While Next is not the only retailer facing a challenging 2017, it has overlooked a fundamental issue – an aging customer base.

When George Davis created Next in the 1980s it filled a gap in the market by delivering fashionable clothes for 25-45 year olds, those starting out on careers and family life.

In particular it was the go-to retailer for work clothes for both men and women, and built a big share of the childrenswear market.

However, just like M&S, its customer base is ageing. Over the past decade its customer profile has changed significantly.

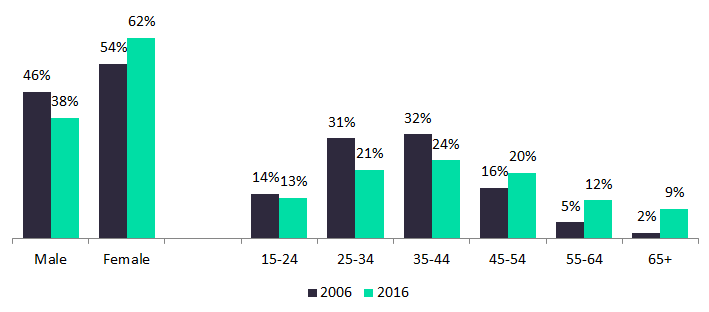

Our research shows that from having 64 percent of its shoppers in the 25-44 age group in 2006, 10 years later it has less than half at 46 percent, and its share of 45+ years has nearly doubled – from 23 percent to 42 percent (see chart below). An ageing customer base is a dangerous trend for a retailer, as it ends in inevitable decline.

Next customer profile 2006 and 2016 (Source: GlobalData)

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Next’s out of town Home stores are more like an own brand department store and fit the modern consumers desire for a mix of convenience and leisure with their Costa Coffee shops, but looking at the customers many are 50+, especially on weekdays.

These are likely to have been loyal Next shoppers for many years, rather than new customers, but is this the customer Next wants to target now?

There are plenty of them, but they have less need for new clothes, new furniture and childrenswear than those at the early family lifestage. And the trend to spend on leisure and experiences rather than consumer goods, is even more prevalent for the active Baby Boomers.

Over the past decade the competition has intensified for Next, indeed for all the traditional mass market clothing retailers.

Consumers have far more choice because of the internet and expanding retailers such as Zara, Ted Baker, Jigsaw, and H&M are producing distinctive, relevant product for their customers.

Next’s male customers are going elsewhere for their tailoring and sportswear because other retailers have greater brand appeal and its home shoppers have more choice as the like of IKEA, Made.com. John Lewis and Amazon expand.

Lord Wolfson has a clear understanding of the economy and the challenges that face consumers in 2017, and Next is still one of the best run retailers in the UK, but it needs to address what many retailers forget, producing a relevant and inspirational product offer for its core target customers – in Next’s case those at the young family lifestage.

Without this it does not matter how operationally efficient the business is.

Related Company Profiles

Amazon.com Inc

Ted Baker PLC