Tesco has made a surprising, and very bold move to acquire food wholesaler Booker for £3.7bn ($4.6bn) this morning.

Investor reaction has been hugely positive, with Tesco shares soaring nine percent in early trading.

Tesco has trumpeted the deal as offering improved availability for consumers, and better choice, price and service for independent retailers.

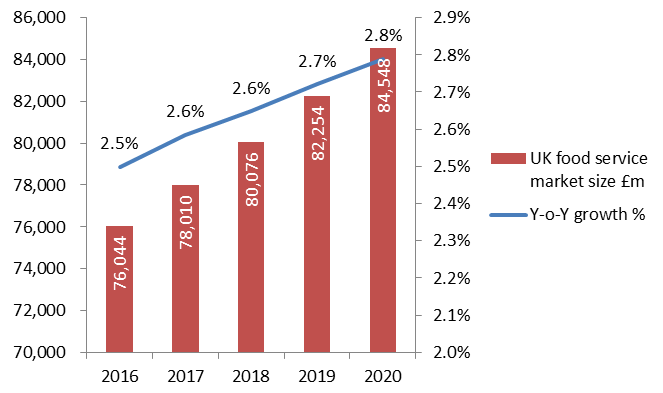

It also gets them into food service supply, and with households increasingly looking to prioritise spend on eating out, this protects it from the downward pressure on retail spend.

The deal gives Tesco the opportunity to sell its own-brand ranges into the convenience stores Booker supplies, enabling it to weaken the power of the big brand suppliers such as Unilever which it had a public spat with over price rises last year.

The challenge for Tesco is in convincing the regulators that the ownership structure of Booker’s symbol group stores means that competition is not compromised, and persuading the owners of the independent convenience stores that being supplied by their largest competitor will be beneficial to them.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Unilever Plc

Tesco Plc