When you’re acquired by one of the biggest names in tech, you don’t typically announce a $60m Series B funding round four years later, but that’s exactly what healthtech pioneer Withings has done.

Announced today, the funding round is led by Gilde Healthcare and long-term investors Idinvest Partners and Bpifrance, with additional funding coming from BNP Paribas Développement, ODDO BHF Private Equity and Adelie Capital.

For those that haven’t been following Withings closely, this will come as highly unexpected news. Founded in 2008, the company was acquired by Nokia in 2016 to form a foundational part of its digital health offering.

But with the hype around wearables seeing something of a collapse, Nokia switched its approach and just two years later Withings divested from the telecoms giant.

Long a key player in the consumer digital health market, the post-Nokia era of Withings has been characterised by a growing focus on the B2B sector. So with fresh funding and a changed world, what plans does Withings have for its future?

Ahead of the official funding announcement, Verdict caught up with Lucie Broto, CMO of Withings, to find out what lies ahead.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataLucy Ingham: Withings has taken a very unusual path to its Series B funding round. For those that are unfamiliar, what is the history of the company?

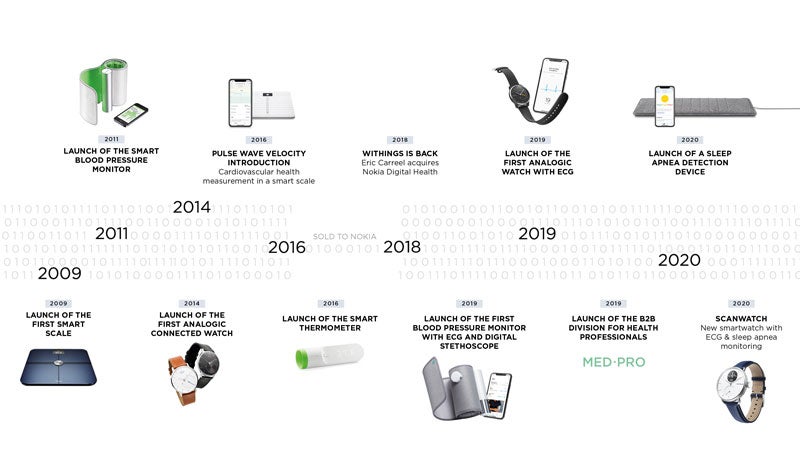

Lucie Broto: The company was founded by French engineers, and we started by inventing the first connected scale in 2009, and then we developed a fully ecosystem of consumer health devices. In 2016, it was sold to Nokia, and so we’ve been through the whole process of transitioning the brand.

We stayed under Nokia, being part of the digital health section of Nokia, [but] that ended up being not the main focus for them a few years later. So it got acquired back by Eric Carreel, who was the founder of the company, in 2018.

He came back with a very clear vision on where the healthcare market was going and the fact that it was the right moment, too, for us to really go deeper into building devices that could provide medical-grade measurements, and really be able to go into this path with conducted clinical studies; being able to develop the right algorithms to be able to detect very specific diseases, etc, to go under a certification process. So when he came back, we really started to go deeper into this healthcare world.

We were coming, really, from a very consumer world. And we realised that there was a huge demand for our products for health professionals, health programmes, etc, that [needed] to be able to collect accurate health data, patient-generated, but that could be collected in a very seamless way. And because we came from this consumer world and we know how to build seamless and elegantly designed devices, we have become a very important actor to help health professionals to collect this accurate data.

So would you say the company has transitioned from a consumer to a B2B focus?

We don’t call it a real transition, it’s just that we expanded our business into the B2B world, because we discovered this need and we had a lot of demand.

It’s very important for us to stress that even with this fundraising, it doesn’t mean that we’ve stopped investing in the in the B2C world.

Part of this investment will be for us to continue investing in R&D to address consumers being also patients directly and it’s also a very strong focus for us. And it’s because we are able to address directly consumers and patients that we are being successful in the in the B2B world.

Looking to the fundraising, what was the motivation for Withings to raise funding now?

Back in 2018, we launched a new round of innovation. And since the last two years, we have been able to launch, actually, a lot of new products. A new range of blood pressure monitors, a device that detects sleep apnea, a new range of watches, etc.

With this in mind and the proof that we were going in the right direction, and the fact that we were starting to have a lot of demand from B2B partners, we wanted to accelerate in this field as we really believe there is a momentum.

I think the current crisis is also [a factor]. Obviously our wish to start working with new partners and new investors started before the Covid crisis, but I think that it became the proof that there was a need for remote medicine and it was really a case for digital health. And so I think it also helped us build very clear momentum in this field.

