Intel is set to conclude the year with a workforce more than 20% smaller than last year, as part of CEO Lip Bu Tan’s strategy to streamline operations and rectify past management errors.

Since assuming leadership in March, Tan has initiated job cuts and asset divestments to refocus the company’s efforts on core businesses. The majority of these job cuts have already been executed, resulting in an overall reduction of around 15%.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The cuts have predominantly targeted middle management, with CFO David Zinsner confirming a reduction of about 50% in management layers, reported Reuters.

Intel’s staff will decrease from 96,400 at the end of June to approximately 75,000 by the year-end. These changes align with Tan’s directive that investments must be economically justified and tailored to customer demand.

The firm’s underperformance in key sectors like AI chips, which is dominated by Nvidia, and personal computer semiconductors, where AMD has gained ground, has prompted this restructuring.

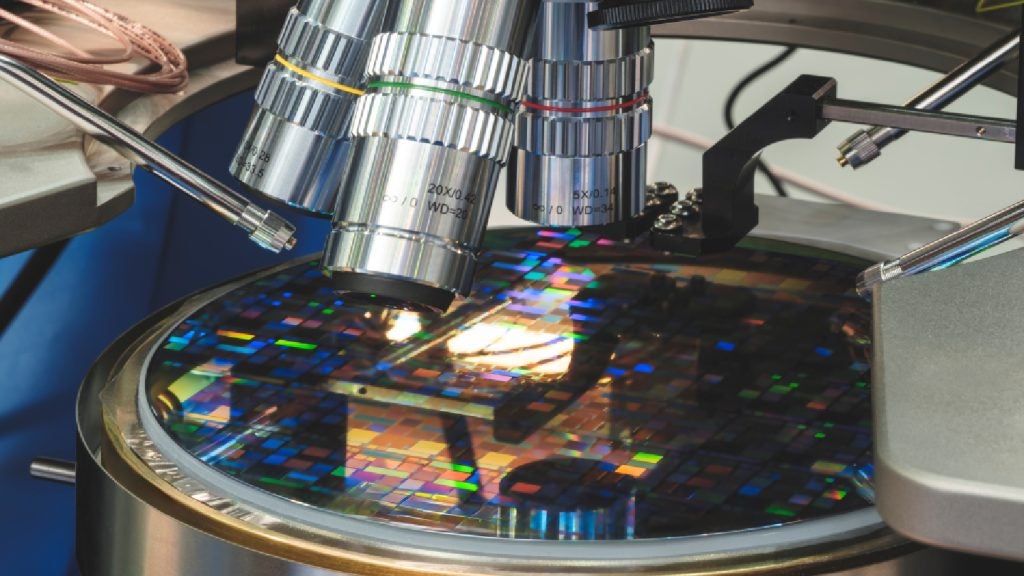

Additionally, Intel’s attempt to build a competitive chip contracting business against Taiwan’s TSMC has not progressed as planned.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFinancial forecasts for the third quarter predict a loss of $0.24 per share, with projected revenue between $12.6bn and $13.6bn.

In the second quarter ended 28 June 2025, Intel reported flat revenue year-over-year at $12.9bn, with earnings impacted by restructuring charges amounting to $1.9bn.

CEO Tan emphasised a shift in manufacturing strategy in his memo to employees, stating Intel will only construct new facilities based on actual demand rather than speculative growth. This approach marks a departure from previous practices where factories were built ahead of need.

Tan also addressed Intel’s 18A manufacturing process during an analyst call, noting its potential profitability if deployed for Intel’s own products. However, he acknowledged that without securing significant external customers for the next-generation 14A process technology, exiting the chip manufacturing business might be necessary.

Going forward, Intel plans to consolidate packaging operations across several countries while slowing or halting new factory construction in locations like Ohio, Poland, and Germany as part of its strategic realignment.

Tan said: “We are laser-focused on strengthening our core product portfolio and our AI roadmap to better serve customers. We are also taking the actions needed to build a more financially disciplined foundry.

“It’s going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value.”

Separately, a US federal judge dismissed a lawsuit alleging Intel misled shareholders about issues in its foundry business. The court ruled that Intel did not delay disclosing a major operating loss and maintained transparency regarding its operations.