Non-fungible tokens, or NFTs, are having a moment in the spotlight. Captain Kirk, Twitter founder Jack Dorsey, rock band Kings of Leon and artist Beeple have all participated in the craze. But what is an NFT and how does it work? More importantly, are NFTs just a bubble waiting to pop?

The short answer to these questions is that NFTs are the latest blockchain fad, following in the footsteps of initial coin offerings, smart contracts and stablecoins. Artists and tech entrepreneurs are increasingly celebrating them because NFTs could enable people to prove ownership and authenticity of digital assets and subsequently sell them, often making a hefty profit in the process.

For a more elaborate answer, just keep reading.

What is an NFT?

An NFT works in the same way as cryptocurrencies like Bitcoin, Ethereum and Dogecoin. Just like these different currencies, NFTs are created on a digital ledger, commonly referred to as a blockchain. They are created as tokens, which are a type of certificate of ownership. Because they are created on a blockchain distributed among thousands of computers around the world, they cannot easily be forged.

There is, however, one clear difference between cryptocurrencies and NFTs: the fact that the latter are non-fungible.

For those not fluent in economic jargon, a fungible asset is a good or a commodity that is interchangeable with units that are identical to the original asset. You can simply pay like for like.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor instance, if a person swaps a £5 note for another £5 note, then the value and things in their ownership essentially remains the same. Money has by its very nature a high fungibility.

A non-fungible asset, such as an NFT, is not interchangeable in the way that cash is. This is because there is only one such asset, meaning that non-fungibles have unique properties.

Examples of non-fungible assets include Buckingham Palace, an individual pet cat and Vincent Van Gogh’s painting The Starry Night.

Another difference between an NFT and a unit of currency is that you cannot sell parts of an NFT just as you cannot sell a piece of the Mona Lisa. It’s the whole thing or you’ve ruined it.

Why does it matter?

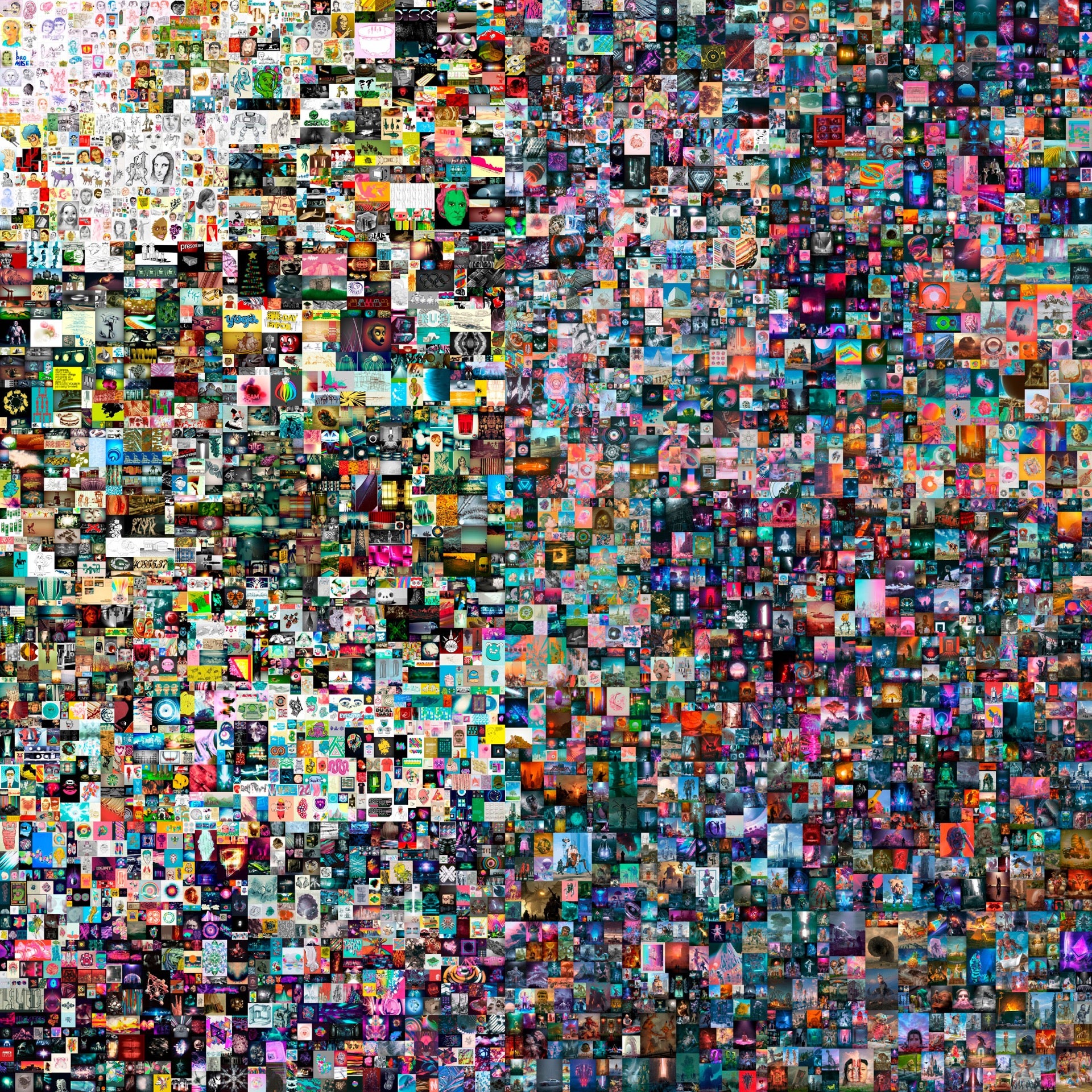

In March, Christie’s held a digital auction where artwork from the artist Beeple was sold for $69.3m.The digital piece of art was sold as an NFT.