How do you envision the investors you’ve attracted helping the company to develop?

We have a few French investors that have been historical partnered with Withings, on the first version of Withings before we got acquired by Nokia. The fact that they are giving their trust us a second time is very important to us as we know them very well and we know how to work with them.

And it was really important for us to have a new kind of partners that were really recognising the healthcare world. And so Gilde Healthcare, we believe, can really help us build the right solution for health professionals, and bring very specific help on the business side for the B2B world.

How do you plan to use the funding you’ve raised to expand your efforts?

We are expanding in two areas. The first one is expanding in R&D to be able to build this new generation of devices. So it’s R&D and everything related to device development, running clinical studies, certification process, etc. And we want to go deeper in being able to track a new type of biomarkers using AI to be able to detect some diseases even before they arrive. So it requires a lot of human resources for that in all those fields.

Secondly, we will also invest in scaling this B2B division as we are seeing a lot of demand, but we need to be able to address all those partners and also to build very specific solutions for them.

We are working with very specific health programmes, for example, or health professionals that have very specific needs in terms of the type of biomarkers that they want to track and so it will also require us to add new resources for that.

Detecting diseases before they arrive is still a young field of healthcare. How do you see your devices contributing to that?

We are actually pretty lucky to have built a very broad ecosystem of devices, so today we are tracking a bit more than 20 different types of vital parameters. And this is allowing us to learn a lot already, because we have all those devices that are being used by people at home.

And just to give a very specific example we have the sleep analyser which is a small pad that you put under your mattress. During those eight hours of you being asleep, we have the ability to analyse of breathing frequency, movement, heartrate etc. And this is teaching us a lot in terms of analysing different types of patterns.

And we are, for example, starting to discover that it could teach some things about alcohol intake, about flu arriving. We are already seeing, [through] mixing those different vital parameters, the ability to discover new things and that’s really an area that we want to focus on.

How do you see healthtech embedding itself into people’s healthcare journeys in the future? Is it going to become more commonplace for consumers or in clinical settings?

So we are seeing it, actually, in both ways. Hardware companies and service companies working directly with and selling products to end consumers. The Covid crisis has show us those things actually: that even from a B2C perspective, we have seen a huge increase in terms of demand for people monitoring their health at home. And with simple devices, being able to use them at home and being able to share their data with their doctors.

I think it’s pretty clear that a lot of companies are trying to pursue this objective as well and to go more into health directly with patients and consumers. Because people are being aware and more educated about prevention; about how they can, by monitoring their vitals and knowing better about themselves, improve their health in the long run.

We are also seeing health professionals being much closer to those patients or consumers with the rise of telemedicine, with the rise of those preventive programmes that are getting reimbursed now in the US.

For example, Medicare is reimbursing some very specific telemedcine actions: today when the healthcare professional monitors remotely the blood pressure of a patient, he gets funded for that. And so this is really helping this whole ecosystem to really extend to broader audiences and to more patients. Because we believe that there is value in that and that it’s helping people to have better prevention and it’s – at the end – less costly for the whole system.

Given the benefits of this monitoring-based approach to healthcare, what needs to happen to make it more widely adopted?

So it’s starting in the US now. Not all health insurances are reimbursing that. But what we need, I think, is more actors that are helping to prove the impact of remote health monitoring.

And I think one important thing also is the ability for providers and actors like us to really also reassure both patients and health professionals that they can use this type of product in a very easy way, that it’s not going to add more work, and that they can trust the quality of what they are using.

So I think it’s really also depending on how actors like us have the ability to bring a very seamless and better experience for all those actors.

The healthtech industry has changed dramatically in the time that Withings has been around as a company. Has anything been particularly surprising about how things have developed?

I don’t think it has been unexpected. We have clearly seen a shift from wellness and fitness-type devices to more medical-grade tracking devices and we don’t think it’s surprising.

It’s also because the whole ecosystem is starting to realise that prevention is a very important thing. And that trying to care about people once they are already sick is not the right way to go for the whole healthcare ecosystem.

So it’s not surprising for us that this shift is happening now, and that even actors like Apple are going more into health and medical measurements now.

Finally, what do you see as the end goal for Withings? Where does the company hope to be in the next decade or so?

Our ambition, and this is the start with this fundraising and it’s a new way for us to present it like that, it’s really to become this trusted intermediary between patients and the healthcare world and healthcare professionals.

We want to really empower both patients and people that are caring for others and that are curing everyone. And we believe that there is a part to play in that and that no one has taken this role yet, to track a huge variety of health data and health parameters. And so we really want to play this part in being this intermediary for the for the healthcare world.

Read more: Otterly indispensable: How Otter.ai has transformed transcription