The year 2021 ended with the 26th UN Climate Change Conference of the Parties, better known as COP26. The much-vaunted event was fittingly summed up by sister title Energy Monitor as a “self-proclaimed failure”. So what of environmental, social and corporate governance (ESG) in 2022? And how will business and tech likely react to the climate change theme in advance of this year’s COP27 event in Egypt?

The Glasgow Climate Pact from COP26, as Energy Monitor reported, “admits action has been lacking and the world is not set to meet its climate ambitions”, but “does not offer much in the way of these enhancements.”

Analytics firm GlobalData saw this coming last summer, looking at the lack of action taken since 2015’s Paris Agreement, and finding an opportunity for business to fill the vacuum.

“Every company must recognize that the science is clear, and the need for climate action will only increase,” GlobalData’s researchers argue.

“It’s an ‘all hands on deck’ moment that calls for an ‘all of the above’ approach: regulation, voluntary action, technology innovation and self-interested action by companies seeking competitive advantage as they balance near-term and long-term business strategies.”

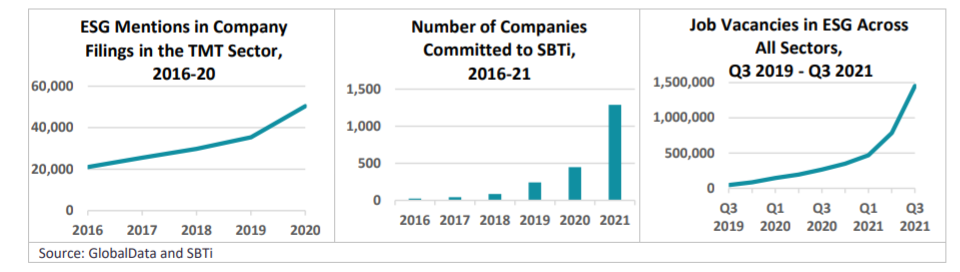

As such, ESG will be the key theme discussed in corporate boardrooms this year, according to GlobalData’s recent predictions for Tech, Media, & Telecom (TMT) in 2022, and an upcoming free webinar taking place Thursday January 13th. January 20th meanwhile see a free webinar from GlobalData all about ESG; register here.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor all its relative failures, COP26 stressed that both private and public finance is required to fund technology for a low-carbon economy. Every financial decision, GlobalData argues, must take the climate into account. Central banks and regulators for example would be wise to ensure financial systems can withstand the impacts of climate change, and factor ESG into all investment decisions.

As of 2021, SFDR (Sustainable Finance Disclosure Regulation) is required by all financial market participants that operate within the EU. ESG reporting will become an expectation in 2022, not a bonus, and the creation of the International Sustainability Standards Board (ISSB) will add clarity to the otherwise confusing world of ESG disclosure. The ISSB was launched by IFRS Foundation Trustees in November to mark COP26.

This year, companies failing to disclose their ESG performance may face backlash from shareholders as they increasingly demand that companies align with ESG standards.

ESG in 2022: SBTi and The Climate Pledge

Market mechanisms are driving the closure of the climate action feedback loop, where companies will increasingly pledge climate action to win stakeholder approval, driving competitive advantage.

The SBTi (Science-Based Target initiative), an NGO-led effort that recruits companies to set emission reduction targets, will build on the success of 2021 and continue to apply pressure on companies to act on climate change.

2022 will also see an increase in signatories to The Climate Pledge, an Amazon initiative under which companies agree to reach net-zero by 2040. As this can be achieved through carbon offset schemes, there will be increasing pressure for the voluntary carbon market to be regulated.

Companies committing to non-credible net-zero targets through offset schemes will face reputational harm. The SBTi and The Climate Pledge will start to hold companies more accountable and require that targets are met.

ESG and EVs in 2022

GlobalData’s predictions for TMT in 2022 also point to battery production as a bellwether of ESG commitments this year, specifically regarding cobalt, an element of the battery-component cathode.

“Cobalt will continue to be phased out of lithium-ion (Li-ion) batteries in 2022,” researchers write. “As ESG becomes more important, companies will restructure their cobalt supply chains, either away from the metal entirely or away from the Democratic Republic of Congo.”

But good intentions aren’t necessarily driving this change. The cathode, after all, is the most expensive part of a battery, and cobalt is the most expensive part of the cathode.

There is also a role being played by electric vehicles (EVs), often seen as a positive tech theme in ESG.

Demand for EVs in the US and Europe will increase significantly over the next decade. As a result, vehicle manufacturers and cell suppliers will invest in building battery plants plus mining and refining facilities in 2022.

Battery recycling plant construction will become increasingly important in 2022 as EV adoption increases. These plants will be important for reducing US and Europe’s dependence on China while they attempt to build their Li-ion battery supply chains.

