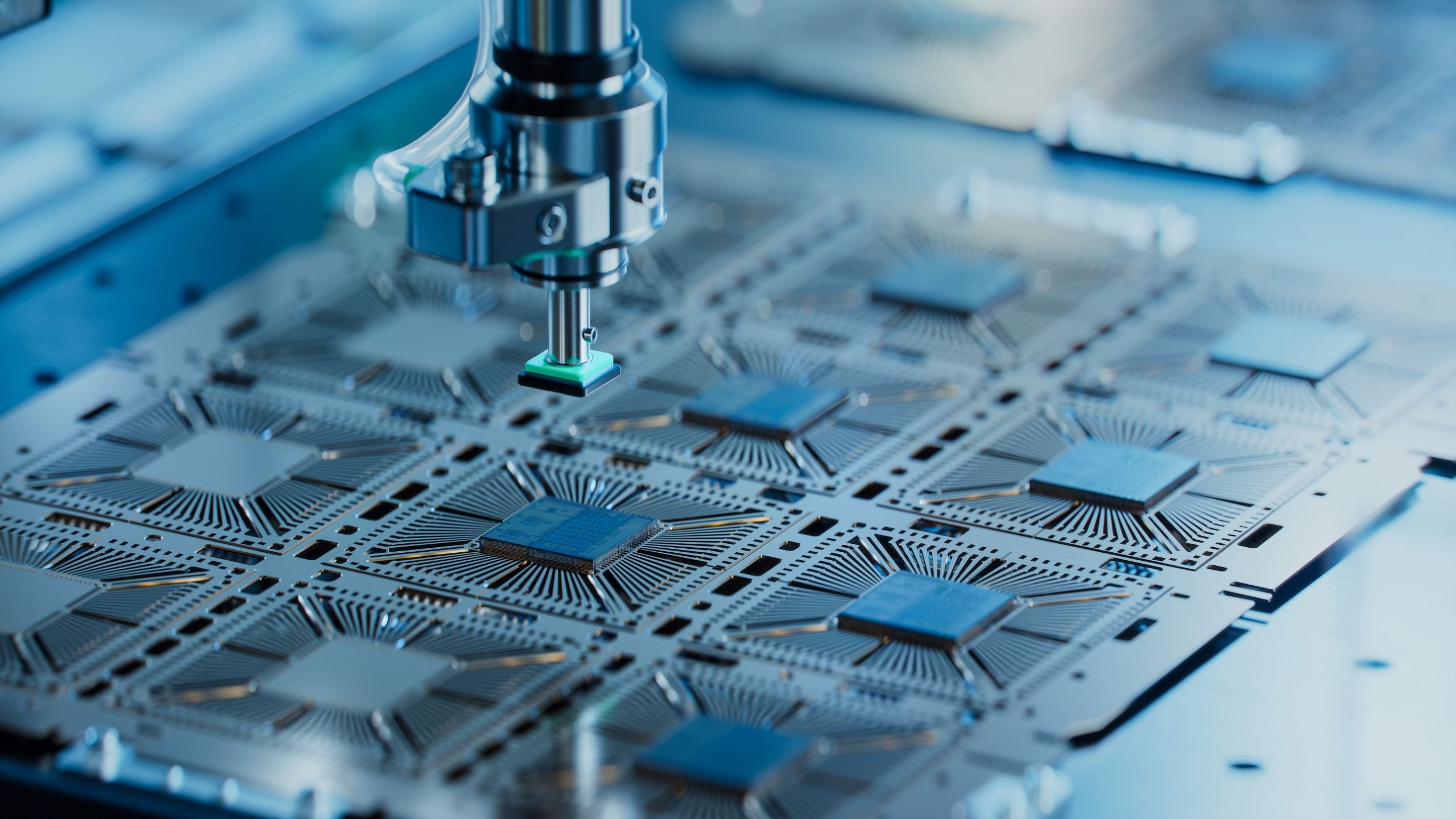

Chipmaking equipment manufacturer Disco has announced plans to construct a cutting-edge plant in Hiroshima region.

The facility, situated in the city of Kure, aims to manufacture a critical component used in processing wafers, positioning the company to cater to the increasing needs of customers ramping up production of chips.

The upcoming plant, with an estimated investment exceeding £200m (40bn yen), will focus on the production of cut-off wheels crucial in the dicing, grinding, and polishing processes.

This development is expected to boost Disco’s output capacity by 14 times, with the ambitious target set for achievement by 2035. Construction is scheduled to commence as early as 2025.

Disco currently holds the world’s dominant market share in machines dedicated to dicing, grinding, and polishing, with the cut-off wheels, composed of diamonds, requiring periodic replacement as they wear out.

Disco already operates two facilities in Hiroshima prefecture and one in Nagano prefecture for the production of these essential components.

Last year, Disco secured an additional plot adjacent to its existing Kure plant, laying the foundation for the construction of three facilities by the year 2035. The plan involves transferring equipment from the existing plant to these new structures, further solidifying Disco’s position in the chipmaking equipment market.

The semiconductor industry is anticipated to witness substantial growth, driven by advancements in artificial intelligence and the widespread adoption of the 5G communications format.

For equipment manufacturers like Disco, replacement parts present lucrative opportunities, offering high margins and ensuring stable revenues. In the fiscal year ending March 2023, Disco reported record sales amounting to £163bn (284.1bn yen), with replacement parts, including cut-off wheels, contributing to 20% of the total revenue. Sales of replacement parts have tripled over the past decade.

Japan announced plans in November to designate an extra $13.3bn (¥2trn) to bolster its domestic semiconductor manufacturing.

Some $5bn of the budget will support chip production, which could include a second Taiwan Semiconductor Manufacturing Co. (TSMC) facility in Kumamoto. The factory is expected to cost $13bn and will produce 2-12 nanometer logic chips.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn October 2023, the secretary general of the Liberal Democratic Party, Yoshihiro Seki, said Japan announced plans to make $10bn of additional funds in subsidies available for a TSMC factory in Kumamoto and the domestic chip venture Rapidus.