The news is awash with headlines bound to make us worried about what is left in our bank accounts: but these headlines are also hitting quantum computing companies hard. This technology—which could revolutionize drug discovery, options trading, and optimization algorithms—could be about to head into a ‘quantum winter’ if investors and technology companies shy away from continued investment.

There are many reasons to worry

Big Tech companies such as Amazon, Google, and Alibaba are among the leaders in quantum computing. However, the breadth and depth of research in the industry mean startups are vital to build a strong quantum ecosystem with multiple sources of innovation. These startups are suffering from the high inflation because this increases their cash burn rate. This means they will run out of money faster.

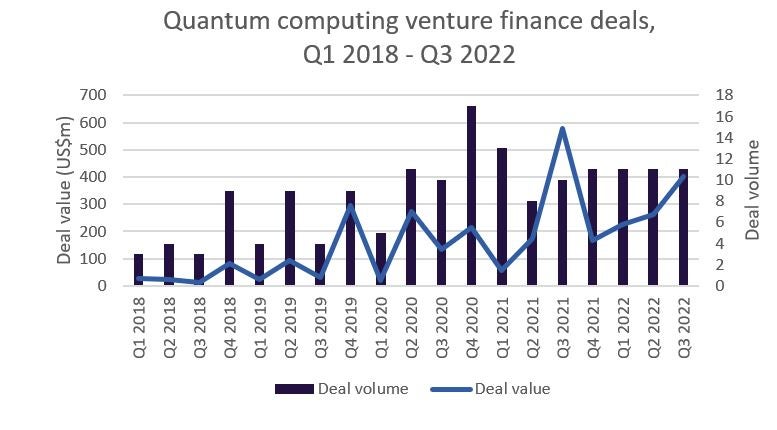

High interest rates will also hurt public and private quantum computing startups alike. Many fund managers and venture capitalists will likely rebalance their portfolios to include lower-risk assets, piling on the further cash strain on quantum computing companies. Therefore, many quantum computing startups will find it more difficult to continue the rapid growth they have experienced in recent years.

Quantum computing companies are not immune to the plummeting valuation of tech companies either. Indeed, the three quantum computing companies that went public recently have followed a similar course to the rest of the tech sector. IonQ floated first in October 2021, and Rigetti Computing and D-Wave followed suit in 2022. IonQ’s share price peaked in November 2021, but a year later it has crashed to 82% of that value.

This market volatility will result in many late-stage startups, such as Anglo-American PsiQuantum delaying an IPO in order to wait for more favorable conditions.

A quantum winter?

Quantum computing has always been vulnerable to a winter similar to that suffered during the development of artificial intelligence. Headwinds facing the sector along with slow progress to meet inflated expectations and the extremely long timelines to commercialization will frustrate the excitement around its potential. This comes at a time when macroeconomic conditions mean more money is needed by cash-hungry companies than ever before.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAlthough companies are always ready to tout their achievements, we are still far off a stable, scalable qubit. The steady flow of announcements, such as IBM’s new 433-qubit processor, presents an illusion that progress is coming in thick and fast. However, there is no reason why progress should accelerate in this industry, and the likely funding cuts add to this concern. Qubits are notoriously difficult to scale, and the industry is waiting on improvements in error-correction technologies.

For the most part, quantum computing is a nascent technology and research progress is highly unpredictable. Experts cannot predict which qubit architecture will dominate in the future, and their belief that systems later this decade will be a mix-and-match affair will not offer much reassurance to worried investors. This lack of predictability and the risk associated with pouring more money into quantum computing may spell trouble.

Are there reasons to be optimistic?

Typically, in recessionary environments, startups focus on short-term profitability rather than revenue growth. However, many quantum computing startups have no current path to profitability. They may be cushioned for a while following the last few years of abundant fundraising but will struggle for cash as these funds run dry.

On the other hand, the Big Tech firms involved will remain focused on quantum computing research after its hype died down in 2019. More realistic progress expectations coupled with the belief that the technology has the potential to dramatically advance the power of computers (and alter their sector) will see many technology companies commit to quantum computing. Those that do will experience the greatest rewards as the technology matures later this decade.

Another point of consideration is the money guaranteed to pour in from central governments. Quantum computing’s geopolitical weight and the risk a powerful quantum computer poses to current cybersecurity measures mean that the US and China—as well as EU countries, the UK, Israel, and Australia—are focused on building strong internal quantum ecosystems in the name of national security. This will allow companies to progress, as seen when the UK Ministry of Defence purchased a quantum computer from ORCA in June 2022.

Strong headwinds, but quantum progress will continue

The importance of quantum computing to governments and technology companies will result in money, and therefore progress, continuing to flow in the sector. However, many quantum computing startups will not find it so easy.

Given that quantum computing remains several years off any significant commercialization, quantum software companies waiting on progress from their hardware partners will struggle. Larger companies, including the likes of Intel, Honeywell, Fujitsu, and Microsoft, may well scoop up struggling startups amid lower valuations.

Related Company Profiles

Intel Corp

Fujitsu Ltd