The US Federal Reserve (the Fed) and its chair Janet Yellen are waiting for more information about president Donald Trump’s economic plans, just like everyone else.

Last night the Fed said its economic outlook remained essentially unchanged since its previous meeting in December. At that meeting, the Fed raised its benchmark interest rate for just the second time since the financial crisis and now sit at 0.5 percent to 0.75 percent, still very low by historical standards.

Low rates encourage borrowing and risk-taking, contributing to faster economic growth. By raising rates, the Fed is gradually reducing the force of that stimulus.

But interest rates have never made for an exciting topic of conversation.

Americans would far rather talk about the ball game, movies, or even politics.

However, an absence of chatter does not mean people are unconscious to the subject.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis is especially so as, since the downturn of 2008, rate shifts have become a rare event. Any change now stands out, and captures people’s attention.

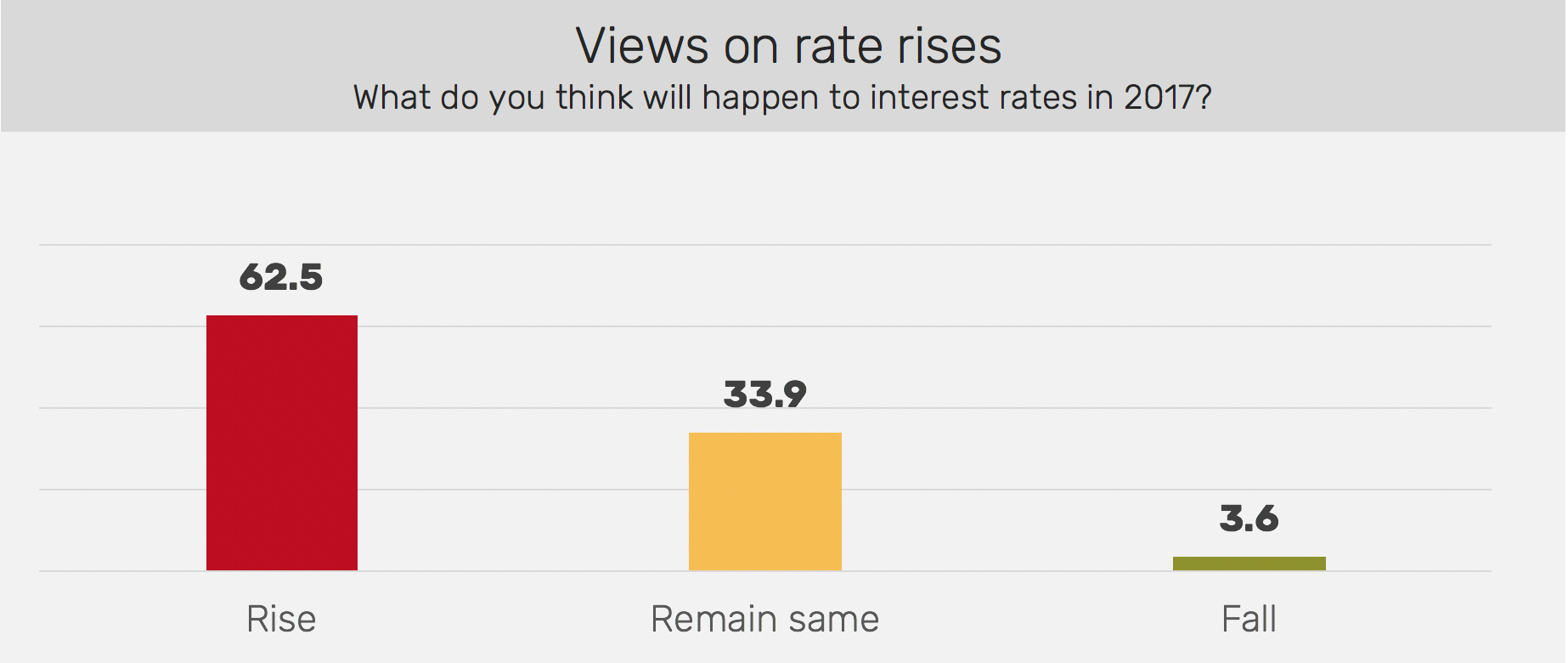

And so it was with the small rise the Fed initiated last year. This not only sent a clear signal to markets, it also shifted consumer views. Before the rise, just under 48 percent of consumers said that they expected rates to increase in 2017. After the rise, this figure jumped to 63 percent.

While the future direction of rates is not the only thing that impacts consumer spending, it is a factor in decision making — especially for larger purchases.

