While not as climate centred as hoped, some interesting green initiatives were announced in the UK’s recent Budget. Environmental concerns can no longer be ignored and that’s why sustainability is the key theme of the decade.

The UK Government announced it will issue green bonds, create a retail saving program to give individuals the opportunity to invest in green products, and create a UK infrastructure bank in Leeds to invest in the green industrial revolution, with an initial £12bn capitalization and £40bn investment as part of its 2021 budget. This is an important step in reaching the UK’s net-zero target by 2050.

However, while significant funds were allocated, the Budget did not detail how specifically they were going to be spent. The transition to a green economy will need significant investment, as net-zero requires switching to an energy system that relies solely on renewables, as well as energy efficiency and green transport projects.

What is important is that a mechanism to drive green competition is emerging worldwide, challenging companies to reduce their environmental impact and offer sustainable products. If the money is allocated correctly, through the UK infrastructure bank, the UK will spur this change, becoming a global environmental leader.

Climate change and competition

Governments, investors, and the public are pushing companies to slash emissions. As a result, climate change commitments are becoming an area of competition for companies. Businesses in every region and sector of the economy are making ambitious new commitments to decarbonize their operations.

The result is a positive feedback loop in which stakeholders harness market forces to drive this positive change towards more sustainable operations. Cutting down on emissions is, therefore, the only way for companies to make future-proof strategic decisions, ensuring that their business models are compatible with a sustainable economy that protects the liveability of the planet. Additionally, as reducing emissions often implies increasing efficiency, it is also the most cost-effective solution, pushing companies and sectors to compete and innovate, ultimately delivering better products.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

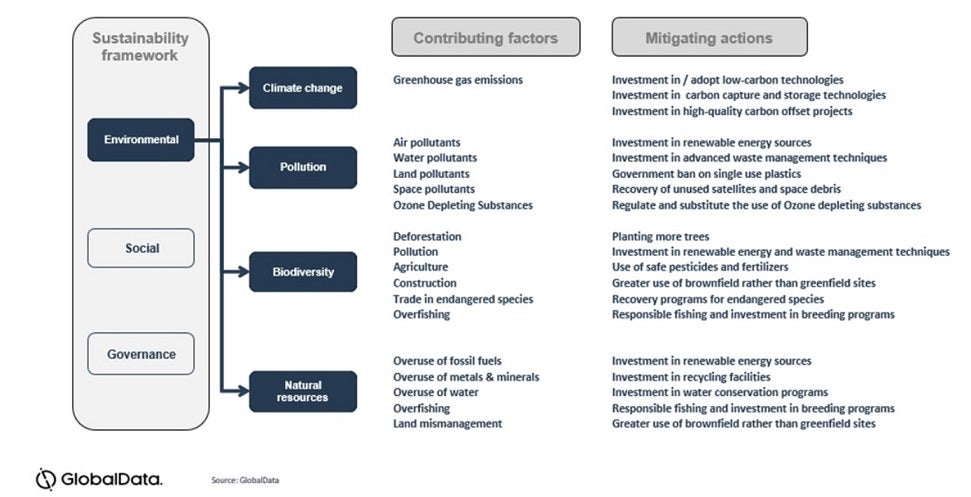

By GlobalDataTo help organizations navigate the complexities of ESG, GlobalData created a comprehensive framework which can be found in its Sustainability report. This diagram shows the environmental aspects of the framework.

Companies now have two options: proactively invest to make their business models sustainable and get ahead of the curve, or fail to innovate and be swept away by the green transition. The rewards to be reaped by those who fully embrace sustainability are plenty, but so too are the financial risks for those who fall behind.

This Thursday, 18 March 2021 at 4pm (GMT), Warren Wilson, Lead Analyst for Thematic Research, and Research Director, Ed Thomas will host a webinar on climate change and green competition. Click on the link to register and find out more about a theme that is disrupting every industry.