There have been multiple signs this week that investor interest in emerging markets is back on.

The latest is from developing markets focused investment fund Ashmore which has today reported a rise in assets under management of $2.8bn, with net inflows of $1.2bn.

This comes after the chair of the US Federal Reserve Janet Yellen told Congress in her semi-annual testimony yesterday that the Fed would continue its gradual path of rate increases amid weak inflation and is unlikely to ramp up rate rises suddenly.

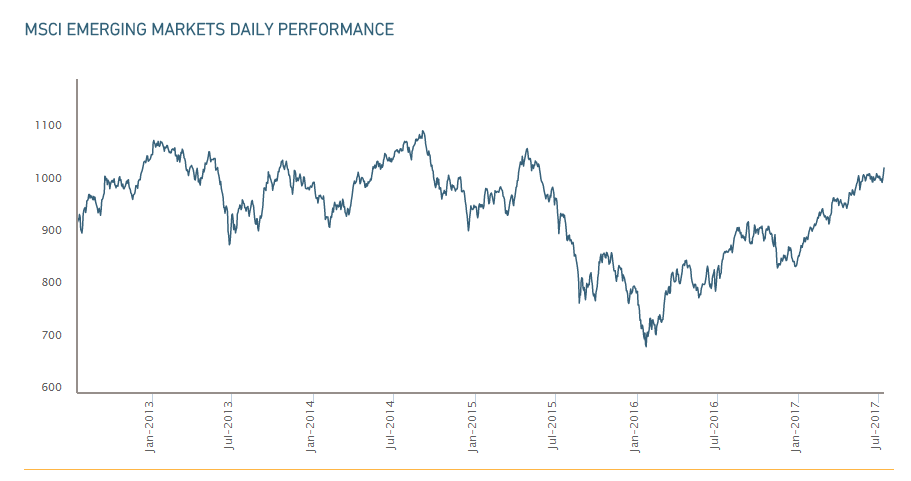

That’s good news for developing markets, with stocks in these regions around the world nearing a technical level unseen in seven years.

The dollar fell back on Yellen’s comments, with greenback strength seen as a negative for emerging markets, as not only does it depress the value of their commodities, but also hikes US dollar-denominated debt.

Despite the sky high valuations of equity in emerging markets, they’re still far cheaper than in developed nations, coming with a 25 percent discount.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWhat’s been the EM worry?

The last few months have been particularly concerning for emerging markets, with Donald Trump’s victory in the US presidential election last November and fears he will enact protectionist measures that could drag on trade.

Meanwhile, concerns around China’s slow down and monetary tightening, persistently low oil prices, and sanctions on Russia all weighing on emerging markets.

However, the MSCI Emerging Markets Index climbed 1.1 percent yesterday, extending this year’s surge to 21 percent.

Click to enlarge

Mark Coombs, Ashmore chief executive, said:

Emerging markets asset prices have started to reflect the resilient fundamentals of the underlying economies and investor activity levels are responding. Looking ahead, there is substantial absolute and relative value still available in emerging markets and investor allocations have much further to run from their significantly underweight levels.