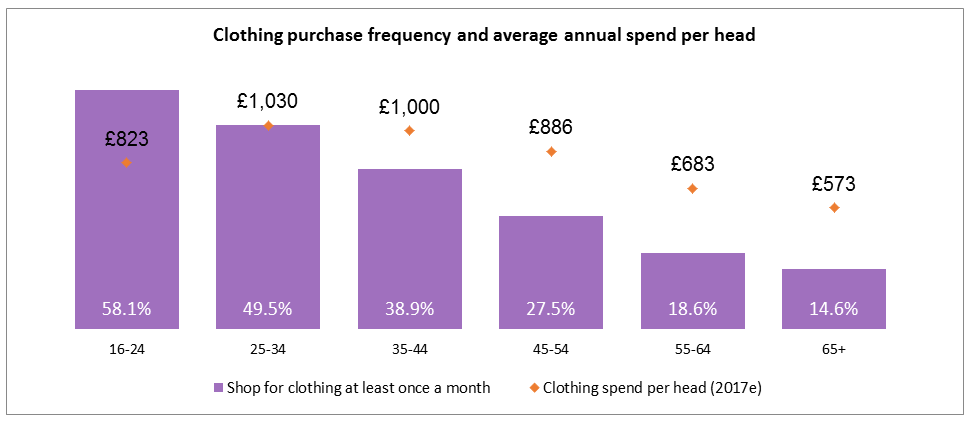

Young people when shopping for clothes have the highest purchase frequency, with 58.1 percent of 16-24s buying clothing at least once a month, compared to 14.6 percent of over 65s, according to GlobalData research.

Regular spending among young shoppers is encouraged by the faster turnover of fashion ranges and more accessible choice, especially online, helping to drive up annual clothing spend – which in 2017 is forecast at £140 higher than that of 55-64s, and £250 higher than the over 65s.

An innate understanding of their core demographic has been central to the success of youth fashion players, with investment in customer engagement, especially via social media, driving regular wants-driven purchases.

Indeed, 64.5 percent of ASOS clothing shoppers shop for clothing once a month, with 56.6 percent of New Look shoppers also stating they shop as frequently for the category.

In contrast, both M&S and Debenhams have a higher proportion of occasional clothing shoppers with just 29 percent and 39.4 percent of their clothing shoppers buying into the category monthly.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe current over 65s are unlikely to significantly change the regularity of their purchasing citing that they have less need for constant wardrobe updates, but retailers can still make this demographic more lucrative.

High street players must instead focus on driving up basket sizes via outfit building, editorial content and a more personalised service, as well as more enjoyable shopping experiences, in a bid to make their core customer base of predominantly occasional shoppers more valuable.

Related Company Profiles

Debenhams plc

ASOS Plc