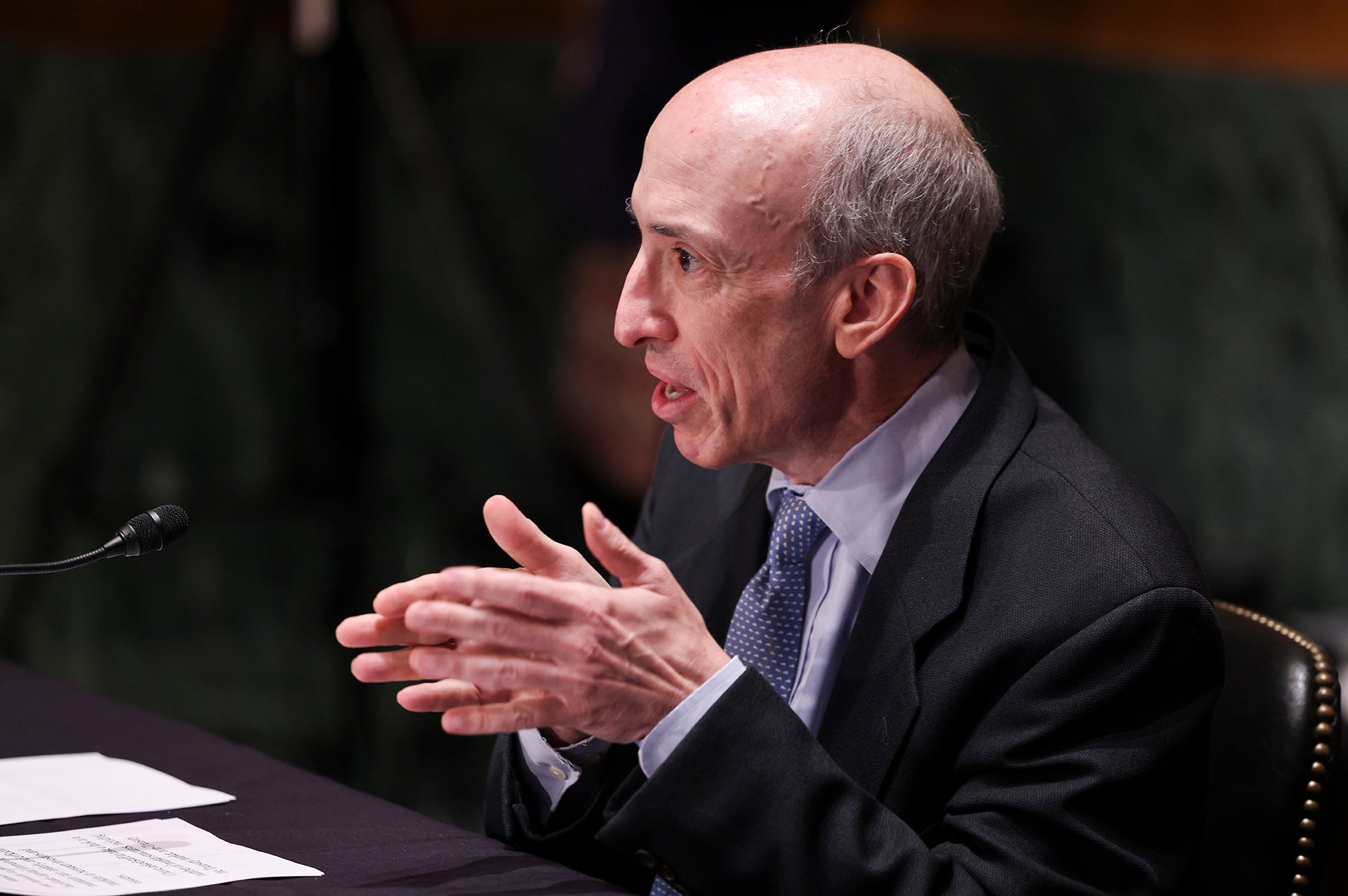

The new chair of the US Securities and Exchange Commission (SEC) doesn’t think there should be a cryptocurrency ban, despite having said that the asset class is “rife with fraud, scams and abuse”.

Gary Gensler’s decision contrasts with views recently expressed by the chair of NatWest Bank, who has compared bitcoin trading to hell and who endorsed China’s ban.

