Cybersecurity startup BlueVoyant has secured $250m in a Series D round. The company is only the latest to reap the benefits of the booming demand for digital defences.

Earlier this week, US-based Beyond Identity raised $100m and Phosphorus Cybersecurity secured $38m in a Series A round.

These cash injections mark an ongoing trend where investors are putting more money into cybersecurity startups.

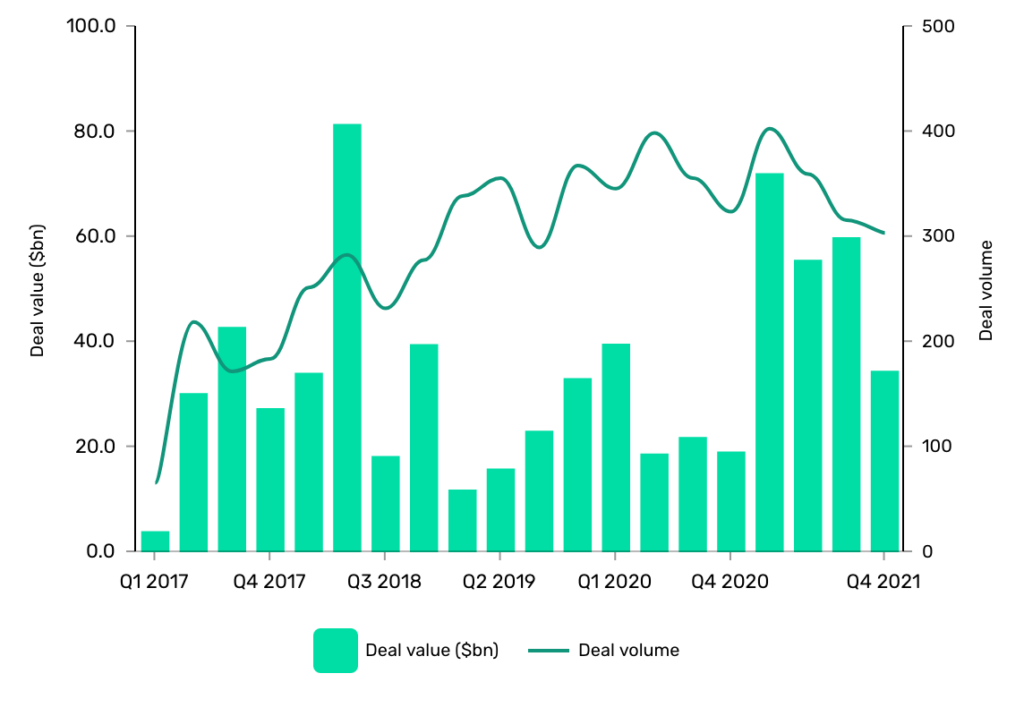

The number of financing, M&A and public float deals reached a fever pitch at the height of the pandemic. Back in 2017, GlobalData recorded 641 deals worth $103.29bn in total. Jump forward to 2021 and the number of deals had jumped to 1,383 deals worth $220.93bn in total.

Covid-19 has contributed to the wave of cybersecurity deals, according to several market stakeholders.

“We have seen a huge shift across the workforce towards remote and hybrid working since the onset of the pandemic,” John Vestberg, CEO of Swedish cybersecurity firm Clavister, tells Verdict.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“As a result, organisations are trying to address what they see as added vulnerability and uncertainty from a security perspective. If remaining reliant on traditional measures, managers have far less control over the networks and devices workers are using. So, by investing more frequently and heavily in cybersecurity, they can shore up their defences against new threats that now pose a greater risk.”

Egita Polanska, managing director of cybersecurity programmes and partner at Estonian accelerator Startup Wise Guys, argues that the industry’s maturity has also contributed to the skyrocketing number of deals.

“Cybersecurity is a vertical that is slowly becoming more mainstream, akin to how fintech grew from a ‘dark art’ – [as in a] highly trained and certified field – to being able to send money by SMS, over the course of the 2010-2015 period,” she tells Verdict. “Cybersecurity as an investable vertical is right about where fintech was in 2010-2011, and this is resulting in investments due to the maturity cycle of the vertical.”

Polanska adds that Covid-19 also made cybersecurity more attractive for investors because other sectors became unattractive.

“The pandemic shrank a lot of industries like hospitality, events, travel and so on and as a result, new verticals got an investment injection,” she says. “Cybersecurity and Information security were two verticals that saw the ticket sizes and deals rise due to this.”

BlueVoyant rides the cybersecurity boom

BlueVoyant has clearly benefited from the growing investor interest in cybersecurity startups, as made evident by the $250m cash injection.

Private equity firm Liberty Strategic Capital, founded by former US Secretary of the Treasury Steven T. Mnuchin, led the raise.

“As cyber threats increase, BlueVoyant has positioned itself as a differentiated leader in managed detection and response, third-party cyber risk management, digital risk protection, and cybersecurity professional services,” says Mnuchin. “We’re thrilled to partner with BlueVoyant and its top-tier management team as they continue to drive growth in this critical and rapidly expanding market.”

Other investors backing the raise include Temasek company ISTARI, Eden Global Partners and 8VC.

BlueVoyant will use the capital to further develop its cybersecurity solutions and to expand globally.

“In just over four years, we have grown to more than 560 employees and have earned the trust of more than 700 customers,” says Jim Rosenthal, CEO of BlueVoyant. “The market demand we are seeing is tremendous and we see this trend accelerating as security professionals pivot to our outcomes-based cybersecurity solutions.”