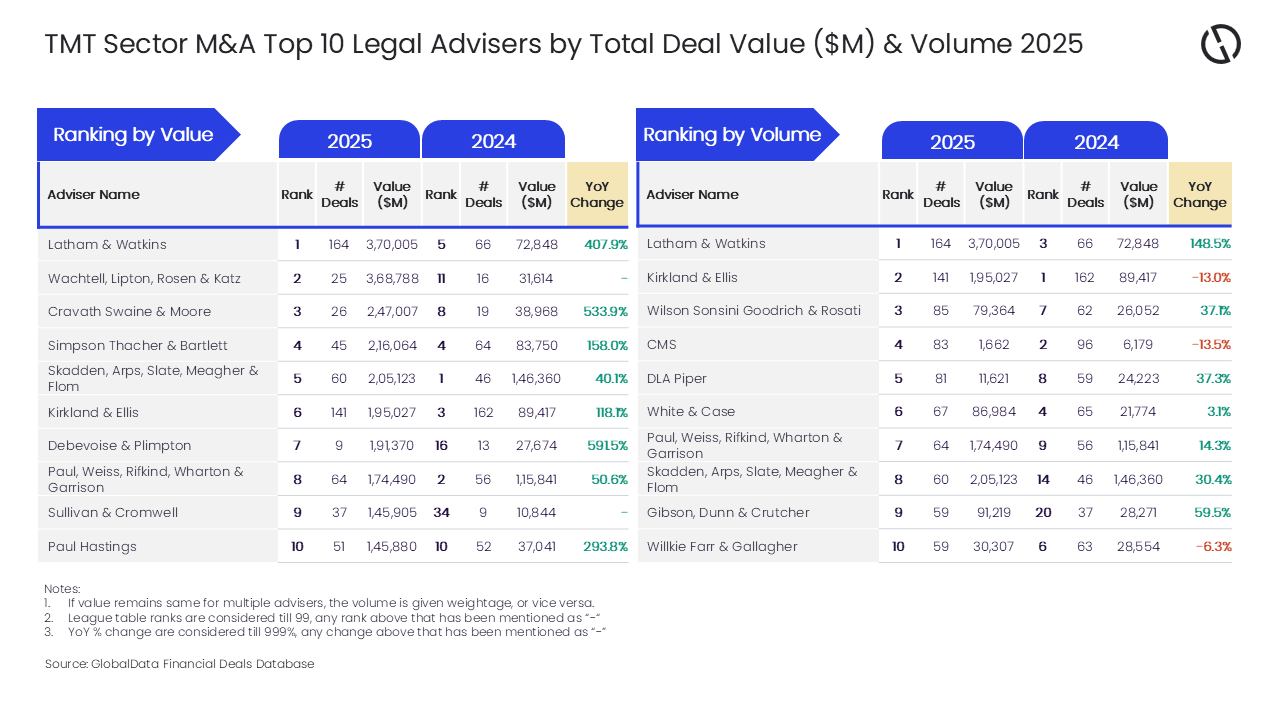

Latham & Watkins has been recognised as the leading legal adviser for mergers and acquisitions (M&A) in the technology, media, and telecom (TMT) sector for the year 2025.

This was disclosed in the latest league table of legal advisers published by GlobalData, an intelligence and productivity platform.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Latham & Watkins secured its top position by advising on a total of 164 deals amounting to $370bn.

In terms of the number of deals handled, Kirkland & Ellis followed closely behind with 141 transactions. Wilson Sonsini Goodrich & Rosati, CMS, and DLA Piper were also significant players, managing 85, 83, and 81 deals respectively.

In terms of deal value, Wachtell, Lipton, Rosen & Katz took the second spot with advisory services on deals worth $368.8bn.

Cravath Swaine & Moore, Simpson Thacher & Bartlett, and Skadden, Arps, Slate, Meagher & Flom also ranked prominently with deal values of $247bn, $216.1bn, and $205.1bn respectively. These figures reflect deals valued at $1bn or more.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData lead analyst Aurojyoti Bose said: “Latham & Watkins was among the only two advisers with triple-digit deal volume in 2025. Moreover, several of the deals advised by it were big-ticket deals, which helped it secure the top spot by value as well.

“The American multinational law firm advised on 29 billion-dollar deals that also included seven mega deals valued more than $10bn.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.