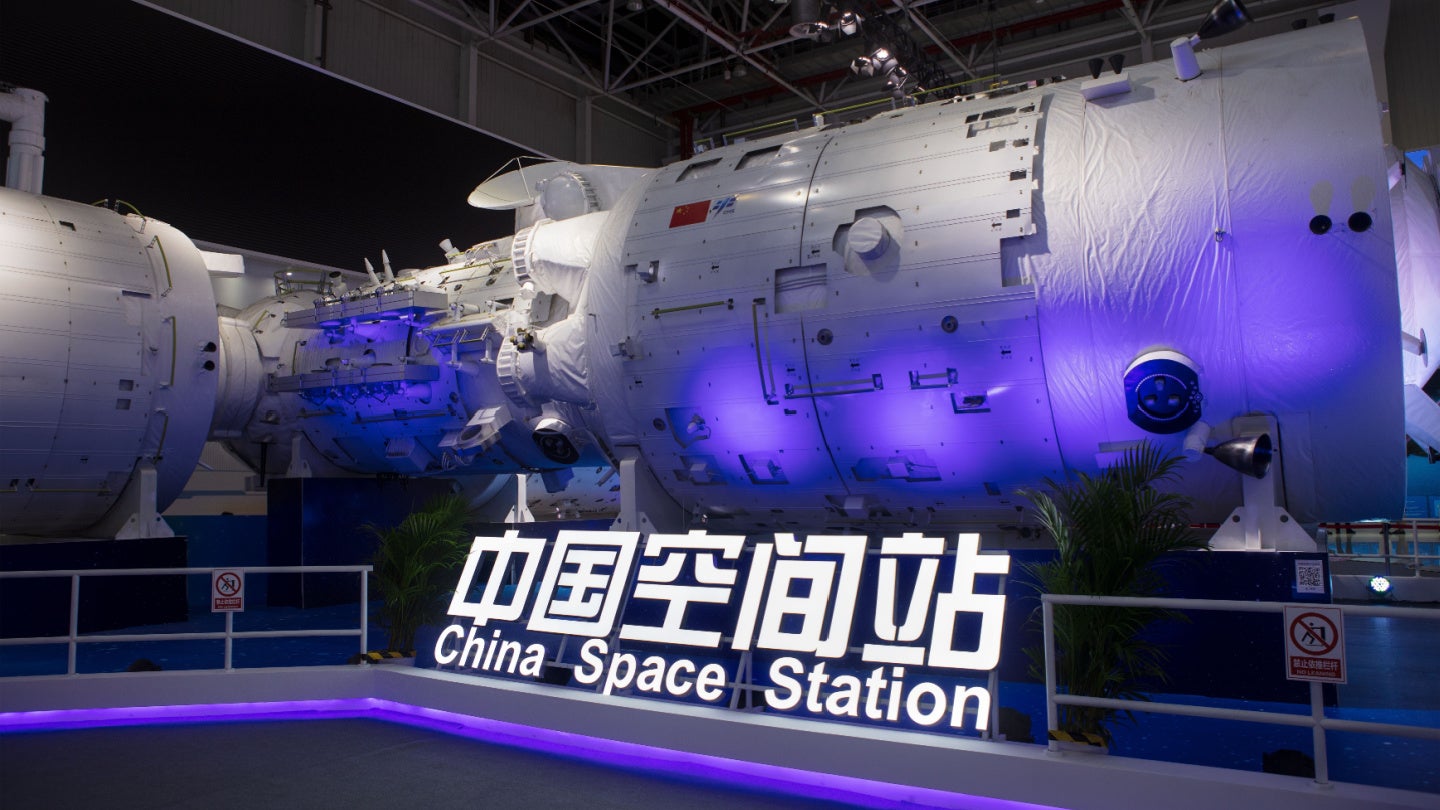

The China National Space Administration (CNSA), China Aerospace Science and Industry Corporation (CASIC), and China Aerospace Science and Technology Corporation (CASC) have planned, coordinated, and operated a majority of China’s space projects since the 1990s.

However, their efforts to catch up to the US and Russia’s space successes have fallen short. In response, the government has made an explicit effort to open the space economy to commercial companies to counteract a potential stagnation in technological advances.

The explosion of space start-ups

The Chinese space economy has grown exponentially, with over 200 commercial companies surfacing in the past ten years. Start-ups have received enormous levels of capital investment and various incentives including discounts on infrastructure set-up, free land, and tax subsidies. By 2021, commercial launch companies Space Pioneer and iSpace both raised over $300m in funding. While funding is no guarantee of success, it is expected that the next few years will see the Chinese space economy skyrocket as commercial firms ramp up production after years of investment and research.

China has around ten commercial launch start-ups with planned launches within the next 18 months. In May 2023, Space Pioneer successfully launched its debut rocket, Tianlong-2, reaching orbit on its first attempt using a fully liquid-fuelled rocket.

China versus Starlink

On the satellite end, the Chinese government has been open about its ambition to compete with Starlink’s constellation. Starlink is a low-earth orbit (LEO) 4,000+ satellite internet constellation operated by the US space giant SpaceX, providing satellite internet access coverage to over 56 countries. In 2021, Chinese officials announced an ambitious plan to build a 13,000-satellite broadband megaconstellation, though these aspirations have yet to materialise.

While the privatisation of launch vehicle manufacturers and operators has been largely encouraged by the government, support has not been consistent across the industry. At first, the Chinese government backed the private funding of satellite manufacturers like GalaxySpace and Commsat. However, in April 2021, the government announced the creation of the state-owned China Satellite Network Group to be responsible for the procurement, deployment, and operation of the megaconstellation.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis U-turn can be explained by the internet’s strategic importance to Chinese domestic policy. After all, all three of the country’s mobile network operators are state-owned, so it makes sense that satellite broadband should follow suit. This turnabout has delayed the deployment of the project and complicated the public-private relationship in satellite manufacturing.

Satellite manufacturers’ financial woes

Another factor hindering the growth of Chinese commercial satellites is the constellation’s profitability. China is a country with a very strong fibre network, whereas Starlink targets customers in isolated areas with weak fibre networks. In China, those regions are populated by lower-income classes with lower purchasing power for satellite broadband. Therefore, there are limited incentives for private companies to explore satellite broadband operations in China.

The megaconstellation is a venture that will be predominantly financed by the government. A large broadband constellation is not a commercial venture, but rather a strategic counter-offensive manoeuvre against Starlink’s monopolisation of the market. It also seeks to secure a China-sized gap in the space market for the as-yet-unknown future applications of satellite technology.

No breathing space

The growth of the Chinese space market will eventually impact foreign markets as low launch costs and more satellite slots attract foreign companies to China. Those companies may be disincentivised from operating in China, as the market will continue to be heavily intertwined with state-owned companies. However, given Starlink’s massive first-mover advantage, China cannot afford to stall operations any longer.