US talk show host John Oliver didn’t hold back when he ripped into his “business daddy” AT&T, the new parent company of HBO, which airs his late-night show ‘Last Week Tonight’. AT&T recently completed a corporate takeover of Time Warner, which had HBO in its stable. “If I wanted exorbitant fees that keep getting raised all the time despite s****y service, I’d become a customer of AT&T,” said Oliver.

Three decades after breaking AT&T into eight different “baby bells”, the verdict is out – the breakup of the Bell System in 1982 has not achieved its central aims.

Instead of increasing competition overall, the breakup of the monopoly simply splintered one monopoly into multiple monopolies divided across the US by geography.

Infrastructure is king and very expensive. The new businesses had little incentive to extend beyond their territories where it would mean challenging the commercial dominion of its brothers and building new telephone lines.

Since then, industry consolidation has reversed much of that demerger. Three companies re-emerged from the Bell fragments – AT&T, Verizon and CenturyLink. And to add to that, monopoly power has strengthened as network convergence technologies have made it possible for HFC networks to deploy cable broadband and IPTV, resulting in mergers of cable and telephony businesses – Time Warner’s acquisition is a case in point.

Most recently, the US Federal Communications Commission (FCC) approved the merger of Sprint and T-Mobile, further exacerbating the monopolistic nature of the US telecoms environment, based on the assertion from the merging parties that such a move was necessary for the deployment of a “world-leading” 5G network.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBehind the invisible wavelengths that hold our bits and bytes are very concrete cables, wires, towers and heavy capital expenditure that drive these corporate actions and therefore the competitive environment that consumers ultimately benefit from in service quality and price. Every US telco company will treat the infrastructure it builds as a walled garden, but regulators should and can step in to promote infrastructure sharing where possible to the benefit of both consumers and telecoms.

NBN is a case in point on the virtues of infrastructure sharing

The latest frontier of network convergence is fibre broadband, which can offer speeds of up to 10Gbps versus 10Mbps to 1Gbps for cable broadband. The unparalleled speed of fibre, combined with Next-Generation Network (NGN) architecture (a packet-based network that can support data, voice and mobility), is a key enabler of IPTV and other Over-The-Top (OTT) services, such as Voice over Internet Protocol (VoIP), that upend traditional pay-TV and voice services transmitted over copper infrastructure. It is, however, prohibitively expensive to deploy FTTP networks where existing cable broadband can support a comparable service level.

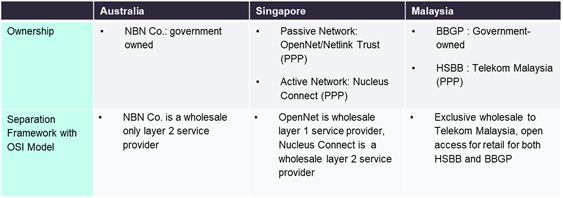

Across the pacific ocean, Australia, Singapore and Malaysia are overcoming these barriers to adoption with the launch of National Broadband Network (NBN) strategies, starting around 2009 to 2010, to fast-track fibre adoption. In doing so, they have forged a path that has proven to be a promising case study for how the relationship between asset and operations should run. While the Australian NBN has been mired in controversy, the Malaysia and Singapore networks have been completed on schedule, with the latter having the greatest reach at 85% household penetration in 2019.

The separation of asset and operations

In 2017, Singapore’s OpenNet was hived off into NetLink NBN Trust and sold to the public in an IPO on the Singapore Stock Exchange (SGX), that valued the company at SGD3.1bn. Singapore not only managed to achieve wide coverage of fibre broadband but in doing so created an investment vehicle that offers a stable and attractive return for investors in a familiar sector. The separation of asset ownership and operations is not a new model to financial markets, having been perfected in real estate markets with REITs and investment trusts.

NBN liberalised telecommunication markets in Singapore beyond just internet services

At the market level, the impact to the various technology segments was profound to both incumbents and challengers.

In the broadband markets, the NBN promoted competition and allowed new entrants to come into the market while placing StarHub’s slower cable broadband in the lurch. MyRepublic, an upstart MVNO, was able to amass a hefty 17% market share in fibre broadband by 2013, just a year after launching in Singapore as an ISP. Niche players were also able to enter without the encumbrances of infrastructure ownership, catering to specific segments such as gamers in the case of ViewQwest.

There was a fundamental shift in the competitive environment in pay-TV. StarHub, which had for many years held the lead in the segment due to its ownership of the country’s only HFC network, began to lose ever greater market share to the challenger Singtel with its Mio IPTV offering, bolstered by the lowered installation costs from being able to utilise pre-existing NBN fibre infrastructure in the household. A greater focus on content and customer satisfaction ensued. StarHub, as a consequence of these advancements, will be phasing out all cable services in 2019.

In fixed communications, Singtel’s dominant grip on voice, due to ownership of the legacy copper POTS network was loosened with VoIP technology. All telcos are now able to utilise the NBN infrastructure to create triple or quad-play bundles.

The greater competition resulted in a natural increase in more-for-less offerings in these fixed communication segments in tandem with higher quality.

Tower infrastructure sharing is a counter-argument to telecom megamergers

Infrastructure is a cliché excuse passed to regulators as the justification for consolidation, such as is in the case of both the Sprint and T-mobile, and TPG Telecom and Vodafone Hutchinson Australia mergers.

A similar model of separation of assets from operations exists in mobile – independent tower companies that lease tower assets. The conventional model of direct mobile network operator-owned tower infrastructure is overrated. Independent tower companies such Crown Castle, American Tower and Protolindo exist where they lease out tower assets for a fixed fee to MNOs. Already, some of these companies are known to be investing heavily in 5G infrastructure to cash in on the soon-to-be lucrative market of ultra-high-speed mobile broadband.

Forming and divesting telco-led tower companies, through public markets or divestitures, can also be a lucrative business for incumbent MNO that have hived off their assets from their business. China Tower, the world’s biggest operator of mobile phone towers formed from the infrastructure of China Mobile, China Unicom and China Telecom, raised US$6.9bn when listed on the Hong Kong Stock Exchange in 2018. In pursuing such a strategy, MNO passes on the hefty capital expenditure to investors and enjoy an asset-light business model, while earning a sizable return.

Crying wolf about the cost of infrastructure is starting to look like a flimsy assertion to justify consolidation.

Related Report:

Cloud Computing in Europe: Telco Cloud Offers, Best Practices, and Market Opportunity

Related Company Profiles

American Tower Corp

China Mobile Ltd

TPG Telecom Ltd

Lumen Technologies Inc

China Telecom Corp Ltd