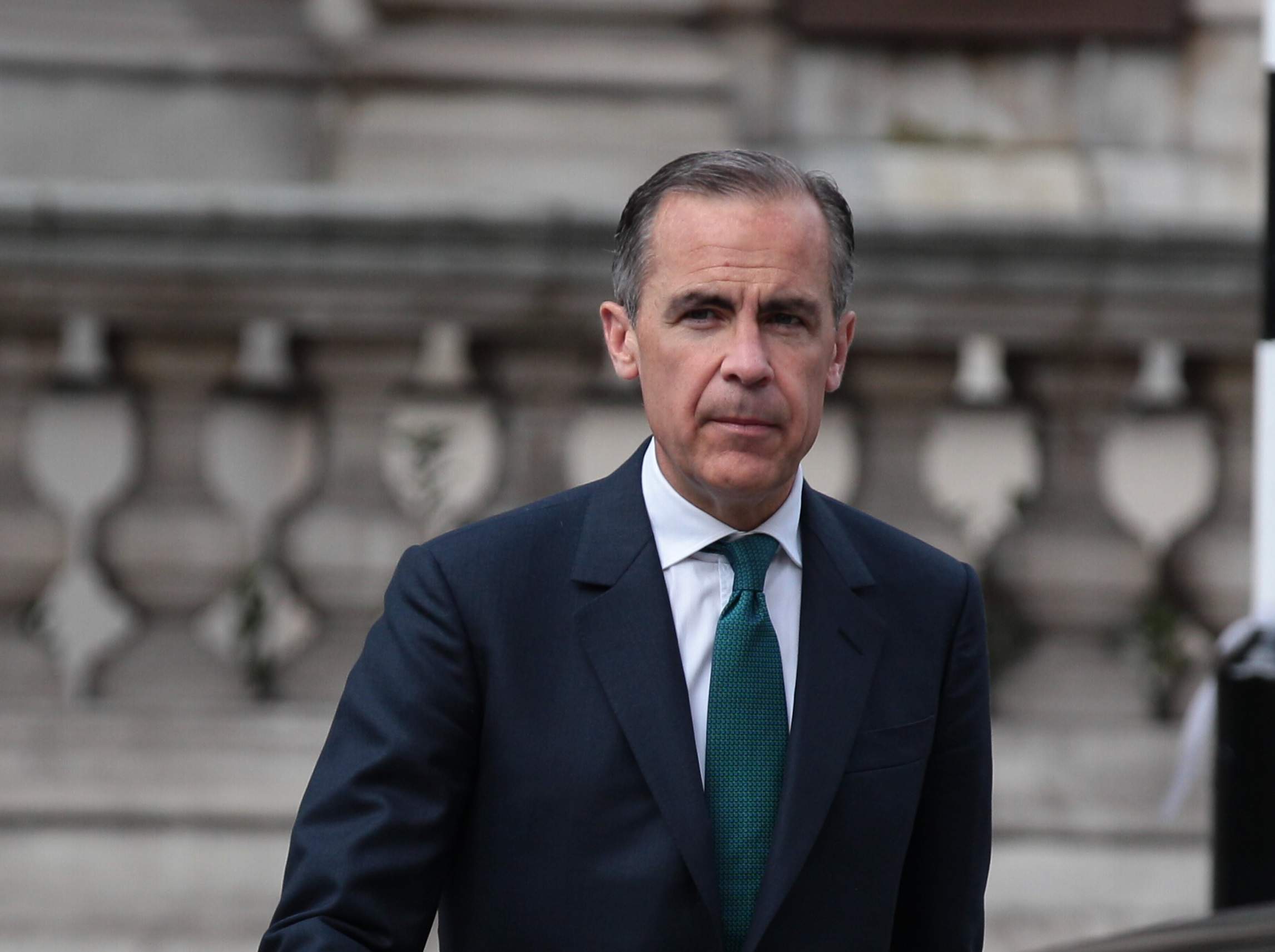

The Bank of England’s governor, Mark Carney, believes the UK’s financial sector could double in size to be 20 times as big as GDP within the next 25 years.

However, Carney thinks the City can only realise its potential if Brexit goes well and the UK government resists pressures to relax regulation.

In an interview with The Guardian, Carney said:

“We have a financial system that is ten times the size of this economy … It brings many strengths, it brings a million jobs, it pays 11 percent of tax revenue, it is the biggest export industry by some token … All good things. But it’s risky.”

The risk he is speaking of is if the financial sector becomes less regulated once the UK leaves the European Union (EU) and isn’t subject to the EU’s banking regulations anymore.

Read more: Which city will be the next City?

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThere are concerns that London could become a low-tax financial centre with a lax regime.

Already, different banks and financial institutions have said they will leave the UK because of Brexit. This week, it was revealed that Deutsche Bank could move 4,000 jobs out of the UK, nearly half of its UK workforce, due to concerns it won’t be able to conduct business throughout Europe once the UK is out of the union.

All this contributes to fears that London’s glowing financial sector will slowly deteriorate and will use light regulation to attract business.

Carney said:

“We have a view… that post-Brexit the level of regulation will be at least as high as it currently is and that’s a level that in many cases substantially exceeds international norms.”

He went on to say:

“If the UK financial system thrives in a post-Brexit world, which is the plan, it will not be 10 times GDP, it will be 15 to 20 times GDP in another quarter of a century because we will keep our market share of cross-border capital flows. Well then you really have to hold your nerve and keep focus.”

Michael Mainelli, director of the city’s leading thinktank Z/Yen, told Verdict that even if some banks and institutions move headquarter to other European cities, it doesn’t mean the end of London.

He said:

“There are only 12 global investment banks and they’re going to be located in all major centres. So if we’re talking about JP Morgan moving a thousand jobs to Dublin, or even moving their European HQ to Dublin, that doesn’t mean they leave London, does it?”