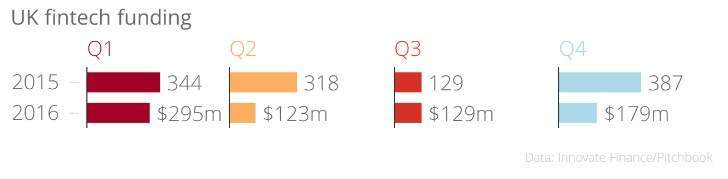

Uncertainty over the Brexit vote has caused investment in the UK’s fintech startups to dry up.

Investment in the country’s fintech startups has dwindled to under the $1bn mark, a decline of 34 percent, according to data from Innovate Finance and Pitchbook.

The UK isn’t the only country to see fintech investment fall. Similar investment in the US also reportedly took a hit, with investment falling 13 percent to $6.2bn. However, China appeared to benefit from this fall with investment shooting up 84 percent to $7.7bn, cementing the country’s position as the new fintech powerhouse.

It appears investors held off from making deals in the first half of the year, before the Brexit vote. This changed in the third quarter, but this wasn’t enough to bolster investments overall. Speaking to City A.M, Innovate Finance’s chief executive Lawrence Wintermeyer said:

“We didn’t have a great year. We think the overall figures for the year are disappointing but we’ve been given rational explanation from the industry. There is global uncertainty and there’s more uncertainty around financial services in the UK than fintech.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free sample

Company Profile – free sampleThank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Earlier this week, it was revealed that around 10,000 financial jobs could move from London to Paris as a result of the UK’s vote to leave the European Union.

At a press conference in London, a panel of delegates from Paris, including the city’s vice-mayor Jean-Louis Missika and the president of the Paris region, Valeria Pecresse, discussed the movement of jobs to Europe.

Pecresse told reporters: “Brexit is a long term process, so the moves will come slowly.”

According to a survey by lobbying group Paris Europlace, around 10,000 financial jobs could move to France’s capital, however this will depend on the strategy of firms and what the outcome of Brexit will be.

Several banks have proposed that they could move staff out of the UK after the country’s withdrawal from the EU is finalised, including HSBC, JPMorgan Chase, UBS and Goldman Sachs.

Despite this bleak outlook of the UK’s financial sector, a recent report by PwC believes the UK can offset the Brexit slump to become the fastest-growing economy in the G7 by 2050.

The company’s latest World in 2050 report stated that the UK could remain a top 10 global economy in 2050, as long as it remains open to talented workers and develops successful trade links with emerging economies, such as Brazil and Indonesia.