Recent geopolitical tensions between the US and China are signalling a reversion back to Cold War strategies. In the near future, governments will use space to express national interests and assert their geopolitical dominance. This will drive investment in space infrastructure, leading to the proliferation of commercial and national space stations.

Geopolitical Cold War tactics

The Cold War was marked by a period of ideological competition that spread beyond conventional military tactics. During this period, the US and the USSR competed to achieve military, nuclear, and spaceflight superiority.

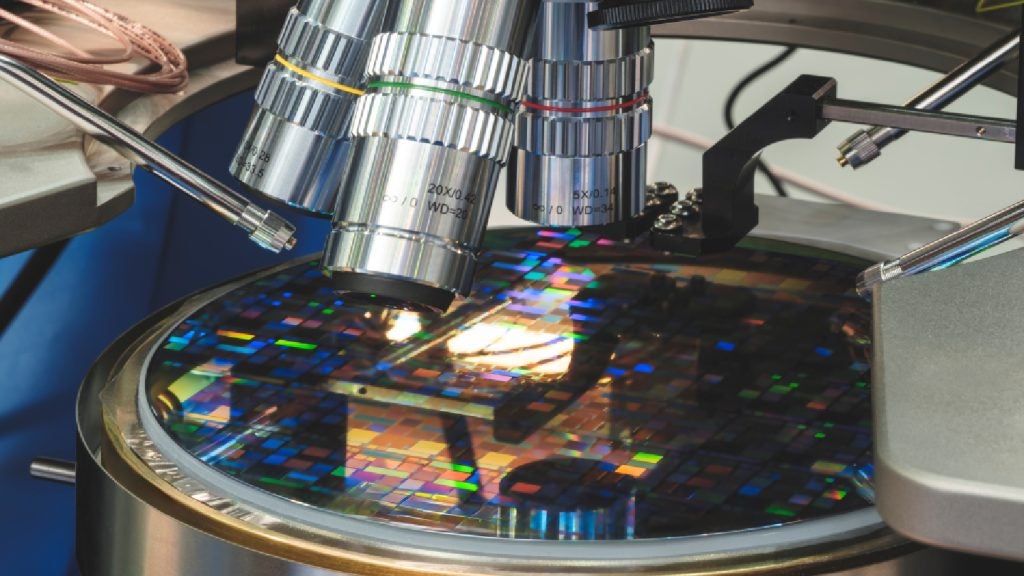

In 2022, the US is competing for superiority against a new foe. In October, the US government announced a series of new sanctions targeted at the Chinese semiconductor industry. According to GlobalData, more than 30% of the US semiconductor industry’s revenues are derived from sales in China. The sanctions aim to hold back Chinese progress in artificial intelligence (AI) and military capabilities and mark another step in the escalation of competing techno spheres between the East and West.

Space economy market

According to GlobalData’s recent Tech, Media, and Telecom Predictions 2023 report, the space economy market will be the next frontier of geopolitical competition between the US and China.

The space economy refers to the full range of activities and the use of resources that create value and benefits for human beings in the course of exploring, researching, understanding, managing, and utilizing space. According to Morgan Stanley’s Satellite Industry Association, the space economy market will be worth over $1 billion by 2040.

The expansion of the satellite market will initially power this growth as low-earth orbit (LEO), medium-earth orbit (MEO), and geostationary (GEO) satellites are widely used across the logistics, communications, and defense sectors. However, the emergence of entirely new sectors in the next decade such as mining, tourism, and construction will provide additional growth in the market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA sign of increased geopolitical competition in space has been the renewed interest in establishing a presence on the moon. The Chinese government expressed interest in having astronauts reach the moon by 2030 following NASA’s successful launch of the Artemis 1 moon-orbiting mission earlier this year.

Geopolitical tensions and militarization of space

In the next decade, we will also experience an escalation in the militarization of space, with US military satellite market revenues increasing by 41% between 2021 and 2031, according to GlobalData forecasts. Satellites are already being used in the Ukraine conflict for intelligence, surveillance, and reconnaissance (IRS) while point-to-point transport and on-demand launches are other focal points of investment for the US and Chinese governments.

Traditionally, governments have focused on increasing their respective space agencies’ capabilities through internal research and investment; however, future capabilities will be achieved through commercial contracts. In the last seven years, the Chinese commercial space sector has received $6.5 billion of investment, predominantly from the state-owned China Aerospace Science and Technology Corporation (CASC) and the China Aerospace Science and Industry Corporation (CASIC).

Additionally, since 2011, the Wolf Amendment prohibits NASA from using federal funds to engage in direct cooperation with the Chinese government. Due to an increase in outsourcing by NASA, this law prevents US space companies with NASA contracts from collaborating with their Chinese counterparts, essentially creating two isolated sectors. Ultimately, geopolitical tensions and onshoring trends will lead space to be one of many competing techno spheres between the two countries for the incoming decade.