Cross-border money transfer company TransferWise announced in September that net profit had doubled since last year. Its success was surprising, given the less-than-stellar performance of competitors Revolut, Starling, and Monzo, which all made losses over the same period. TransferWise’s global expansion plans appear to be paying off, but further growth opportunities remain unclear. More importantly, the partnerships forged with other challenger banks could be detrimental to the company’s own platform.

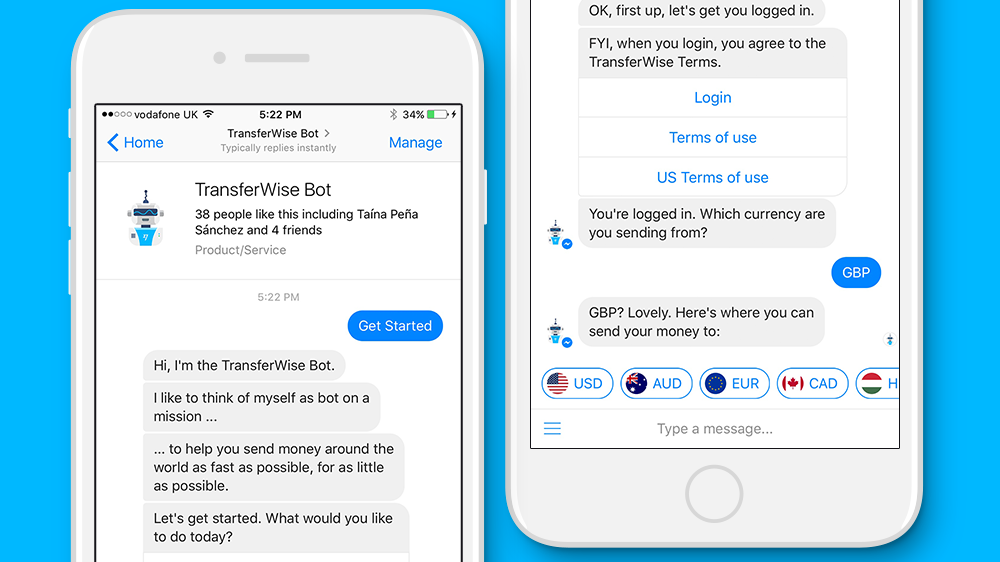

In the increasingly competitive fintech space, TransferWise has been a notable success. The company has been profitable since 2017. Its platform, which allows customers to make peer-to-peer (P2P) transfers without incurring the exchange fees associated with traditional banking methods, has proved popular both with travellers and those sending money abroad. Also, collaboration with Monzo, N26, Starling, and Mastercard has helped the company expand into more than 50 countries and record 70% revenue growth in the financial year ending March 2020.

Aside from company plans to scale up globally, Covid-19-driven volatility in transfer volume and currency value has not affected trading expectations. However, there may be a flaw in TransferWise’s growth strategy.

Alternative tech could be a problem for TransferWise

Revolut, TransferWise’s close competitor and an early player in the digital-only banking services market, offers its own money transferring service. Unlike other challenger banks, it does not rely on TransferWise tech. Instead, Revolut allows users to open bank accounts, hold cryptocurrencies, and access a budgeting and analytics tool – all features that TransferWise currently lacks. While Revolut made a net loss in its most recent fiscal year, revenue growth of 180% in 2019 suggests that customer engagement is strong. Its ability to provide users with a robust currency transfer platform, plus additional banking services, makes TransferWise seem less impressive.

Overall, Revolut’s success at creating an all-round package for consumers calls into question TransferWise’s early move to offer their software to rival fintechs. The company has launched a borderless currency account with a debit card and even has FCA approval to offer investment products over the next 12 months. Expanding its product offering means TransferWise is now more directly competing with its partners. With convenience and easy access increasingly important for users, there is little to differentiate the company’s platform from those that offer the same services and more.

Covid-19 could have a long term impact

Another area of concern for currency exchange apps is the long-term impact of the pandemic on consumer behaviour. According to GlobalData’s Covid-19 Tracker Survey, in 10 out of 11 countries surveyed, 30% or more respondents planned to reduce international travel following the pandemic. This is a problem for TransferWise, which relies on travellers requiring access to local currencies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUltimately, TransferWise needs a longer-term growth strategy, and the pandemic offers an excellent opportunity to shift focus onto mobile payments. With cash potentially a vehicle for virus transmission, payment tools requiring minimal contact with physical point-of-sale (POS) terminals are increasingly popular. Thus, the P2P transfer and mobile payments sectors have huge growth potential.

P2P proximity payments are just one service TransferWise could offer. By combining a QR-code form of payment (such as those developed by AliPay and WeChat) with a peer transferring aspect, it can eliminate the need for a card-based payment system whilst also remaining a P2P company. Penetration rates of mobile proximity payments are highest in developing countries, which also aligns with the company’s ambition to expand its customer base.

Related Company Profiles

Revolut Ltd

Mastercard Inc

Wise