Sony’s shares plummeted this week following the company’s annual profit outlook falling short of initial market expectations.

The Japanese-based entertainment and electronic giant saw its shares fall as far as 4.8% on Monday.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

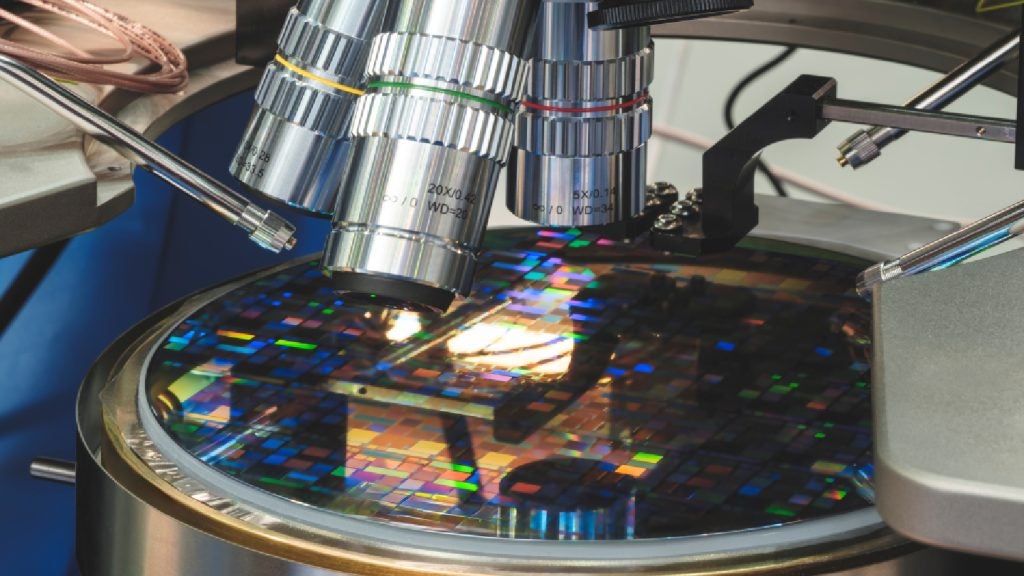

The news comes after the company posted a record annual operating profit for the financial year ending in March 2023. Sony says profits were driven by microchip sales and music units.

However, the company projected a 3.8% profit decline to $8.55bn this business year, missing an analyst’s average estimate of a $9.2bn profit for the year, Reuters reported.

Sony says it is expecting a slow rebuild in profits in its videogame unit. The company’s Playstation 5 console had been pulled down by delays due to the accessibility of microchips during Covid-19.

Atul Goyal, an analyst from investment banking company Jeffries, said the prediction from Sony “is overly conservative”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGoyal added that he expects the company will benefit from backed-up demand for its PlayStation 5 console and software.

This comes after a statement last week by Hiroki Totoki, president of Sony, which stated the company was now in a position to deliver the consoles without any more wait time.

Sony is reportedly hoping to sell 25 million PlayStation 5 units before March 2024.

Gaming exploded during the pandemic

The combined sales of games, consoles and subscriptions totalled around $191bn globally in 2021. The pandemic brought in an influx of new players, as well as long-time players spending more time and money.

“Gaming was a vital entertainment channel for many people during Covid-19 lockdowns,” Rupantar Guha, analyst at GlobalData, previously told Verdict.

“The industry enjoyed a rapid influx of new users in 2020, which resulted in revenue growth.”

This growth has slowed right down in the following years, with rising inflation, increased cost of living and as the world came out of the pandemic.

Spending on video games in the US totalled $56.6bn in 2022, a 5% decrease from the previous year, according to the NPD Group.

GlobalData is the parent company of Verdict and its sister publication