ByteDance owned Chinese VR headset startup Pico is reportedly undergoing substantial layoffs and restructuring to focus on hardware.

Tencent Technology News, a competitor of ByteDance, reported that these layoffs are anticipated to affect thousands of Pico’s employees, shrinking the company’s workforce from its peak of around 2,000 to just a few hundred individuals.

Pico told employees in an internal meeting that its software team would be restructured into ByteDance’s product development team while it would retain its hardware team, sources told Reuters.

In February, it was reported that Pico had laid off over 200 employees.

TikTok-owner ByteDance acquired Pico in mid-2021, when the company was valued at $1bn, to rival Meta’s Quest VR headsets.

Pico transitioned from primarily focusing on business-oriented VR solutions to launching its consumer headset, the Pico 4, in European markets just months after the acquisition.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe Pico 4 featured dual 2K displays and pancake lenses, positioning it as a competitive choice from Meta’s Oculus Quest 2.

However, the Pico 4 has not been made available in North America due to regulatory scrutiny tied to ByteDance-owned platform TikTok.

Despite ByteDance’s efforts to encourage developers to bring popular content from the Oculus Quest Store to Pico’s ecosystem, it still lacks some of the exclusive titles that Meta offers, such as Beat Saber, Resident Evil 4, Population: ONE, and Onward.

Pico’s VR lineup has faced challenges since its launch, with reports from insiders suggesting that sales fell short of expectations. Furthermore, ByteDance’s acquisition of Pico allegedly led to internal disputes between existing employees and new staff brought in by the tech giant.

A report by Chinese technology company, Sina Technology, estimates that ByteDance is losing approximately $140 per headset sold.

Pico had announced Ubisoft’s Just Dance VR as a major exclusive title, with an anticipated release date in 2023. However, the game has yet to ship and no specific release date has been confirmed. Pico has yet to announce any other significant exclusive titles in its lineup.

Last month, ByteDance claimed it has no plans to shut down Pico, saying it would remain committed to the technology in the future.

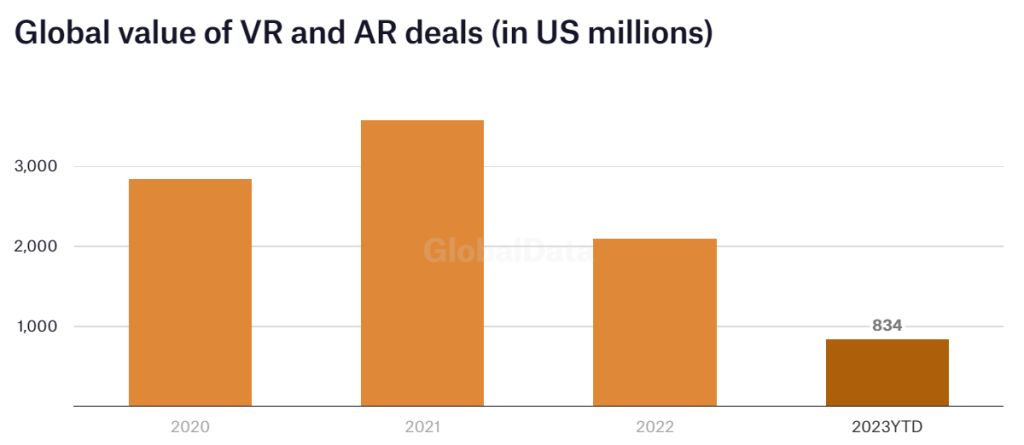

According to research company GlobalData, the value of VR and AR venture financing, acquisition and equity offering deals peaked in 2021.

In 2021, the VR and AR deals totalled $3.5bn globally. In 2022, the technology saw a significant drop to just over $2bn.

In 2023 so far, VR and AR deals have totalled $834m, significantly lower than the year prior. GlobalData estimates the metaverse economy will be worth $400bn by 2030, up from $48bn in 2022. However, the theme has struggled to live up to the excessive hype that built up in 2021 and early 2022.

In GlobalData’s Tech Sentiment Polls Q3 2023, 41% of respondents said they did not expect the metaverse ever to disrupt their industry. 59% of respondents believe it is all hype and no substance.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.