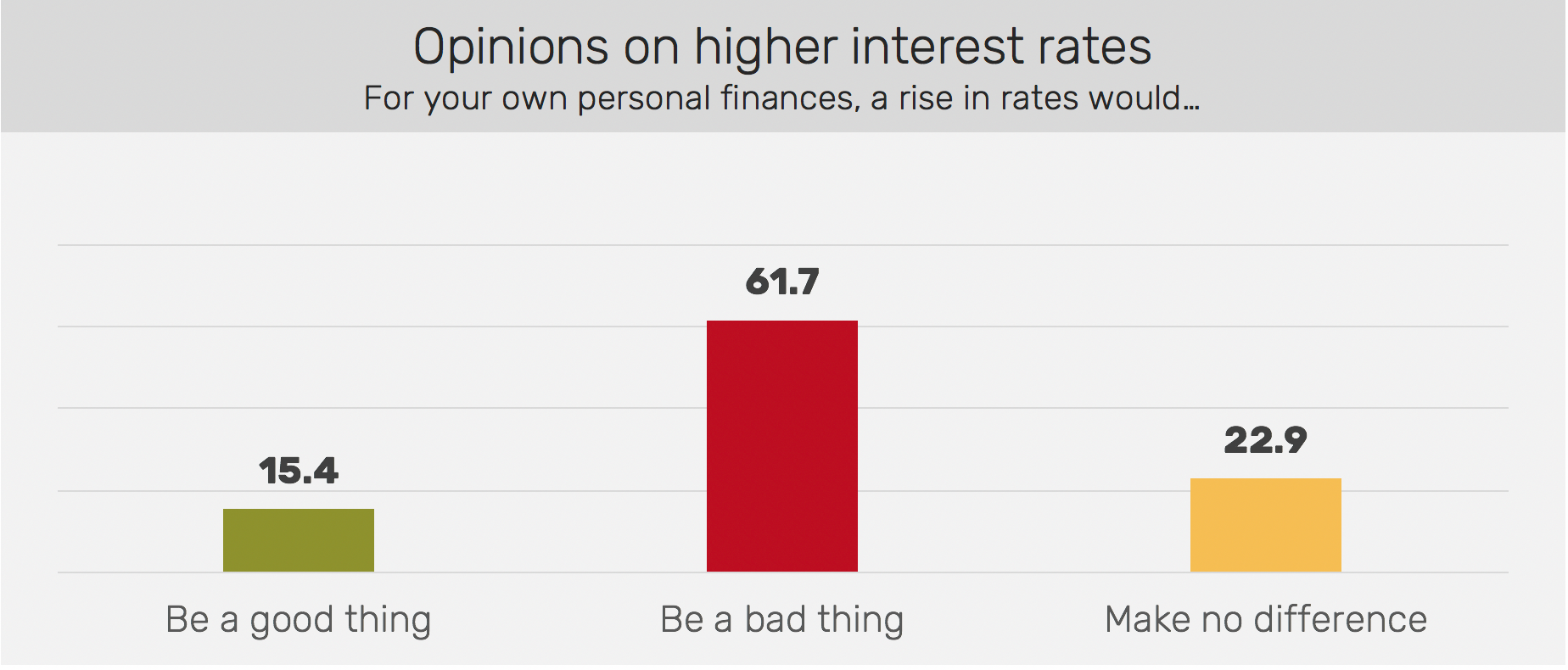

The effect of actual, or anticipated, rate rises varies from consumer to consumers. Those with savings and low debt are more inclined to view a rate rise as positive; those in the opposite position take a contrary view.

Unfortunately, the number of Americans with high debts and low savings are in the majority. Indeed, at the end of last year we estimate that US consumers had $792bn in outstanding credit card debt, with a further $8.4trn in mortgage debts, and $1.3trn in car loans.

Not all this debt will be subject to interest rate variations, but much of it will be. As such, even a small rate hike is bad news for many Americans: from our consumer survey 62 percent say increases adversely impact their personal finances.

To date, the magnitude of the increases is not sufficient to put a major dint in consumer spending. However, if rates creep up further and consumers feel their finances tightening, the effect could be much more pronounced.

Today, America is a country where consumer finances are fragile, wage growth is sluggish, the economic future is uncertain, and where living standards are relatively static. Against this backdrop for many consumers, debt has become a shortcut, and even a necessity, for attaining the American dream

Unless the dynamics of the situation change, the Federal Reserve will continue to walk a tightrope in balancing the need for responsible monetary policy with the necessity of keeping consumer demand buoyant.

Note:

Consumer research is taken from GlobalData retail’s monthly US sentiment survey; the numbers in this article are from the February publication, which was based on a representative sample of 2,575 Americans over the last two weeks of January.