The technology industry continues to be a hotbed of innovation, with activity driven by the rapid emergence and widespread adoption of game-changing technologies such as artificial intelligence (AI), Internet of Things (IoT), and robotics, and growing importance of technologies such as machine vision systems, ultrasonic testing, eddy current testing, and X-ray and radiographic testing. In the last three years alone, there have been over 3.6 million patents filed and granted in the technology industry, according to GlobalData’s report on Innovation in Artificial Intelligence: Defect detection techniques. Buy the report here.

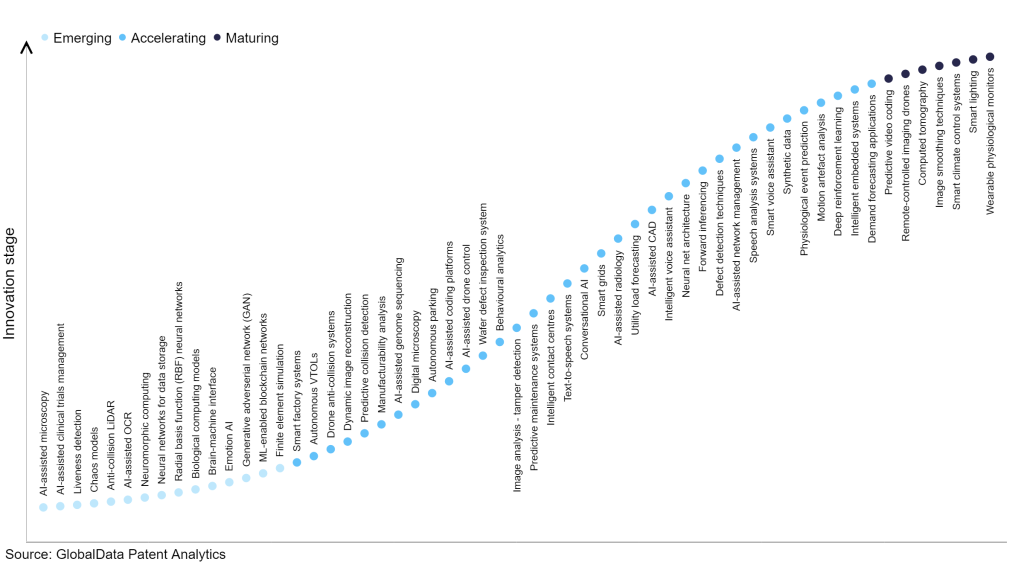

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

300+ innovations will shape the technology industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the technology industry using innovation intensity models built on over 2.5 million patents, there are 300+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, finite element simulation, ML-enabled blockchain networks and generative adversarial networks (GAN) are disruptive technologies that are in the early stages of application and should be tracked closely. Demand forecasting applications, intelligent embedded systems, and deep reinforcement learning are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are wearable physiological monitors and smart lighting, which are now well established in the industry.

Innovation S-curve for artificial intelligence in the technology industry

Defect detection techniques is a key innovation area in artificial intelligence

Defect detection techniques encompass various approaches employed to identify and assess software defects, ensuring the proper functioning and alignment with customer requirements. These techniques involve static analysis, dynamic analysis, code review, debugging, and testing, all aimed at identifying and evaluating the severity of defects within the software.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 120+ companies, spanning technology vendors, established technology companies, and up-and-coming start-ups engaged in the development and application of defect detection techniques.

Key players in defect detection techniques – a disruptive innovation in the technology industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to defect detection techniques

Source: GlobalData Patent Analytics

KLA is a leading patent filer in defect detection techniques. One company’s patents are focused on methods and systems for determining characteristics of patterns of interest (POIs). A system acquires output from an inspection system without defect detection at the POI instances to generate a selection of POI instances. The system then acquires output from an output acquisition subsystem for the selected POI instances and determines their characteristics based on the acquired output.

Other prominent patent filers in the space include Toshiba and Hitachi.

By geographical reach, ThyssenKrupp leads the pack, followed by SUSS MicroTec Lithography and Compagnie de Saint-Gobain. In terms of application diversity, Nanotronics Imaging holds the top position, followed by XiAn Bright Laser Technologies and Ocado Group.

Defect detection techniques are gaining significance as they help identify and mitigate software defects, ensuring the quality and reliability of software applications. By detecting and addressing defects early in the development process, these techniques contribute to improved software performance, enhanced user experience, and reduced risks and costs associated with software failures.

To further understand how artificial intelligence is disrupting the technology industry, access GlobalData’s latest thematic research report on Artificial Intelligence (AI) – Thematic Intelligence.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.