Spatial computing technologies, including augmented reality (AR), virtual reality (VR), or mixed reality (MR), enable users to interact with computers in three-dimensional space.

This article takes a sneak peek at four spatial computing predictions for 2026 as GlobalData’s Strategic Intelligence team prepares to release its annual Tech Predictions report.

Spatial computing will transform our daily interactions with screens

GlobalData predicts that spatial computing adoption will accelerate in 2026, with consumers enjoying immersive entertainment and social experiences, while industries deploy AR and VR for operations and training. Big Tech and pure play companies will push hardware and software innovation, including collaborating on large language model (LLM) licensing for third-party devices. Chinese companies will advance in AR and VR with state backing and aggressive investment, but geopolitical tensions will curb their involvement on the global stage. Meanwhile, rivals in the US, South Korea, and Japan will benefit.

AR smart glasses will gain momentum, but stay far from the mainstream

Consumer AR smart glasses powered by multimodal LLMs will gain traction in 2026. Companies like Snap and Xreal will start the year with new releases, while tech giants including Meta, Apple, Samsung Electronics, Amazon, and Huawei will enter the market in 2026 and 2027. These devices will offer intuitive features like hands-free voice interaction, language translation, and transcription, making them increasingly useful as smartphone companions.

Despite growing interest, mainstream adoption will not happen next year due to persistent challenges like high costs, limited use cases, privacy concerns, and the need to balance style with functionality.

Competition will intensify in the enterprise market

Apple and Samsung Electronics will target the enterprise AR and VR market with the Vision Pro and Galaxy XR, respectively. Apple will focus on manufacturing, retail, and healthcare partnerships, while Samsung Electronics will pivot to the enterprise market if consumer interest wanes. However, high costs, bulky form factors, and performance limitations will hinder widespread business adoption. Instead, niche, industry-specific AR and VR solutions will gain traction. Companies like Anduril Industries, Rivet, Honeywell, and ThirdEye Gen will compete to become staple US Army device contractors. Mass enterprise uptake will remain elusive before 2030.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAI will aid the development of virtual worlds

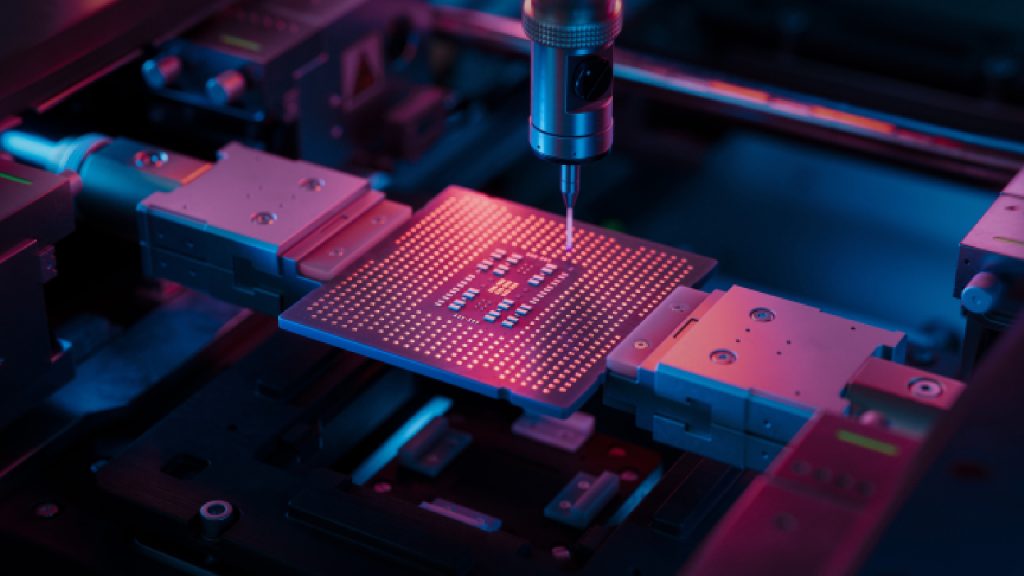

The final prediction is that AR and VR experiences will move past pre-scripted narratives, creating compelling and realistic content. Non-player characters (NPCs) will be powered by LLMs, allowing them to have persistent memories, pursue independent goals, and engage in meaningful, unscripted conversations. Immersive virtual worlds in AR and VR will evolve through the convergence of four core elements: AR and VR hardware, AI models, development tools, and custom chips.