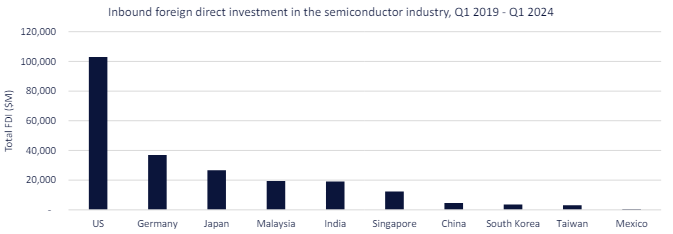

The US semiconductor industry has attracted over $100bn in foreign direct investment (FDI) since 2019, making it the largest recipient of FDI globally according to research and analysis company GlobalData.

In its 2024 thematic intelligence report into next-generation chips, GlobalData reported that the top investors into the US were TSMC, Infineon, Bosch and ASML.

GlobalData reported that TSMC would increase its future investment into the US from $45bn to $65bn by 2030.

The research analyst credited the US $6.6bn CHIPS Act subsidy as the main motivation behind TSMC’s increased investment.

US-TSMC relations have been strained, following a US skills shortage facing its chip industry and several setbacks in the construction of TSMC’s second Arizona plant.

While the US CHIPS Act promised an additional $52.7bn in funding for semiconductor research, TSMC has faced delays in its payment making it harder for the company to construct chip plants and develop its US workforce.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFollowing its April 2024 payment of $6.6bn, TSMC has committed to building a third plant in Arizona, signifying a consolidation in its relationship with the US chip industry.

However, constructing chip plants in the US continues to be a significant labour and materials cost for TSMC in comparison to building in Asia. GlobalData’s report forecasts that the US will need to continue its financial commitment to supporting chip companies like TSMC to continue fostering local chip production.

GlobalData acknowledged that this could be disrupted by the US 2024 Presidential election.

Germany ranked second to the US in terms of global FDI in semiconductors, with a total of nearly $40m in FDI since 2019.

However, GlobalData forecasts that Germany is cementing its place as Europe’s chip hub following a 69% increase in FDI from 2022.

TSMC has similarly committed to constructing a $3.8bn chip plant in Dresden, which aims to produce around 12-28 million chips by 2028.

GlobalData noted that Europe only accounts for 10% of global chip manufacturing, making it hard for the continent to compete with the US or Asia-Pacific region. Despite this, GlobalData predicts that Europe will intend to improve its chip self-sufficiency, potentially creating it as a subsidiary production hub of either the US or China depending on geopolitics.