The news comes as financial watchdogs around the world are increasingly trying to regulate cryptocurrencies more strictly, as predicted in a recent GlobalData research report.

The SEC chair made his comment during a four-hour congressional hearing on Tuesday. He replied to a question from Ted Budd, a Republican congressman and member of the Congressional Blockchain Caucus, who asked if the market regulator was planning on following China’s example and banning cryptocurrencies.

“No, that would be up to Congress,” Gensler said. “We’re really working with the authorities you’ve given us and I’ve said this [before]: I think that many of these tokens – it’s based on the facts and circumstances – but many of these tokens do meet the test of being an investment contract or note or some other form of security, that would bring them within the investor protection remit of the SEC.”

While Gensler said the SEC wasn’t looking to ban bitcoin, ethereum or even dogecoin, he is keen to have lawmakers on Capitol Hill give his organisation more powers to better regulate the cryptocurrency market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis is not the first time he has expressed such views. The SEC chair implored lawmakers to grant the watchdog more regulatory firepower while speaking at the Aspen Security Forum in August.

Gensler said: “This asset class is rife with fraud, scams, and abuse in certain applications.”

Scammers have used different digital tokens for years to squeeze money from unknowing victims. BitConnect, OneCoin and GainBitcoin are just three of these frauds that have made the headlines. The fact that bitcoin is the payment method of choice for ransomware gangs doesn’t help cryptocurrencies’ image either.

However, Gensler has also been adamant that there are benefits to cryptocurrencies, having compared them with exchange-traded funds regulated by the SEC.

To prevent investors falling prey to scammers or losing their money to bad cryptocurrency investments, the SEC boss urged politicians to give the watchdog “additional congressional authorities to prevent transactions, products, and platforms from falling between regulatory cracks.”

Speaking to Congress on Tuesday, Gensler argued that tighter rules could also benefit blockchain-based currencies.

“New technologies rarely last long if they try to stay outside of whatever the public policy goals that a society lays out [are],” he said. “And investor protection has worked for us for 90 years and I think it’s an important piece of whether cryptocurrency is going to survive or not and meet its potential, whatever that potential might be.”

SEC won’t create a cryptocurrency ban

Gensler’s latest statement comes as regulators around the world are increasingly trying to find ways to regulate the emerging market. However, not everyone agrees what those rules should be.

On the one extreme you have countries like China, which has flat out banned cryptocurrency trading, and on the other you have El Salvador making bitcoin a legal tender in the country.

Beijing has fought against cryptocurrencies in China for years. The protracted battle intensified over the summer when the People’s Bank of China ordered four state-owned banks and the leading Ant Group-backed mobile payment app Alipay to cut off all transactions linked to bitcoin and other cryptocurrencies.

In late September, China banned cryptocurrency transactions and mining, stopping short of barring ownership of cryptocurrencies all together. Market stakeholders have long seen the Beijing endgame as being China’s digital Yuan.

Sir Howard Davies, the chair of NatWest and former deputy governor of the Bank of England, said he was in support of a recent cryptocurrency ban in China, despite not agreeing with all regulatory actions from Beijing.

“It’s gambling as far as I can see, with a sort of libertarian veneer on top of it. You should put a big sign on the door saying, Abandon Hope All Ye Who Enter Here,” he said, referencing the inscription over Hell’s gates in 14th-century writer Dante’s Inferno.

Meanwhile digital token evangelists were quick to hail El Salvador’s introduction of bitcoin as legal tender, the decision resulted in an immediate backlash from citizens, who set fire to cryptocurrency kiosks and marched in protest.

It didn’t help that the launch itself was marred by tech issues.

Other regulations are coming

Between these two extremes, regulators have been trying to find a constructive regulatory solution to the cryptocurrency conundrum.

South Korea has introduced new rules for cryptocurrency exchanges operating in the country, meaning operators had to go through stringent background checks and partner up with traditional banks. The new rules meant around 60 cryptocurrency platforms had to suspend their operations in the country, leaving just four operating.

The latest push came earlier this week when the IOSCO group of securities regulators and the Bank for International Settlements launched a consultancy into how stablecoins should be regulated.

They proposed that current rules for major clearing, settlement and payment services should also be applied to stablecoins.

That would mean stablecoin operators must set up legal entities showing how they are governed and manage operational risks.