Contactless cards have already taken off in some European countries.

In Poland 78 percent of all payment cards were contactless at the end of 2016 and by the beginning of 2017 61 percent of cards in the UK could be used contactlessly.

Over the next few years, other European markets are expected to follow suit.

However, contactless card adoption has varied depending both on how early contactless roll out began and on the level of engagement from banks, card schemes, and retailers.

Markets that started using contactless cards earlier naturally have higher levels of penetration.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

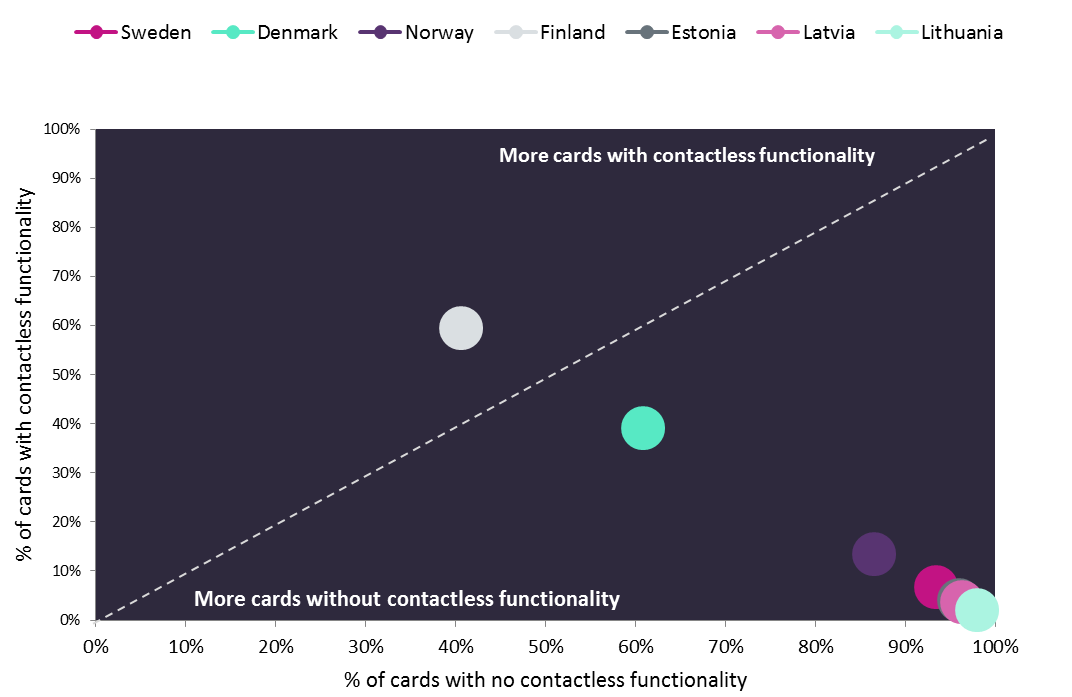

By GlobalDataFinland, the most developed contactless market, was also the first market in the region to roll them out, starting in 2012.

By contrast, Estonia, Latvia, and Lithuania, which are the weakest markets by contactless card penetration, began roll out just last year.

However, the success of contactless within a market is not solely measured by the number of cards produced.

Finland’s contactless market may be strong but the Bank of Finland has said uptake has been slow over the five years it’s been on offer and is only now ramping up.

In Denmark, contactless card issuing began in 2015 but did not pick up momentum until 2016, when national scheme Dankort launched a card-reissuing campaign, supported by the large banks and retailers in the market.

As a result of this concerted effort, the number of contactless cards and the number of contactless transactions increased rapidly from 2015–16, with the number of Dankort contactless cards growing from less than 15 percent to 64 percent and the number of transactions growing from 1.9m to 85.4m — still fewer than five percent of total card transactions in 2016.

Both Denmark and Norway have dominant national schemes in place – Dankort in Denmark and BankAxept in Norway.

In 2016, fewer than 20 percent of cards in Norway had contactless functionality and very few point of sale terminals were enabled due to BankAxept’s (and the Norwegian banks’) lack of support for the technology.

However, contactless will take off in Norway this year due to a deal between BankAxept and Canada’s Interac to supply the tech.

Banks play an important role in creating a strong contactless card market, but retailer buy-in is necessary too if the cards are to be used.

In 2015, ICA Banken (a mid-sized bank owned by a major supermarket chain in Sweden) started issuing contactless cards and at the same time it turned on its in store contactless terminals.

There were about 7m contactless transactions in less than a year when only 400,000 customers even had a card.