The AI boom is no longer confined to hyperscale server rooms; it’s now reshaping the economics of consumer electronics. Smartphones, PCs, and tablets are increasingly competing with AI data centres for the same core components: memory chips. Nothing CEO Carl Pei argues this is a first for the modern smartphone era, and the market signals back him up. As memory pricing climbs and supply tightens, device makers are being forced into uncomfortable trade-offs: raise retail prices, hold prices but cut specs, or quietly downgrade other components to protect margins.

Why memory is the new battleground

To understand the squeeze, it helps to separate the types of memory involved. Standard dynamic random access memory (DRAM) is a device’s short-term ‘working’ memory—what helps your phone keep apps open and switch quickly. NAND flash is long-term storage, holding photos, apps, and files. These are the components that dominate smartphone bills of materials.

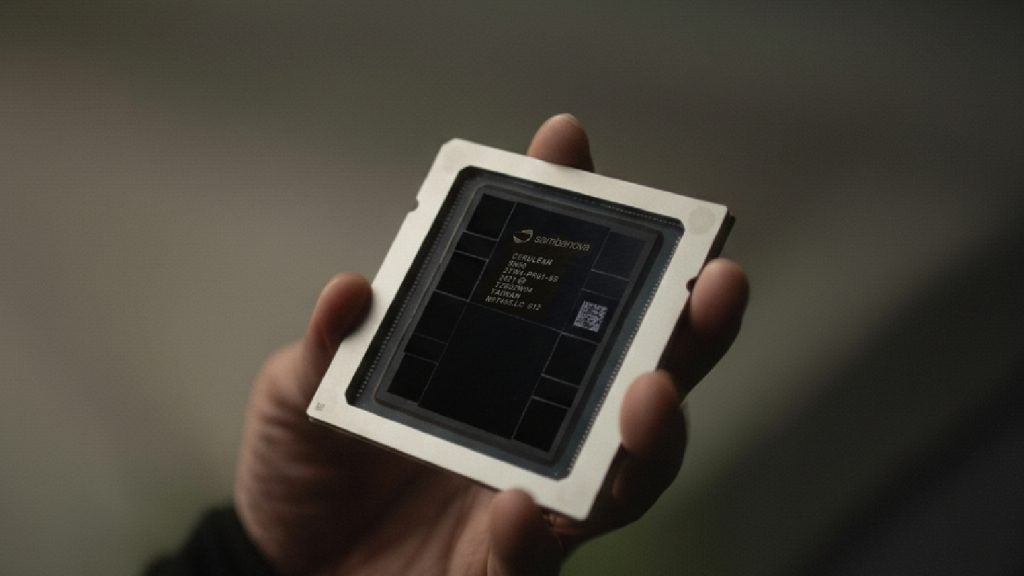

But the real disruption is being driven by high bandwidth memory (HBM), an advanced, ultra-fast form of DRAM used in AI accelerators and data centre GPUs such as Nvidia’s H100 and the emerging Nvidia Blackwell platform. HBM is difficult and expensive to manufacture, and it’s essential to today’s large-model training and inference workloads. As demand for AI compute explodes, memory makers are shifting capacity away from conventional DRAM and toward HBM—because that’s where the margins are.

Suppliers are prioritising AI customers

Samsung, SK Hynix, and Micron are increasingly optimising production for AI-focused memory, and the biggest winners are the companies able to commit huge capital up front. Nvidia and AMD sit at the centre of the AI hardware stack, while hyperscalers such as Microsoft, Google, Amazon Web Services (AWS), and Meta are locking in supply through long-term contracts and multi-billion-dollar prepayments.

This has a direct opportunity cost. Semiconductor manufacturing capacity is finite: Every wafer devoted to high-profit HBM is capacity not spent on the DRAM and NAND that consumer devices rely on. Even worse for OEMs, AI-grade memory can consume disproportionately large amounts of production resources, making the reallocation feel “zero-sum” for consumer electronics.

Winners, losers, and who hedged early

Supply security is now a strategic edge. Apple reportedly locked in NAND through Q1 2026, though DRAM could reprice sharply. Samsung benefits from its in-house memory supply, avoiding shortages even if transfer prices rise. Lenovo holds inventory ~50% above industry norms via long-term contracts, helping Motorola secure cheaper LPDDR4x/LPDDR5 chips used in its budget and mid-range devices.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHuawei is insulated by sanctions and domestic suppliers, plus investments across chip developers. Xiaomi, Oppo, and Vivo may cut 2026 output by 15%–20%. Dell and HP have warned of higher device costs, and ultra price-sensitive brands such as Transsion (including sub-brands Tecno Mobile and Infinix) may cut shipments as bill-of-material inflation is difficult to pass on in their target emerging markets.

Higher prices—and a mid-range squeeze

As memory becomes a dominant cost driver, the market is drifting toward a higher pricing “normal.” Pei’s cited estimates suggest memory modules that once cost under $20 could exceed $100 by end-2026 in high-end configurations, transforming memory from an incremental expense into a defining constraint.

The biggest casualty may be the mid-range smartphone. The $400–$600 tier is squeezed between rising memory costs and broader component shortages, including “legacy” parts impacted as foundries pivot capacity toward advanced AI nodes. Flagships can absorb cost increases through margin. Budget devices can hold price by cutting specs. The mid-range can do neither without breaking its core “flagship killer” promise. The result: fewer compelling $500 phones, slower spec progress, and potentially a shrinking segment by 2027.