Now, what is preventing any of us from simply checking out Beeple’s social media feed and copying the art?

The answer: absolutely nothing.

So what’s the point?

The point is that only the individual who owns the Beeple art can prove that they own it. Consider how anyone can buy a poster of the Mona Lisa, but only the Louvre has the original.

This is due to the three characteristics that make NFTs particularly valuable for people: authenticity, proof of ownership and that they can be transferable.

As we mentioned earlier, blockchain-based tokens such as an NFT cannot easily be forged. This means that a person looking to buy a digital asset in the form of an NFT can be certain that they are paying the true owner and that their ownership of it will be acknowledged by others once the transfer has taken place.

Because blockchain technology can be used to prove ownership of a product, once the NFT has switched hands, then that’s it. Once that happens only the new owner can sell the NFT to the next person. However the creator of the NFT, such as an artist, can include a smart contract in the original token saying they should get a cut of future sales of the asset.

All these aspects open up opportunities across various industries to unlock new revenue streams.

For instance, when fintech giant Square bought music-streaming startup TIDAL, the companies stated that they would look to create new revenue streams for artists. This caused some analysts to speculate that it would be done by offering artists the opportunity to make some money via NFTs.

These rumours gained even more momentum after Square’s founder and CEO Jack Dorsey, who also co-founded Twitter, auctioned the very first tweet ever tweeted on Twitter as an NFT at the beginning of March. At the time of writing, the highest bid on the tweet is $2.5m.

Dorsey and rapper Jay-Z, who bosses TIDAL, announced a joint 500 bitcoin investment to fuel the development of cryptocurrency companies in February, further fuelling NFT speculation.

Whatever TIDAL and Square’s future plans may be, it’s clear that NFTs do offer new ways of doing business.

Nothing new

NFTs are nothing new. The first one was created in 2012 in the form of the so-called Coloured Coins, aka Bitcoin 2.x. As the name suggests, it was to be built on top of the Bitcoin network.

NFTs have popped up over the years since then. Some readers may remember the bizarre blockchain craze for CryptoKitties around 2019. That fad revolved around a game called CryptoKitties where users could trade, collect, buy and breed virtual cats. Each of these cats existed as a unique token on the Ethereum blockchain, meaning that they were very difficult to copy. Only one individual could own each CryptoKitten.

If this sounds familiar, it is because it should. Each of these virtual cats was an NFT.

Why is it happening now?

The CryptoKitties craze came and went but NFTs have grown popular in a variety of applications lately. Forbes recently noted that nearly $50m worth of NFTs change hands every week.

Several factors have contributed to this renewed interest in NFTs. One is that a plethora of different organisations, predominantly in the crypto space, have made it easier to create and sell NFTs. For instance the decentralised application Rarible launched in 2020, enabling users to mint their own NFTs. Similarly, crypto exchange CoinGecko launched a dedicated NFT forum in 2019.

Another reason why NFTs are gaining momentum now could be because they have been in the public eye enough lately for more people to be aware of them. That means that more people understand how the technology can be used to solve the problem of how to prove and transfer ownership of something that could otherwise be easily and endlessly duplicated, such as virtual collectibles, or Beeple’s art.

There have certainly been a lot of NFT news stories lately. Music artist Grimes has sold digital art as NFTs to the tune of $6m, Star Trek actor William Shatner has sold 90,000 blockchain-powered trading cards with his own face on them, and clips of NBA star LeBron James dunking have sold for as much as $250,000 a pop. In early March, rock stars Kings of Leon released their latest album entirely as an NFT.

Okay, so what’s the problem?

While there are clearly advantages to NFTs, some may still wonder where the actual value is. If people can simply copy the artwork, albeit without proof of ownership, then what’s the deal? Anti-piracy advocates and rights owners have struggled with this issue for decades, especially when it has been a matter of copying music and movies.

In short, why would anyone in their right mind cough up £69.3m to buy ownership of a digital piece of art?

That’s the question even some of the experts on NFTs seem to struggle with. For instance, digital artist Anne Spalter has sold multiple pieces of art as tokens and even she can’t seem to explain why some of these NFTs rake in multi-million payouts. She, like some others, believes that the NFT boom could be rushing towards a bust.

“I’m still mystified by the prices and how high they are,” she recently told the Associated Press. “I think there will be a correction.”

If, when and how big that correction could be is anyone’s guess.

Read more: Real-world CryptoKitties see blockchain collectibles enter reality