Japanese Toyota supplier Denso has announced it plans to invest $3bn into semiconductor materials and pivot employees into semiconductor roles.

Denso president Shinnosuke Hayashi made the statement on the opening day of the Japan Mobility Show, as first reported by Reuters. The $3bn investment consolidates Denso’s ambition to triple its chips production by 2030.

“To expand production, we must ensure the stable procurement of materials,” explained Hayashi. “Thus, we will forge strategic partnerships with various companies.”

In February 2022, Denso acquired a minority stake in a TSMC-owned semiconductor manufacturing plant in Japan. On the news, TSMC CEO Dr CC Wei stated that he was “glad” to welcome Denso’s partnership within semiconductor manufacturing and expected the demand for semiconductors to grow considerably as connected and electric cars become more commonplace.

In its 2023 thematic intelligence report into electric vehicles (EVs), research analyst company GlobalData states that the transition to electrification has created “unprecedented disruption” within the automotive industry.

Original equipment manufacturers with over a century of previous experience, Denso itself was formed in 1949, are now at risk of falling behind and battling with big costs to retool their factories. EVs and connected cars are not traditionally a core competency for car manufacturers, leading to EV startups booming to meet demand.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

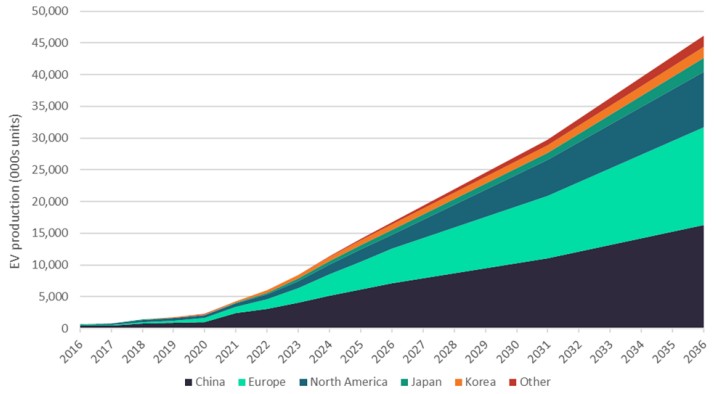

By GlobalDataJapan’s regional production of EVs is drastically lagging behind China, the US and Europe.

EV production forecast by region, 2016-2036.

GlobalData credits China’s early lead in EV production with government incentives pushing buyers towards EVs, as well as typically shorter commutes than Western countries that made even early EV models suitable for consumer needs.

Harvard economist and lecturer Dr Rebecca Henderson warned about China’s potential lead in EVs and green technology during her keynote speech at this year’s Nordic Business Forum.

Warning that the US may be falling behind China in its green transition, Dr Henderson stated she was “nervous” about an autocratic state dominating such change.

However, GlobalData also recognises that the semiconductor market is strongly guided by geopolitics and AI making its supply chain susceptible to conflicts and events such as the Covid-19 pandemic.

Despite this, the analyst concluded that by 2030, 80% of a vehicle’s value will be in its software and content, with AI having a major impact on a car’s content and abilities.