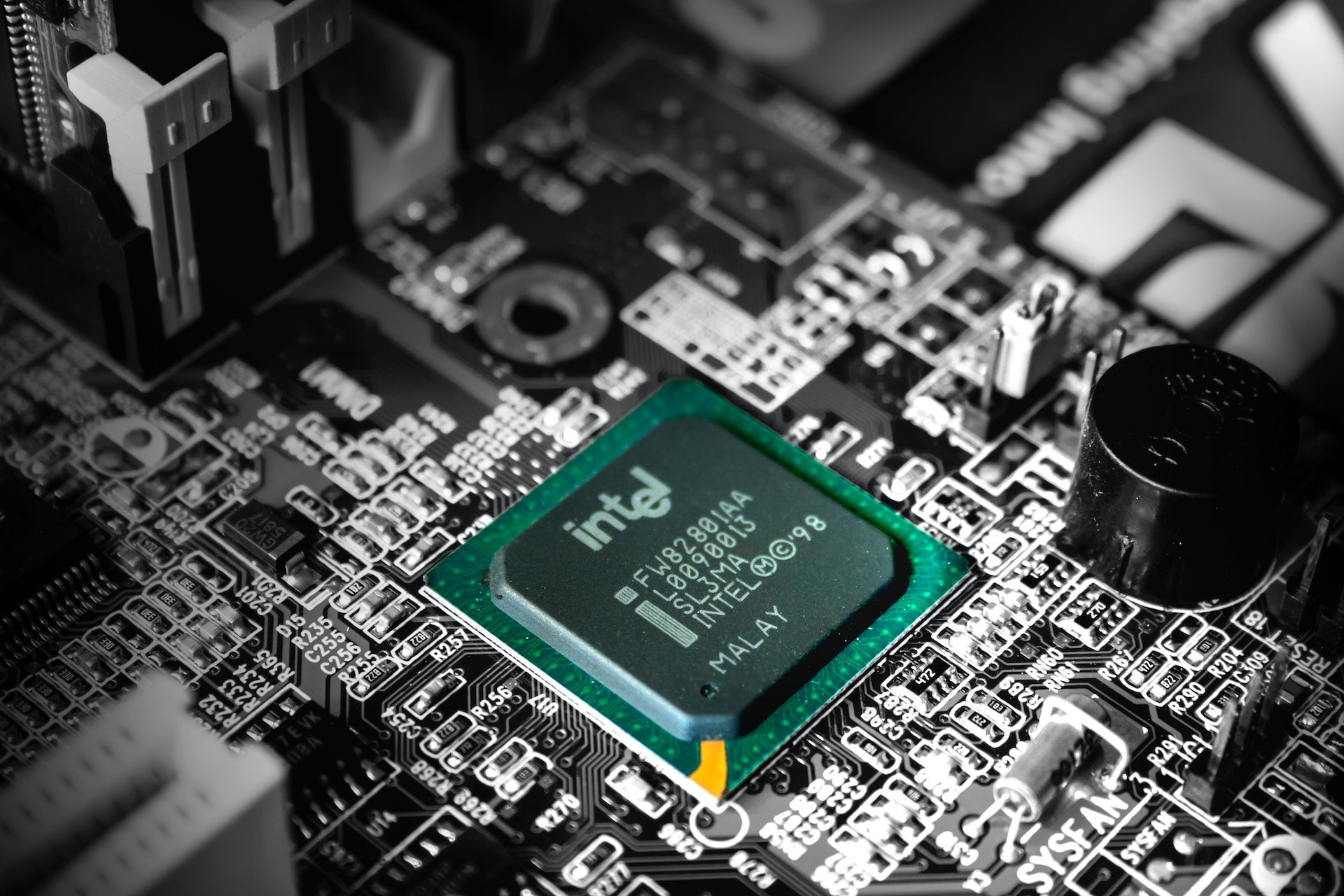

Intel has mutually agreed to terminate the $5.4bn acquisition of Israeli chip company Tower Semiconductor citing failure to receive regulatory approval in a timely manner.

As per the terms of the merger agreement, which was announced last February, Intel will pay $353m (NIS1.3bn) in termination fees to TOWER.

Through the acquisition of Tower, Intel hoped to bolster its end-to-end foundry business across the globe.

Intel CEO Pat Gelsinger said: “Our foundry efforts are critical to unlocking the full potential of IDM 2.0, and we continue to drive forward on all facets of our strategy.

“We are executing well on our roadmap to regain transistor performance and power performance leadership by 2025, building momentum with customers and the broader ecosystem and investing to deliver the geographically diverse and resilient manufacturing footprint the world needs.”

Tower Semiconductor CEO Russell Ellwanger said: “Tower was very excited to join Intel to enable Pat Gelsinger’s vision for Intel’s foundry business. During the past 18 months, we have made significant technological, operational, and business advancements.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIntel and Tower did not provide any detail about the regulatory hurdle.

According to Reuters’ report, the acquisition did not receive clearance from Chinese authorities.

Due to delays in obtaining approval from Chinese regulators, DuPont de Nemours terminated its $5.2bn deal to purchase electronics materials manufacturer Rogers Corporation in 2022.

In June this year, it was reported that Intel is planning to invest $25bn to build a new chip factory in Israel.