US semiconductor manufacturer Broadcom has completed the acquisition of cloud computing company VMware.

The closure of the $61bn cash and stock deal comes after Broadcom secured approval in China, Australia, Brazil, Canada, the European Union, Israel, Japan, South Africa, South Korea, Taiwan, and the UK.

Established in 1998, California-headquartered VMware agreed to merge with Broadcom in May 2022.

Now, VMware’s common stock will stop trading on the New York Stock Exchange.

As part of the merger, Broadcom Software Group will be renamed and operate as VMware, combining Broadcom’s infrastructure and security software capabilities into an expanded VMware offering.

Broadcom also said that it will invest in VMware Cloud Foundation, the software stack that forms the basis of both private and hybrid clouds.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBroadcom president and CEO Hock Tan said: “We are excited to welcome VMware to Broadcom and bring together our engineering-first, innovation-centric teams as we take another important step forward in building the world’s leading infrastructure technology company.

“With a shared focus on customer success, together we are well positioned to enable global enterprises to embrace private and hybrid cloud environments, making them more secure and resilient.”

China was the last major hurdle in the way of the merger, and regulatory approval from the Chinese authorities came through on 21 November 2023, reported Reuters.

Concerns over Broadcom’s ability to complete the transaction by the deadline of 26 November 2023, had been heightened by the ongoing hostilities between the US and China over stricter chip export control regulations.

The deal was subject to stringent regulatory examination in other jurisdictions too, and the firms had to postpone the closing date three times.

The UK competition watchdog approved the multi-billion dollar merger following an in-depth multi-phase investigation.

In July, the European Commission approved the deal on the condition that Broadcom would meet certain compliance commitments it had made to ensure the merger would not lead to a conglomerate effect in the server market.

The US semiconductor giant promised rivals Marvell Technology and others that it would provide materials, tools, and technical support for the creation and certification of third-party fibre channel host bus adapters.

As technology transforms everyday life and workdays, tech companies are increasingly under scrutiny over their ethical and competition practices.

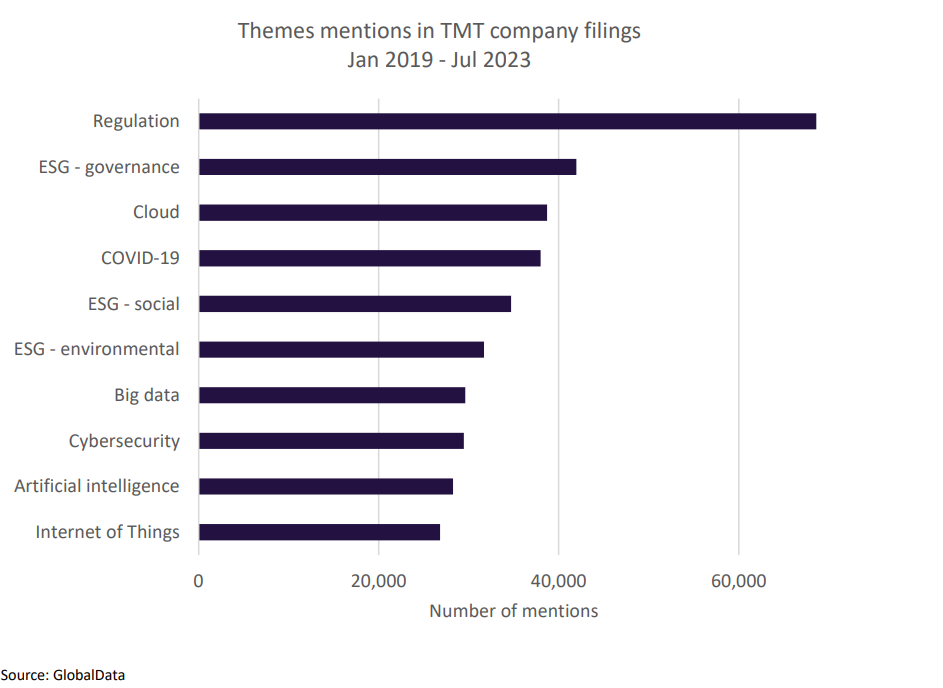

According to research company GlobalData, between 2019 and 2023, tech regulation remained the most mentioned topic in technology sector filings, overtaking themes such as environmental policies and AI with over 60,000 mentions.

Data privacy, antitrust, AI, and online harm are the biggest focuses of regulatory control, since these are most critical to a safe and efficient digital economy.

In its 2023 thematic intelligence report into tech regulation, research analyst company GlobalData found that the Chinese government must “strike a delicate balance” compared to other governments.

Whilst all regulators need to balance safety guards with innovation, China is under unique pressures from US regulation over its tech market.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.