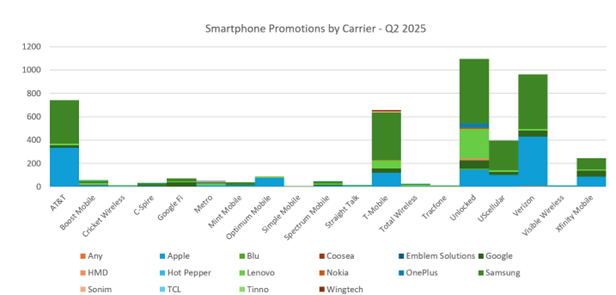

The US smartphone market in Q2 2025 was defined by aggressive and diversified promotional strategies, totaling 4,567 new deals across 14 promotion types.

Trade-in offers, bundle deals, and complimentary subscriptions remained the dominant tactics, signaling an industry-wide pivot toward value-added incentives designed to boost consumer engagement and loyalty. Samsung and Apple led device promotions, with 2,286 and 1,372 offers respectively, underscoring their entrenched dominance.

Q2 carrier competitive dynamics

Verizon emerged as the most active promoter, launching 963 campaigns across ten strategies. Its aggressive trade-in programs, including the standout offer of a free Samsung Galaxy S25 Edge with any device trade-in on unlimited plans, highlighted a push to simplify eligibility and maximise perceived value. Accessory bundling—such as Ray-Ban Meta Glasses—strengthened Verizon’s ecosystem appeal. Verizon’s three-year price guarantee bolstered its stability narrative, although it faced a net loss of 50,000 postpaid subscribers despite a +2.3% YoY revenue gain.

AT&T followed with 742 promotions, focusing heavily on retention through transparent trade-in terms. Its record $1,320 discount on the Motorola razr ultra (2025) set a high-value benchmark. Tiered incentives tied to device storage and bundled accessories targeted ARPU growth. While AT&T added 401,000 postpaid lines and achieved +3% mobility revenue growth, prepaid churn rose sharply to 2.64%, reflecting competitive headwinds. T-Mobile’s 656 promotions reflected a layered incentive strategy tied closely to its new Experience More and Experience Beyond plans, backed by a five-year price guarantee. By offering device credits exceeding $1,000 for trade-ins in any condition, T-Mobile drove premium plan adoption and posted 830,000 postpaid net adds—the strongest among national carriers. Samsung devices dominated its promotional mix (407 offers), reinforcing the brand’s premium device pull.

Source: GlobalData Pricing and Promotions, Handset Promotions US, April to June 2025

Cable MVNO momentum

Cable MVNOs continued to expand their market footprint through aggressive, targeted promotions. Spectrum launched 46 premium-focused offers—63% requiring trade-ins—fueling 500,000 new mobile lines and +25% YoY service revenue growth. Xfinity Mobile doubled its quarterly promotions to 244, leveraging an $830 trade-in credit on flagship devices and simplifying its plan lineup to drive 378,000 new lines. Optimum Mobile tripled promotions to 88, 89% of which featured Apple devices, achieving a 42% YoY increase in total lines and boosting cross-service adoption from 4.7% to 6.8%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataQ2 strategic implications

The quarter’s activity highlighted three converging trends:

- Relaxed Trade-in Conditions – Acceptance of devices in “any condition” and expansion of high-value incentives to non-premium plans is lowering the barrier to switching providers. This will likely accelerate churn unless retention parity is maintained for existing customers.

- Price Assurance as a Differentiator – Multi-year price guarantees from Verizon and T-Mobile are addressing rising cost concerns, but carriers must refine guarantee language to avoid undermining trust.

- Cable MVNO Ascendancy – Spectrum, Xfinity, and Optimum are leveraging convergence strategies and premium Android/iOS promotions to capture share from traditional carriers, aided by deep broadband customer penetration.

Outlook

With cable MVNOs accelerating their growth and national carriers tying promotions more tightly to premium plans, competitive intensity will remain elevated.

Samsung’s commanding promotion share positions it to sustain market leadership if it continues aggressive trade-in valuations and deep channel integration. Carriers must balance acquisition efforts with churn mitigation, especially as relaxed trade-in rules and broadband-mobile bundling reshape customer expectations.