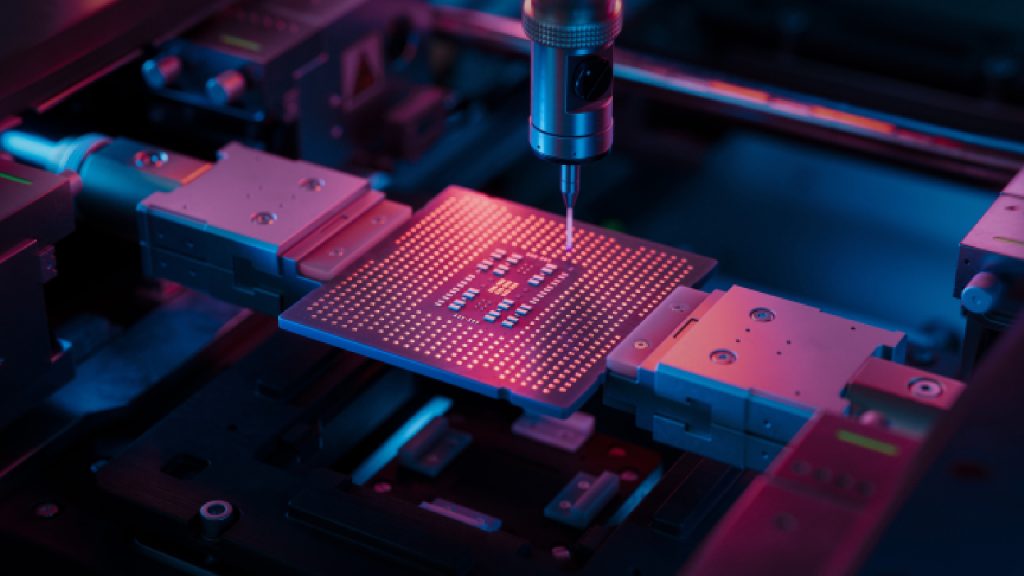

Meta has confirmed plans to allocate more than $600bn towards AI technology, data centres, and related infrastructure in the US through 2028.

The social technology company said that this investment is intended to support its development of AI systems and scale operational capacity across its sites in the country.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Currently, Meta claims to generate more than $20bn in business for domestic subcontractors across areas such as steel fabrication, electrical installation, pipefitting, and fibre optic deployment.

Regarding power consumption, Meta coordinates with utilities to address energy requirements for its facilities and covers all associated costs.

According to the Facebook owner, direct investments have resulted in hundreds of millions of dollars being allocated to grid infrastructure upgrades and added 15 gigawatts (GW) of new energy capacity to US power grids.

On water management, Meta reported implementing data centre designs that reduce water use compared to industry averages.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe company stated that it also restores water to local watersheds and is targeting a water-positive footprint by 2030.

In addition, Meta revealed that it invests in community infrastructure such as roads and water systems at its data centre locations.

Meta indicated that as demand for AI accelerates, it will continue scaling its data centre infrastructure in the US.

In October 2025, Meta and funds managed by Blue Owl Capital formed a joint venture (JV) to manage the development and ownership of the Hyperion data centre campus in Richland Parish, Louisiana.

Meta will oversee the construction and property management of the facility.

Recently, Meta announced its third-quarter 2025 (Q3 2025) results, with net income declining 83% to $2.7bn from $15.7bn in Q3 2024. Revenue for Q3 2025 surged 26% to $51.2bn, up from $40.6bn in Q3 2024.