But GlobalData believes rising Li-ion battery prices will slow the acceleration of EV adoption this year.

In 2022, the growing gap between supply and demand for lithium, as well as other core battery raw materials, will become increasingly evident. In response, miners of core battery raw materials will see an influx of deals and investment, and automakers like Tesla will continue to lobby the US government to waive tariffs on Chinese-dominated battery materials such as graphite. The increased cost will cause EVs to become more expensive, slowing public adoption.

The shift towards EVs has been primarily driven by legislative changes to meet ESG targets, but momentum is also becoming demand led. In the short term, the lithium shortage will have little impact on large players with a vertically integrated supply chain, such as Tesla and Toyota.

It’s worth bearing in mind that that the humble car charger will have to be as big a story as EVs: For the electric car to become a serious and viable option, cities will need the right charging infrastructure for EVs to work.

For Anders Bergtoft, CEO of Swedish green tech company Charge Amps, most countries across the globe need a sufficient mix of both public and private charging solutions.

“I think the trick to meet zero-emission targets and to make widespread EV-ownership possible globally, will be to make public charging as accessible as it can be, while at-home and in-office charging is made affordable enough to act as a viable complement.”

Social Governance in 2022

But there is more to ESG than environmental measures. There is also the hot topic of social governance.

Big Tech companies have constantly evaded accountability for data breaches, fake news and online abuse perpetrated through their internet platforms. After a Meta whistle-blower revealed details of Facebook’s impact on users’ mental health, there will be greater pressure to regulate social media in 2022.

Network techniques may also help to detect particular users on social media platforms who are more prone to sharing fake news, and thus try to encourage better enforcement against the content that they share. Greater transparency will be expected from Big Tech companies, and there is growing pressure on regulators to audit the Silicon Valley giants regarding their management of misinformation.

To this end, the UK government is revising its IT Act and Online Safety Bill, and other countries will likely follow suit. But as Verdict reported last year, current proposals don’t make the cut. The current consensus on the UK’s proposed Online Safety Bill for example is that it is a failure, and instead of taking away power from the social giants, it instead makes US-based Big Tech the gatekeepers of UK online content.

“Service providers will most likely be tasked with removing content and accounts deemed harmful,” Paul Bischoff, privacy advocate at Comparitech, told this title last autumn. “It’s not clear whether this will require tech companies to pre-screen content, which has huge implications for online free speech.

“The very companies that the UK is trying to rein in become the arbiters of what speech should be allowed online. It (also) attacks the messenger, punishing social media companies for content posted by users, instead of going after the real perpetrators of harmful content.”

In countries like China, meanwhile, the cover of social governance is arguably (and perhaps unsurprisingly) being used to limit anti-state narratives. While 2022 will see social governance increase, it would be wise to ensure checkpoints for the endgame of such control.

AI and ESG

In the fight against fake news in 2022, artificial intelligence (AI) could play a key role. As Henry Brown, director of data & analytics consulting at Ciklum told Verdict last year, natural language processing (NLP) can be “used to detect nuances in grammar, spelling and sentence structure, which in turn may reveal an issue with the original author of an article or piece of content.

“Network techniques may also help to detect particular users on social media platforms who are more prone to sharing fake news, and thus try to encourage better enforcement of the content that they share,” Brown added. “A fake news warning could then be shared with other users on the platform.”

AI detection can also “stamp” content online as sealed, verifiable data.

“For example, if a detection algorithm were used on a video uploaded to social media, the results of the analysis could be attached to the video in the same way verifiable assertions like copyright, camera data and edit history are secured,” Andy Parsons, director of Content Authenticity Initiative at Adobe, tells Verdict.

ESG and Industry 4.0

The increasing emphasis on ESG will push Industry 4.0 tech like AI to the forefront in 2022, according to GlobalData. Platforms for analysing a company’s environmental impact across its supply chain will become more readily available and easier to integrate into existing systems.

Consumers are also placing greater importance on companies’ environmental impacts. As such, businesses that fail to proactively monitor and reduce their environmental impact with Industry 4.0 technologies will likely suffer.

Many companies also failed to handle the supply chain disruptions that occurred in 2021. Industry 4.0 technologies can help when such disturbances arise by proactively assessing disruptions and providing prompt data-driven strategies.

“Companies that fail to integrate technologies such as AI, digital twins, and edge computing into their systems in 2022 will be sidelined by the next disruptive event,” GlobalData researchers believe.

Find out more in a free webinar taking place Thursday January 13th as GlobalData gives a guide on some of the hottest themes for 2022 and the top TMT predictions for the coming year. January 20th meanwhile sees a free webinar from GlobalData all about ESG; register here.

Related Company Profiles

Accenture Plc