Unilever has said it will be selling its margarine business, which includes staple UK brands Flora and Stork, to streamline its food portfolio to reduce costs and raise profit margins as a reaction to Kraft Heinz’s failed takeover bid.

Click to enlarge

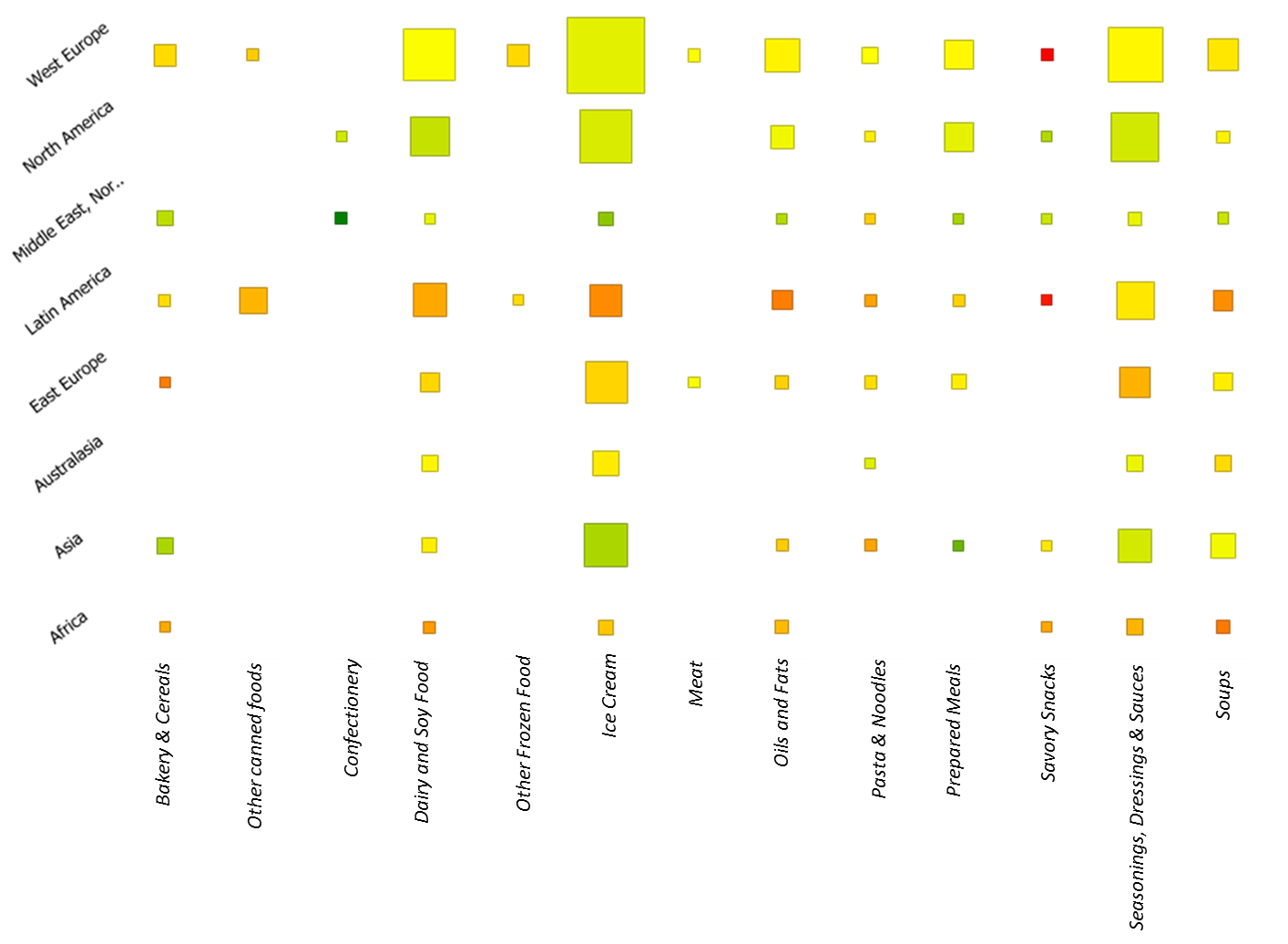

The grid above shows sales of Unilever’s brands by retail selling price in different categories and regions in 2015.

Square sizes indicates value, with larger size representing higher value, while colour represents 2010-2015 growth with green being strong growth.

The proposed sell off by Unilever leaves the margarine industry in a state of disarray as one of its biggest players plans on leaving the category after decades of declining growth rates.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis not only leaves Unilever’s former competitors scrambling to fill this new power vacuum, but may also be seen by shareholders of these businesses as an admission of the failure of margarine to appeal to the new generation of consumers.

The move does make sounds financial sense for Unilever however, as it has seen very slow growth rates for its oils and fats segment, particularly in emerging markets, and will want to capitalise on the brands even as they struggle.

Raising funds from these brands, and streamlining their operation will also give Unilever a competitive advantage in the segments which they see as the future battlegrounds, likely ice cream and seasonings, dressings and sauces, where they are seeing strong successes.

This could have future shockwaves too; a succesful sale of these brands, and allocation of the resulting funds, could leave Unilever thinking “what’s next”?

With a wide brand umbrella, there are vast opportunities to trim the branches, and strugglers in savory snacks, such as Beigel & Beigel and Bifi, could well find themselves to be next on the chopping block as Unilever better positions itself to play to it’s strengths.

Related Company Profiles

Unilever Plc