The UK government’s decision to maintain access to cash is only a temporary solution that will need to be replaced with a better strategy to help cash-reliant people adopt cashless transactions, writes Chris Dinga

The UK government is empowering the Financial Conduct Authority (FCA) with the responsibility to ensure that cash can still be accessed in the future while the UK transitions to a cashless economy. Although it is inevitable that cash usage will continue to decline, the FCA estimates that at least 5.4 million UK adults directly depend on access to cash. Rather than simply ensuring continued access to cash, the government should also focus on solutions that help these individuals adopt payment cards or mobile wallets.

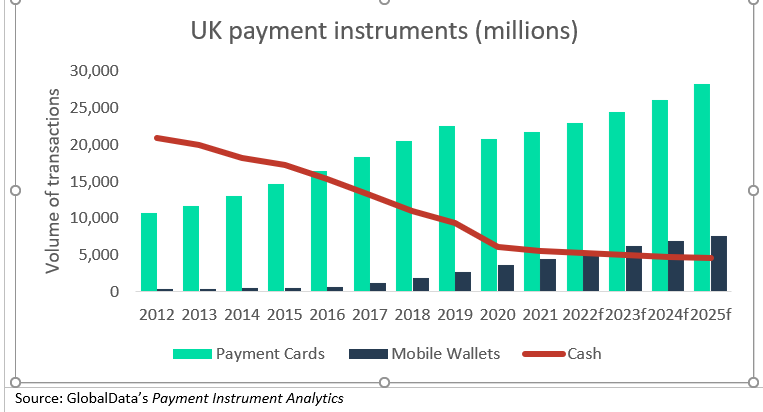

GlobalData’s Payment Instrument Analytics

For many years, cash was the primary payment tool for both UK consumers and merchants. According to GlobalData’s Payment Instrument Analytics, the volume of cash transactions stood at 20.8 billion in 2012, putting it ahead of payment cards (10.5 billion) and mobile wallets (304 million). But between 2012 and 2021, cash transaction volume recorded a compound annual growth rate of -13.7%, with most payments in the UK now taking place using non-cash options.

2006: Cards overtake cash in the UK as top payment instrument

Cards overtook cash as the top payment instrument in 2016, while cash will be overtaken by mobile wallets in 2023.

There is clearly a need for a plan to be put in place to avoid help consumers who rely on cash. Ensuring that some financial institutions still provide cash to people who need it is a good temporary solution, but it will not be sustainable in the long run. Unless all merchants are required to always accept cash, the economy will gradually see the number of businesses accepting cash decrease. The ideal solution would be to help the population who depend on cash to adopt card payments and other non-cash payment options.

There are two main groups who will be severely affected by the shift to a cashless society: older people and the unbanked population. Older people may find using non-cash payment options such as mobile wallets and QR codes challenging. In response, banks and fintechs should consider developing training courses to help them adopt these new solutions. In 2021, HSBC introduced a program to help customers who are used to visiting its branches to adopt online banking. Similar programs could be introduced to help older people adopt non-cash payments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData1.2 million unbanked adults in the UK

Meanwhile, the FCA estimates that the UK had 1.2 million unbanked adults in 2020. An inability to access cash would marginalise them from society. Finding solutions to bring them within the banking system would enable them to not only access non-cash payments but to benefit from the other services banks provide.

Some challengers are already focusing on this space. For example, neobank Monese was partly created to help unbanked individuals access banking services. Other countries such as India and Brazil have launched instant payment solutions that consumers can access on their smartphones. Pix in Brazil and Unified Payments Interface in India allow unbanked individuals to access digital payments without the need for a bank account. The UK government could use its own instant payments infrastructure, Faster Payments, to launch a similar solution.

In the short term, it will be necessary to maintain access to cash as 5.4 million UK adults rely on it for their daily expenditures. But in the long term, the government will need to find more effective solutions to help cash-reliant people transition to the cashless economy.