The advent of open banking and the PSD2 regulation is over a month old, yet the benefits are hardly trickling through yet.

In fact, it could be another 18 months until the real innovation in the space starts to happen, according to Emma Bryne, head of communications for the governmetn body tasked with implementing Open Banking.

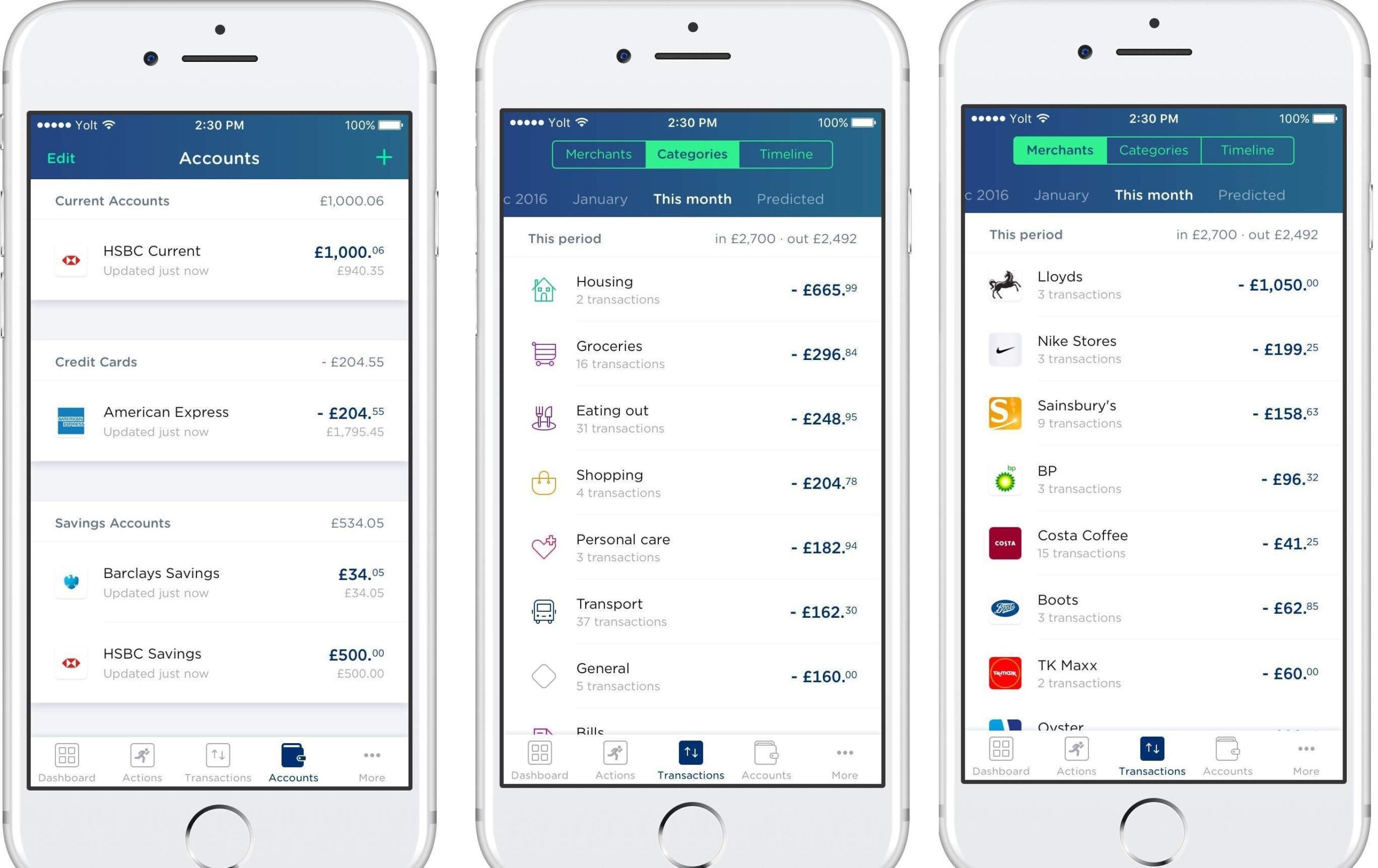

At a briefing today held by Yolt, a smart money management app, Byrne said:

“These things take time. I think the next six, 12, 18 months are likely to be about an incremental improvement in the market on what already exists. The really good stuff is going to come when true innovation starts being introduced.

“It’s incredibly early days. And anyone who thought that on 13 January, the advent of PDS2 as well as open banking, that suddenly the world is open banking will have been a little bit naïve.”

The future of open banking is still far away

When open banking came into force with the PSD2 regulation last month, there was much excitement that it would lead to new innovation in banking. The big banks were forced to open up their data, which would allow fintech startups to create new and exciting products for customers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, it is going to take a while for this to happen. According to research by Yolt, there’s still a lack of knowledge about open banking amongst consumers.

According to the study, 39 percent of consumers had no idea what the initiative is. Less than one in four people knew about it. However, this is up from one in 10 people, according to a Which survey from last October.

Yolt is optimistic about the results and says the potential for open banking is coming. It was one of the first third-party providers to make a successful connection with a major bank, Lloyds Banking Group, under the new legislation.

Its chief operating officer, Leon Muis, said:

“Just over a month since the open banking process started in earnest, the dial has really moved in terms of consumer understanding of what the open banking reforms are all about, which is great to see.

“If we can move from 8 percent to 22 percent in just a few months, it suggests that customers are receptive to the possibilities open banking can offer.”

Collaboration between the big banks and the new contenders

One of the topics discussed at the Yolt briefing was whether consumers need to understand open banking for the initiative to make progress. Simon Taylor, co-founder of fintech consultancy 11:FS, raised the point that people don’t need to understand how Uber works to want to use its service.

Instead, what will propel open banking forward is when the companies within the space gradually get onboard.

Ricky Knox, chief executive officer of challenger bank Tandem, told Verdict:

“With any legislative change it does take time to see an industry, and attitudes, catch up. We’re seeing a lot of excitement, some skepticism, and big changes in the fintech space. There’s no doubt in my mind that within a couple of years most people will use a trusted third party service provider to help them with their finances without a second thought.”

Until there is a full understanding and take up between the big banks and the fintechs, it’s going to be a while before consumers reap the benefits.

“So far banks, especially big banks have been working on compliance, literally having the structures in place to share user data securely. Likewise, providers are going through the process of enrolment into the Open Banking directory. We’ll see big changes in the next six months as this all takes place.

“It’s an exciting time to own a bank, that’s for sure,” added Knox.