JPMorgan Chase axed around 500 roles that will mostly impact technology and operations roles, CNBC reported, citing sources aware of the development.

The cuts, which happened last week, were spread across the company’s retail and commercial banking, asset and wealth management and corporate and investment banking divisions.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

JPMorgan declined to comment on the development.

Separately, the US financial services giant said it is axing jobs at First Republic Bank, a collapsed bank it acquired earlier this month.

The decision is likely to impact some 1,000 First Republic employees.

“Since our acquisition of First Republic on May 1, we have been transparent with their employees and kept our promise to update them on their employment status within 30 days,” a spokesperson was quoted by Bloomberg as saying.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“We recognise that they have been under stress and uncertainty since March and hope that today will bring clarity and closure.”

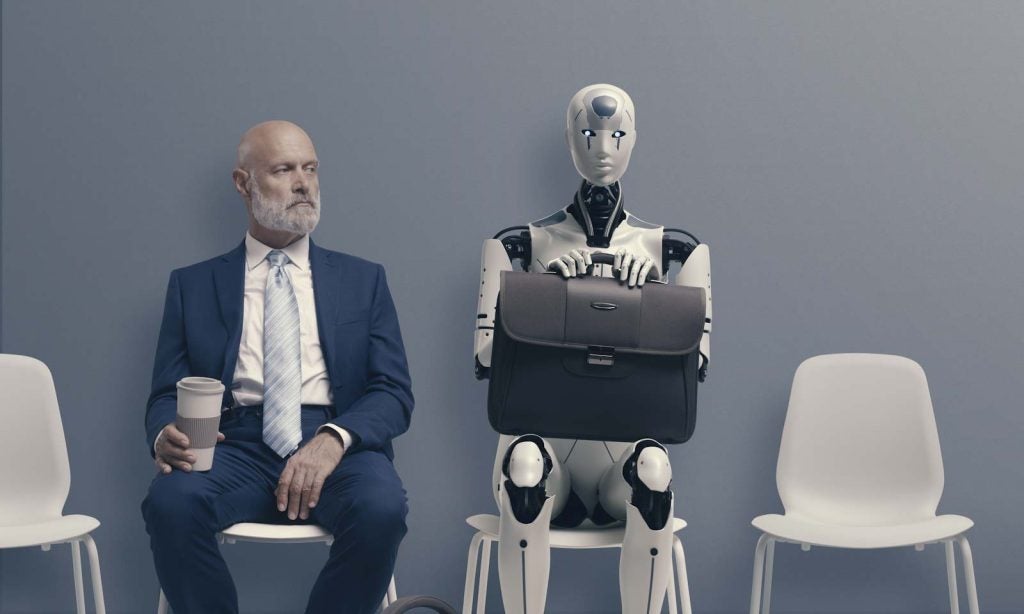

The job cuts come as the bank works to launch an artificial intelligence (AI) solution similar to ChatGPT to offer investment advice.

JPMorgan filed an application to trademark a product, called ChatGPT, CNBC reported, citing a filing.

According to the bank, IndexGPT will leverage “cloud computing software using artificial intelligence” for “analysing and selecting securities tailored to customer needs.”

If the product comes to market, JPMorgan will become the first financial services provider to launch such an offering directly to its customers.