Facebook founder Mark Zuckerberg has said that he will remain chairman of the board, despite mounting pressure for him to quit the role following a number of controversies.

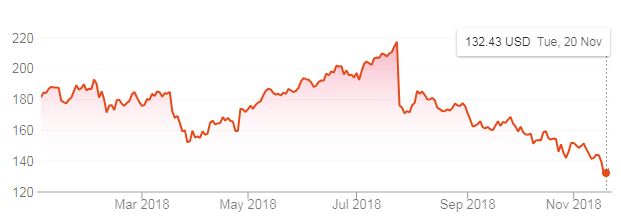

The company’s stock price has been battered this year, falling by almost 40% from its July peak of more than $217 to below $135. The Cambridge Analytica scandal, Russian interference in the 2016 United States presidential election and a data breach involving more than 50 million users, are just some of the issues that Zuckerberg has had to navigate over the past 12 months.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

A recent report by the New York Times, accusing Facebook of covering up knowledge of and attempting to deflect attention away from its controversies, has led to fresh calls for Zuckerberg to stand down.

With shareholders keen to see somebody new take control, could Zuckerberg be forced out of one, or both, of his Facebook positions?

Zuckerberg’s Facebook ‘dictatorship’

In order to force Zuckerberg out of his position, shareholders would have to hold a vote. The majority would need to agree that Zuckerberg is not the right person for the role.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe issue with this is Zuckerberg is the majority. The Facebook founder still owns approximately 60% of the company’s voting shares, with his close allies controlling another 10%.

Zuckerberg only owns around 28% of Facebook stock. However, his shares are worth more than the publicly traded shares. Class A shares, the kind that are traded on the NASDAQ exchange, are good for one vote per share. Class B shares, the type retained by Zuckerberg and a small group of executives, are worth 10 votes per share.

Google operates a similar way, with B shares also holding superior voting power. These shares are largely held by co-founders Larry Page and Sergey Brin, as well as early employee Eric Schmidt.

What this means is that unless Zuckerberg decides to resign, it is almost impossible for shareholders to force his exit.

Even if he was to relinquish one of his roles, it would subject him to the potential changes that could force him out.

Apple co-founder Steve Jobs found himself in a similar situation in 1985. After luring John Sculley from Pepsi Co to serve as CEO, Sculley gained the support of the board to restructure the organisation and move Jobs into a position that severely reduced his power. Jobs was forced to hand in his resignation within months.

Uber founder Travis Kalanick was similarly overthrown. First pressured into stepping down as chairman following a sexism scandal, the board then ousted him as CEO a few months later.

Could the authorities intervene?

The United States Security and Exchange Commission, the government agency responsible for protecting investors and ensuring market fairness, can and has forced business leaders to stand down in the past.

Elon Musk, CEO and co-founder of Tesla, was forced to resign as chairman of the electric vehicle manufacturer in September after he was found to have misled investors by claiming that he had secured the funding to buy out the company and take it private. However, these cases are extremely rare.

Facebook has come under fire by lawmakers over the Russian election meddling scandal. However, this doesn’t concern Facebook as a business. While allowing this to go on may have damaged the brand, Zuckerberg hasn’t directly sought to mislead Facebook investors or gain an unfair advantage in the market, so it seems unlikely that the Security and Exchange Commission will act.

So is there any chance of Zuckerberg stepping down?

It seems unlikely right now.

Speaking to CNN following the latest calls for him to relinquish his role as chairman of the board, Zuckerberg said that he is “not currently thinking that that makes sense”.

However, mounting pressure from politicians, users and, most importantly, investors, could eventually force Zuckerberg’s hand. With Facebook’s stock falling, a new face at the helm could help to steady the ship.

Given how heavily invested Zuckerberg is in his social network, he will want to see it doing well on the stock exchange as much as the next investor.

When Facebook stock plunged in July as the company reported that earnings had fallen short of expectations in the second quarter, more than $20bn was wiped off of Zuckerberg’s net worth in a matter of hours.

With Zuckerberg hoping to provide all children with an education, change long established social systems, and cure all diseases by the end of the century through the Chan Zuckerberg Initiative, he needs money and, according to Microsoft founder Bill Gates, time, in order to achieve his philanthropy goals.

“My full-time work will be the [Bill & Melinda Gates] foundation for the rest of my life,” Gates said. “The foundation is the biggest part of my time, but then I put part-time work in to help as a [Microsoft] board member.”

Stepping aside at Facebook would provide Zuckerberg with both of those things. Unfortunately for Facebook’s concerned shareholders, fixing Facebook still appears to be his main focus.