UK grocery and technology company Ocado saw its shares fall to their lowest point since the start of the pandemic after financial results revealed pre-tax losses stemming from its robotics and smart platform investments.

Ocado shares fell by 18% to £11.56 towards market close on Tuesday, their lowest performance on the London Stock Exchange since the start of the pandemic in March 2020. Despite profiting from the pandemic-driven uptick in online grocery deliveries, Ocado has lost more than half of its value in the last year.

The share decline followed Ocado’s financial results for the 2021 financial year. Pre-tax losses were revealed to have increased from £52.3m to £176.9m in 2021 as the company increased investments in its robot warehouses and smart platforms. Ocado, quite apart from being a groceries retailer itself, is a robotics company that licenses its automated warehouse technology to other retailers around the world.

A request for comment from Ocado saw Verdict directed by the company to its official press release on the results.

According to SWOT analysis from research firm GlobalData, huge debt remains a major concern for the company. At the end of the 2020 financial year, Ocado had long-term debt of £997.4m as compared to £219.7m in 2019.

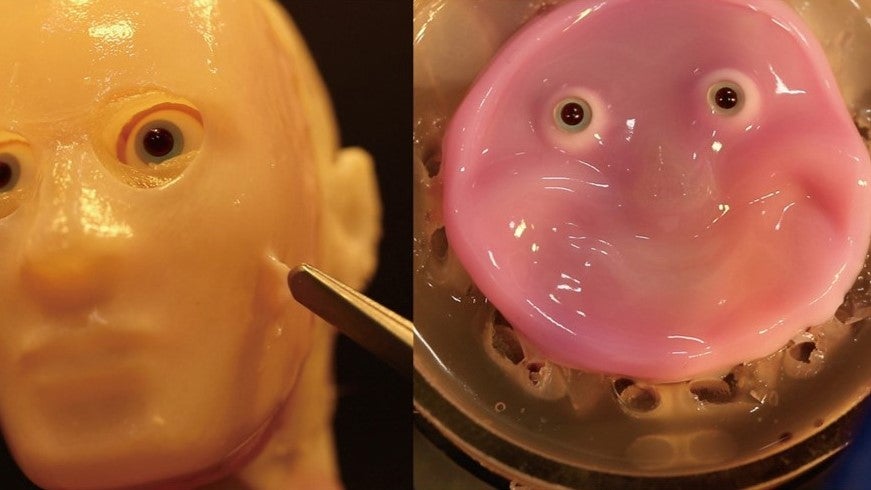

The company has also suffered serious problems at its customer fulfilment centres (CFCs), for example a warehouse fire caused by a robot collision in Erith which it picked out as one cause for slow growth, alongside UK labour shortages on its grocery side which, as Verdict recently covered, robotics could help ease in future.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“While Ocado reported an increase in customer orders of 11.9% during FY2020/21, retail sales growth was hampered by its fire at Erith CFC in July 2021 which considerably reduced its capacity and resulted in a £10m operating loss – impacting its retail EBITDA margin for the period which was 0.2ppts lower than in FY2019/20 at 6.6%,” says Juliet Cuell, retail analyst at GlobalData.

“Despite reporting growth on a tough comparative, Ocado lagged behind its supermarket rivals in 2021. In H1 FY2020/21, Ocado’s retail revenue grew 19.8%, yet Sainsbury’s reported online grocery sales growth of 29% over a similar period, and as the first half of 2021 was characterised by lockdowns and tighter COVID-19 restrictions, Ocado should have better capitalised on demand.”

Besides catering to online consumers, Ocado also has to satisfy its retailer clients on the logistics side. According to UK robotics expert Tom Andersson, Principal Analyst at STIQ Ltd, robotic innovations unveiled by Ocado last month may have come out a little too late to reverse the company’s fortunes any time soon.

“Ocado Solutions took a leaf out of Alibaba & Amazon’s playbooks when they made a big PR event of their most recent innovations. The Jan 26th Re:imagine event showcased six separate developments; whilst most of these developments looked great, none will be available to customers before the end of 2023.”

Andersson adds that one new robot from Ocado uses induction charging, which he says is 25-40% more expensive than standard charging to date. Other hardware meanwhile looked “hugely complex” to combine with storage in and around a picking robot, despite the business’s new solutions appearing to be “solely focused on improving Ocado’s Unit Picks per man Hour (UPH).”

On the software side, Ocado’s details were “a bit opaque”.

“The question remains if these innovations will simply offer gradual increases or a dramatic 20-30% improvement of throughput,” adds Andersson. “Whilst Ocado did refer to overall savings, they did not mention UPH in the Re:imagine presentation.”

Ocado is one of the top 20 international companies in GlobalData’s Industrial Automation thematic scorecard, where it as stands as the UK’s leading brand for robotics.

GlobalData is Verdict and its sister publications’ parent company.