. “Every small business and entrepreneur currently building their business online benefits from this technology. And every fintech currently solving problems and creating solutions for merchants and consumers should be inspired by the Stripe success story.”

Stripe has not only provided access to online payments for its clients, but has also established itself as a backer of new tech companies. Over the years, it has invested in new companies such as online payment provider PayMongo, identity authentication venture Touchtech Payments and Fast, a startup building platform-agnostic login and checkout services.

“Stripe is an accelerator of global economic growth and a leader in sustainable finance,” said Conor O’Kelly, CEO of NTMA. “We are convinced that, despite making great progress over the last 10 years, most of Stripe’s success is yet to come. We’re delighted to back Ireland’s and Europe’s most prominent success story, and, in doing so, to help millions of other ambitious companies become more competitive in the global economy.”

Read more: Someone will pay for this later: Klarna goes tridecacorn in $1bn round