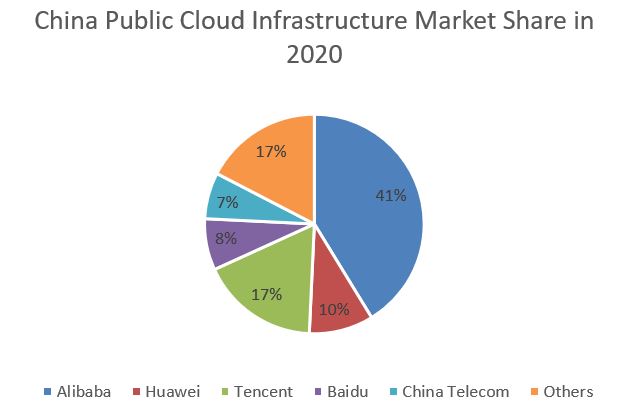

China’s public cloud infrastructure services market, comprising infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and cloud management platform, grew over 50% year-over-year in 2020 to reach $14.8 billion. China has managed the pandemic better than many countries and it has weathered the economic impact relatively well. However, with the international travel restrictions and the government’s priority to get the economic growth back on track, there has been stronger investment focus on digital technologies.

This includes digital infrastructure (e.g., 5G and data centers) and solutions around AI, big data, IoT and smart city. These initiatives have a direct, positive impact on public cloud services. Domestic vendors including Alibaba, Baidu, Huawei, and Tencent are also investing heavily in developing cloud-based AI technologies to drive different use cases including autonomous vehicles, voice assistant, machine vision, etc. Moreover, the pandemic has driven greater demand for online activities such as healthcare and education, and the adoption of cloud-based solutions across all industries is expected to continue beyond the pandemic.

China will embrace cloud services

Chinese consumers are already big users of digital services including e-commerce, online payment, and online entertainment. These activities grew in 2020 when travel restrictions were in place. In particular, the demand for over-the-top (OTT) video, online gaming (including esport), and live commerce (popular influencers called ‘Key Opinion Leaders’ producing live streams to promote products) have gained traction during the pandemic.

For example, Tencent Video, recorded 123 million paid subscribers by year end 2020, a growth of 16% from a year ago; and leading platforms for esports content, HUYA and Douyu, reported 178.5 million and 174.4 million monthly active users in 4Q 2020 respectively, with Huya growing 18.8 per cent compared to 2019 and Douyu 5.2 per cent. These applications drive the need for more cloud computing resources, AI/analytics platforms, as well as networking solutions such as content delivery network (CDN).

Competitive landscape

The competitive landscape of the public cloud market in China is unique. The home-grown cloud vendors – Alibaba Cloud, Tencent Cloud, Huawei, Baidu and China Telecom – continue to lead the market. In particular, market leaders Alibaba Cloud and Tencent Cloud have benefited from the demand of e-commerce, web hosting, and multimedia services including CDN. With the investment in AI, the two competitors are also building industry-specific solutions across sectors such as education, healthcare and retail.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis does not mean that the global providers are missing out in the Chinese market. For example, AWS have two Regions in mainland China – in Beijing and Ningxia but they are operated by local firms Sinnet and Ningxia Western Cloud Data Technology (NWCD) respectively. This allows AWS to meet local regulations while offering customers globally consistent services across its portfolio. The company continues to win local customers, for example, Huami a wearable computing device vendor has turned to AWS to support its operations in international markets.

The local presence is also crucial for supporting global MNCs that have business operations in China. AWS continues to invest in China with plans to expand its Ningxia facility and add a third availability zone in Beijing. Meanwhile, Huawei has also ramped up its cloud business in China and the company sees a strong link between AI and cloud. The company has the financial resources and its investment in multi-access edge computing (MEC) will further strengthen its cloud offerings.

Digital is a key driver

The digital start-ups, e-commercia and digital media companies have been key drivers for the demand for cloud services in China. Larger enterprises and government organizations are now leveraging a range of technologies such as big data, AI, and AR/VR, which will further boost the demand for cloud services.

In particular, China has a huge manufacturing industry and we expect more investments in technologies to accelerate the transformation to ‘Industry 4.0’. Industry 4.0 Is aimed at achieving efficiency through integrated smart systems, processes, sensors, data, analytics and AI.

This can be applied in key business areas including production, manufacturing, business support, and engineering. Technologies such as 5G/MEC and cloud-enabled AI, IoT, automation, and AR/VR will underpin the manufacturing transformation, allowing China to become a more sophisticated manufacturing powerhouse; instead of relying on labor cost as a key competitive advantage.

Related Company Profiles

Baidu Inc

Tencent Holdings Ltd

China Telecom Corp Ltd

HUYA Inc