Intel is in early discussions to acquire AI chip designer SambaNova, according to a Bloomberg News report that cites sources with knowledge of the matter.

This development comes as Intel continues to pursue a larger role in the AI hardware space, following limited success in gaining traction against established competitors such as Nvidia in the AI graphics processing unit (GPU) segment.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Intel’s earlier strategies, which positioned its chips as cost-effective alternatives to Nvidia’s, have not produced significant market impact, reported Reuters.

SambaNova, which was founded in 2017 in California, has engaged bankers to assess market interest from possible acquirers.

If an agreement is reached, the transaction would likely value SambaNova under the $5bn benchmark set during its 2021 financing round.

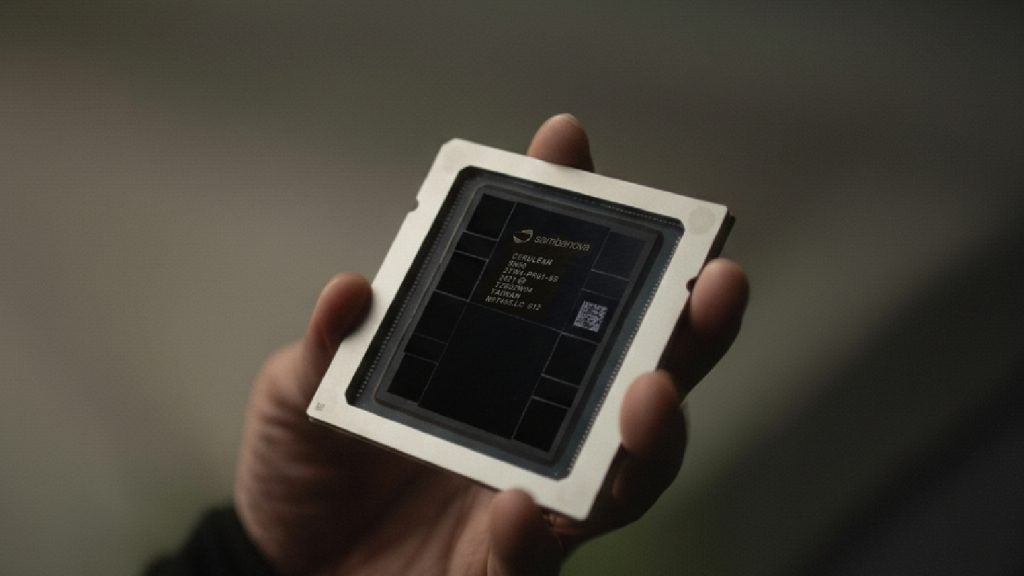

SambaNova specialises in custom AI chips and systems for large-scale applications. The company has previously drawn investment from key players connected to Intel.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIntel Capital is among its investors, while Intel CEO Lip-Bu Tan’s Walden International was an early backer.

SoftBank’s Vision Fund, associated with Intel through prior investments, has also provided funding to SambaNova. In 2024, SambaNova appointed Tan as executive chairman, signalling a deepened relationship between the two companies.

Amid these acquisition talks, Intel has outlined plans for renewed entry into the AI GPU market through a new AI data centre chip scheduled for launch in 2026.

At the recent Open Compute Summit, Intel chief technology officer Sachin Katti discussed the industry’s transition from static training to real-time inference in AI applications.

Katti emphasised the need for heterogeneous systems tailored to specific tasks and highlighted Intel’s Xe architecture data centre GPU as a solution designed to address increasing demand and support growing AI workloads.

The upcoming data centre GPU, named Crescent Island, is designed with 160GB of memory that differs from the high bandwidth memory used in competing AMD and Nvidia products. Crescent Island leverages architecture previously used in Intel’s consumer GPUs.

Financially, Intel recently reported third-quarter 2025 revenue of $13.7bn, a 3% increase year-over-year.

Earnings per share (EPS) attributable to Intel stood at $0.9, while non-GAAP EPS was $0.23 for the quarter. The company forecasts fourth-quarter revenue between $12.8bn and $13.8bn with projected EPS of $(0.14) and non-GAAP EPS of $0.08.